Question: a. b. C. d. Is the restaurant becoming more efficient in the collection of its account receivable? Over the years has more or less

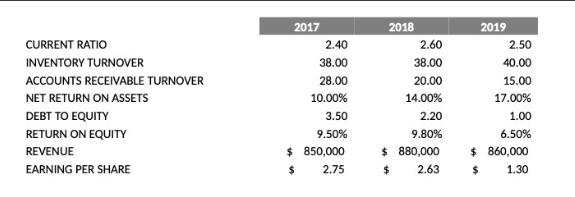

a. b. C. d. Is the restaurant becoming more efficient in the collection of its account receivable? Over the years has more or less money been invested in inventory? Has the working capital increased since 2017? Did the company issue new stocks to increase equity in 2019? CURRENT RATIO INVENTORY TURNOVER ACCOUNTS RECEIVABLE TURNOVER NET RETURN ON ASSETS DEBT TO EQUITY RETURN ON EQUITY REVENUE EARNING PER SHARE 2017 2.40 38.00 28.00 10.00% 3.50 9.50% $ 850,000 $ 2.75 2018 2.60 38.00 20.00 14.00% 2.20 9.80% $ 880,000 $ 2.63 2019 2.50 40.00 15.00 17.00% 1.00 6.50% $ 860,000 $ 1.30

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

a To determine whether the company is becoming more efficient in the collection of its accounts receivable we can look at the accounts receivable turn... View full answer

Get step-by-step solutions from verified subject matter experts