Question: A: B: C: D: Perform a vertical analysis for the balance sheet entry Accounts Payable given below (as a %). (Round your answer to one

A:

B:

C:

D:

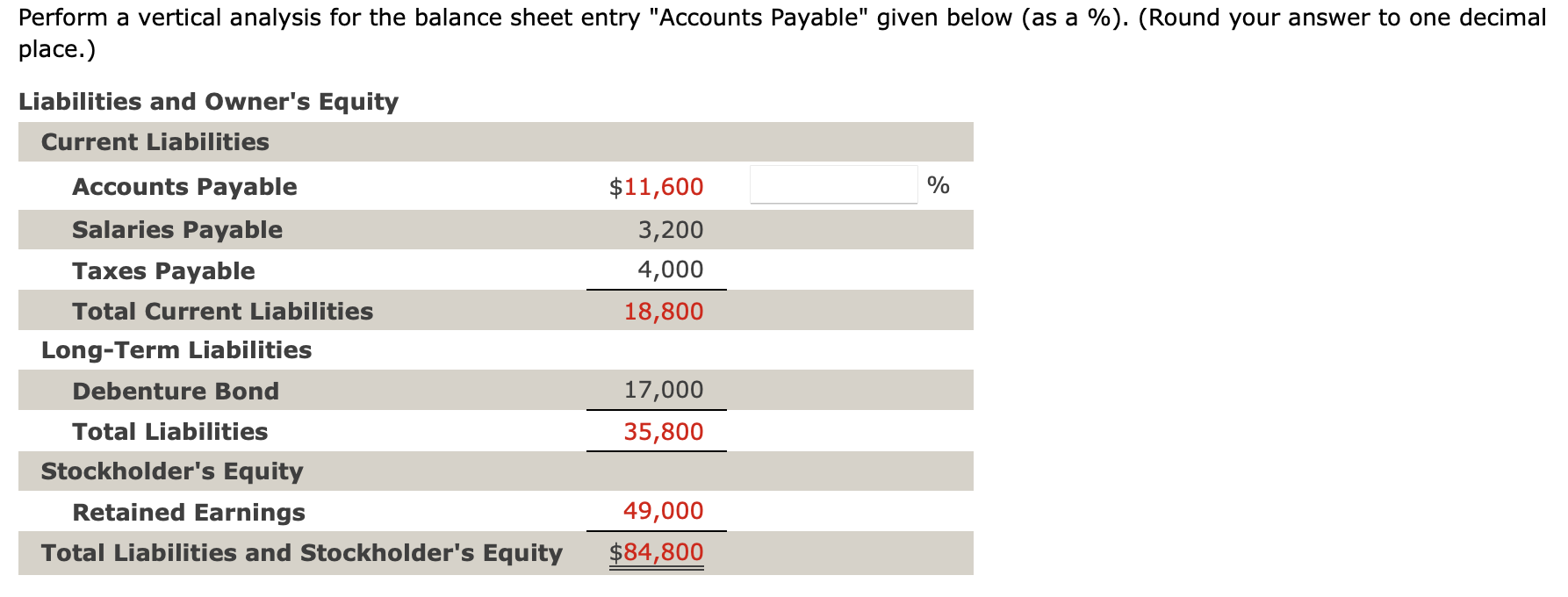

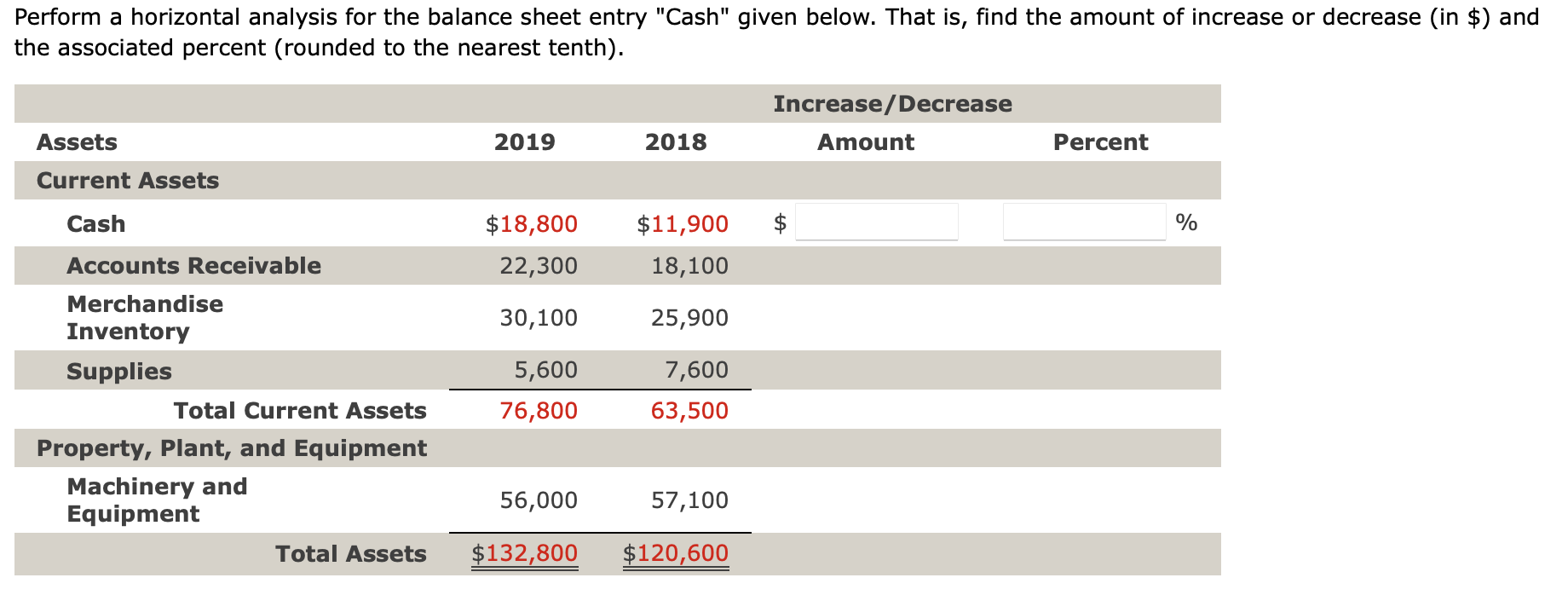

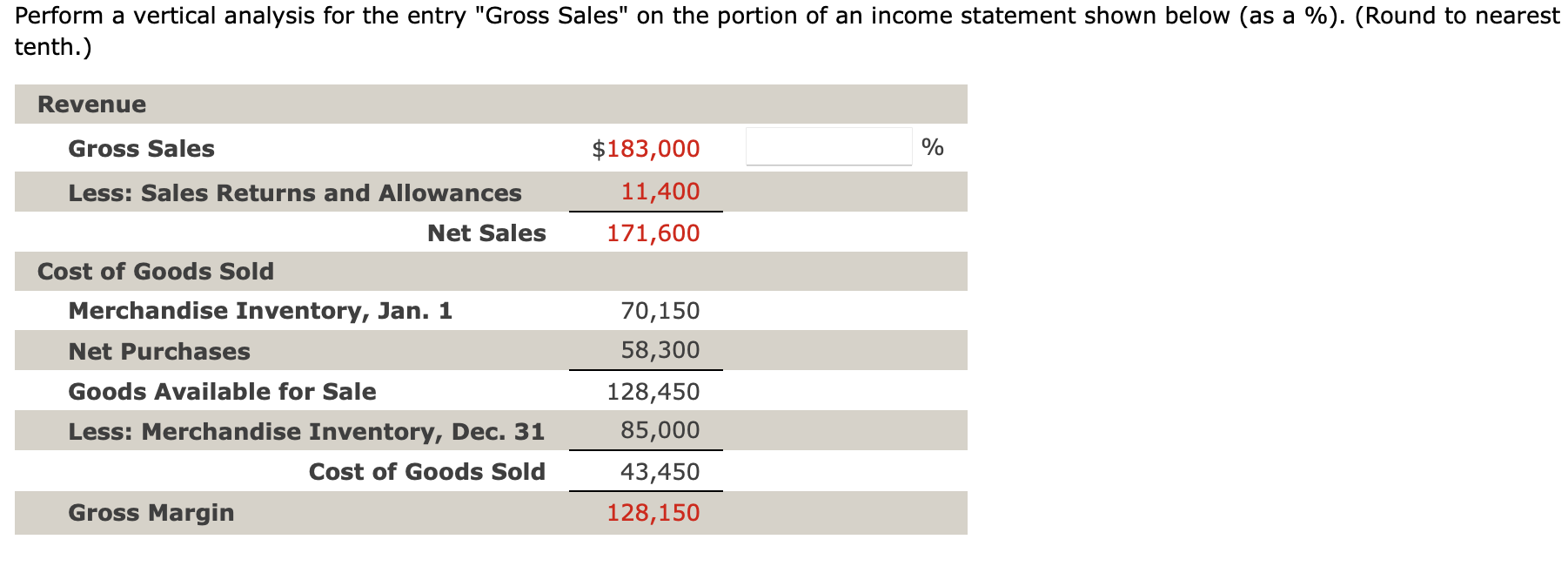

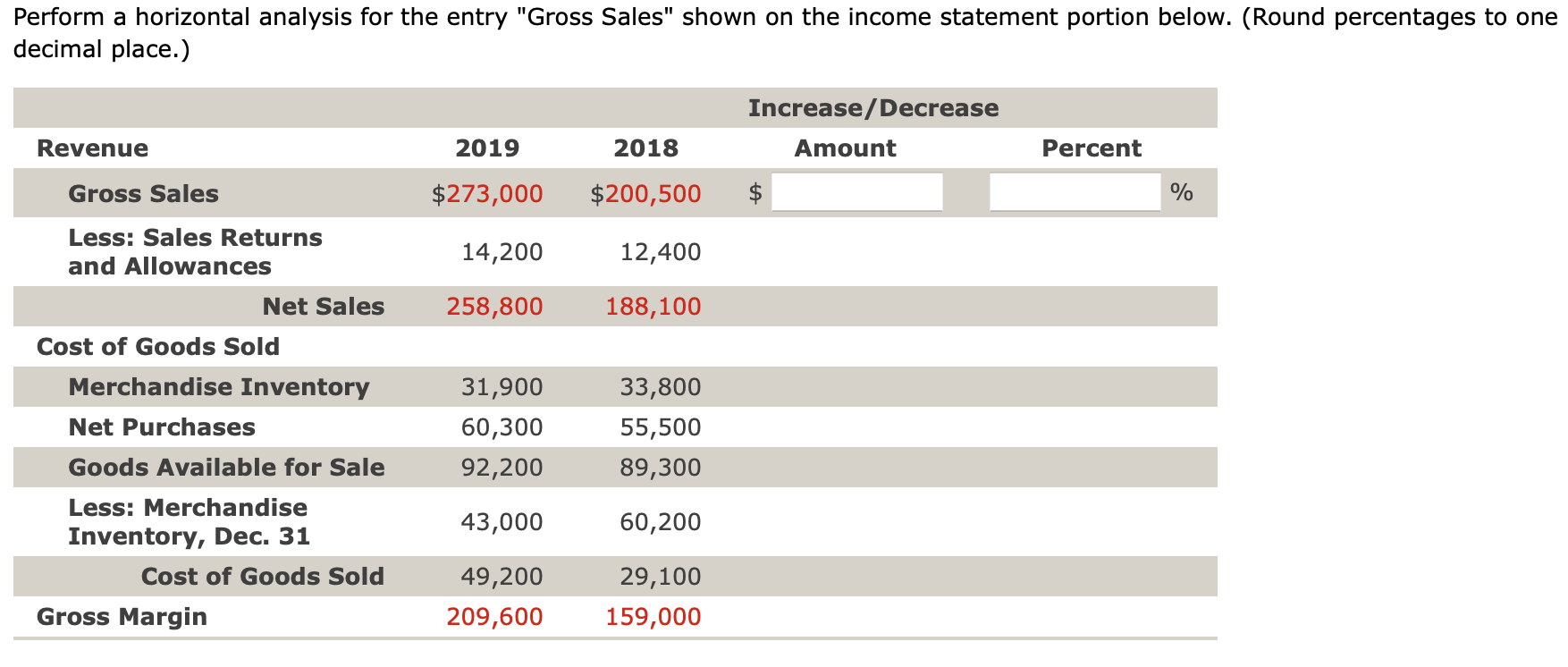

Perform a vertical analysis for the balance sheet entry "Accounts Payable" given below (as a %). (Round your answer to one decimal place.) Liabilities and Owner's Equity Current Liabilities % $11,600 3,200 4,000 Accounts Payable Salaries Payable Taxes Payable Total Current Liabilities Long-Term Liabilities Debenture Bond 18,800 17,000 35,800 Total Liabilities Stockholder's Equity Retained Earnings Total Liabilities and Stockholder's Equity 49,000 $84,800 Perform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the amount of increase or decrease (in $) and the associated percent (rounded to the nearest tenth). Increase/Decrease Amount Assets 2019 2018 Percent Current Assets Cash % $18,800 22,300 $11,900 18,100 30,100 25,900 Accounts Receivable Merchandise Inventory Supplies Total Current Assets Property, Plant, and Equipment Machinery and Equipment 5,600 76,800 7,600 63,500 56,000 57,100 Total Assets $132,800 $120,600 Perform a vertical analysis for the entry "Gross Sales" on the portion of an income statement shown below (as a %). (Round to nearest tenth.) Revenue Gross Sales % Less: Sales Returns and Allowances $183,000 11,400 171,600 Net Sales Cost of Goods Sold Merchandise Inventory, Jan. 1 Net Purchases Goods Available for Sale Less: Merchandise Inventory, Dec. 31 Cost of Goods Sold 70,150 58,300 128,450 85,000 43,450 128,150 Gross Margin Perform a horizontal analysis for the entry "Gross Sales" shown on the income statement portion below. (Round percentages to one decimal place.) Increase/Decrease Amount Revenue 2019 2018 Percent Gross Sales $273,000 $200,500 % 14,200 12,400 258,800 188,100 Less: Sales Returns and Allowances Net Sales Cost of Goods Sold Merchandise Inventory Net Purchases Goods Available for Sale 31,900 60,300 92,200 33,800 55,500 89,300 43,000 60,200 Less: Merchandise Inventory, Dec. 31 Cost of Goods Sold Gross Margin 49,200 209,600 29,100 159,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts