Question: A B C D E Question 21: You are given the following information on Stocks A & B: State of Probability of State Rate of

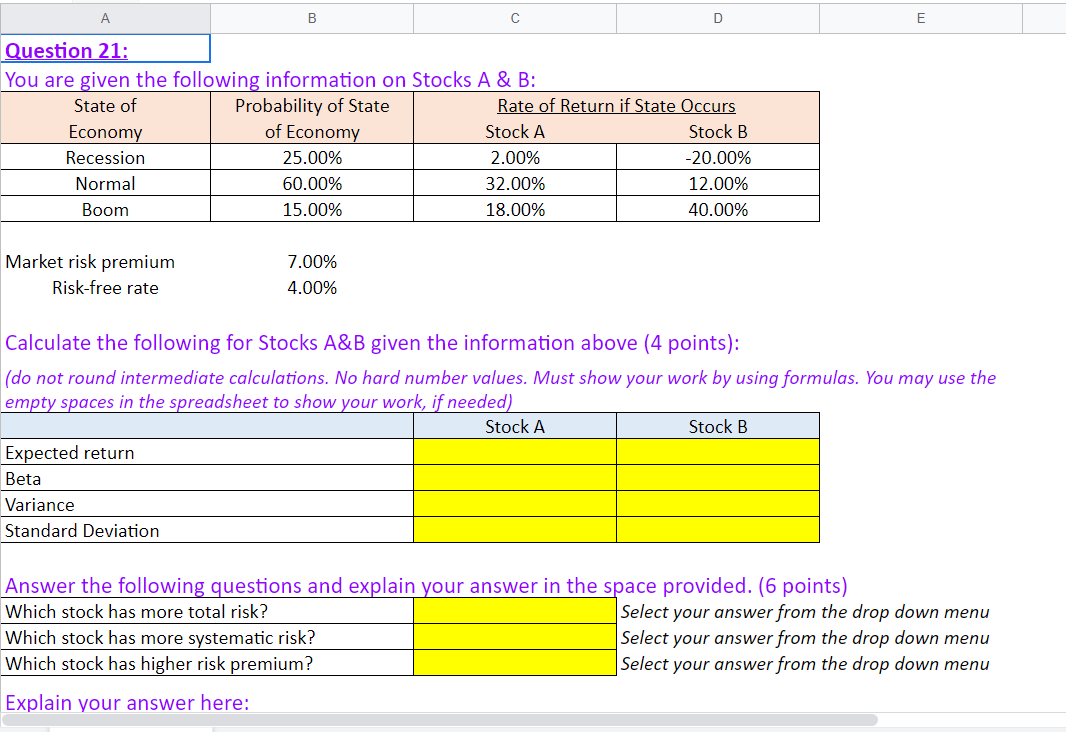

A B C D E Question 21: You are given the following information on Stocks A & B: State of Probability of State Rate of Return if State Occurs Economy of Economy Stock A Stock B Recession 25.00% 2.00% -20.00% Normal 60.00% 32.00% 12.00% Boom 15.00% 18.00% 40.00% Market risk premium 7.00% Risk-free rate 4.00% Calculate the following for Stocks A&B given the information above (4 points): (do not round intermediate calculations. No hard number values. Must show your work by using formulas. You may use the empty spaces in the spreadsheet to show your work, if needed) Stock A Stock B Expected return Beta Variance Standard Deviation Answer the following questions and explain your answer in the space provided. (6 points) Which stock has more total risk? Which stock has more systematic risk? Select your answer from the drop down menu Select your answer from the drop down menu Select your answer from the drop down menu Which stock has higher risk premium? Explain your answer here: A B C D E Question 21: You are given the following information on Stocks A & B: State of Probability of State Rate of Return if State Occurs Economy of Economy Stock A Stock B Recession 25.00% 2.00% -20.00% Normal 60.00% 32.00% 12.00% Boom 15.00% 18.00% 40.00% Market risk premium 7.00% Risk-free rate 4.00% Calculate the following for Stocks A&B given the information above (4 points): (do not round intermediate calculations. No hard number values. Must show your work by using formulas. You may use the empty spaces in the spreadsheet to show your work, if needed) Stock A Stock B Expected return Beta Variance Standard Deviation Answer the following questions and explain your answer in the space provided. (6 points) Which stock has more total risk? Which stock has more systematic risk? Select your answer from the drop down menu Select your answer from the drop down menu Select your answer from the drop down menu Which stock has higher risk premium? Explain your answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts