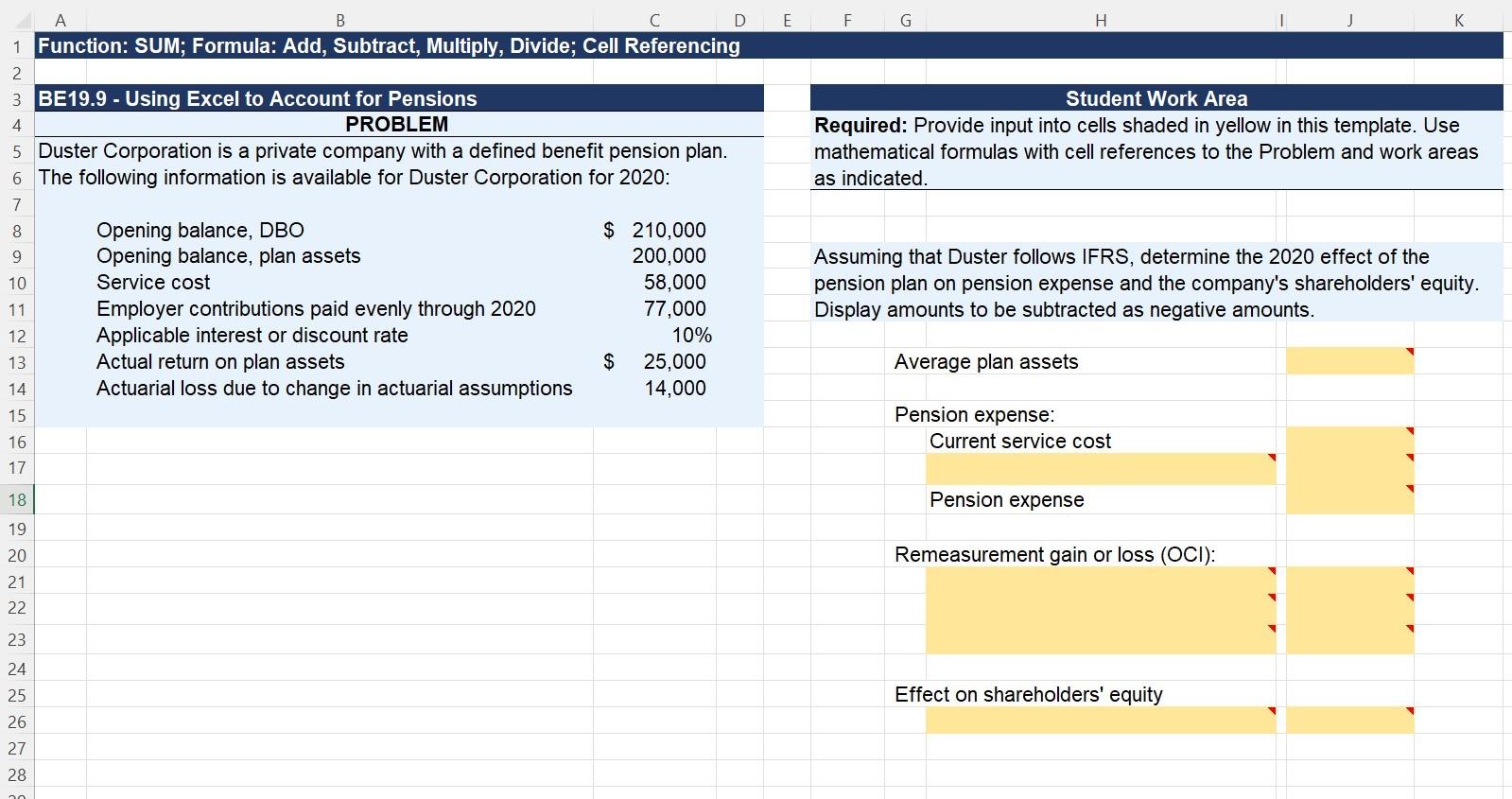

Question: A B C DEF G H J K 1 Function: SUM; Formula: Add, Subtract, Multiply, Divide; Cell Referencing 2 3 BE19.9 - Using Excel to

A B C DEF G H J K 1 Function: SUM; Formula: Add, Subtract, Multiply, Divide; Cell Referencing 2 3 BE19.9 - Using Excel to Account for Pensions Student Work Area 4 PROBLEM Required: Provide input into cells shaded in yellow in this template. Use 5 Duster Corporation is a private company with a defined benefit pension plan. mathematical formulas with cell references to the Problem and work areas 6 The following information is available for Duster Corporation for 2020: as indicated. 7 8 Opening balance, DBO $ 210,000 9 Opening balance, plan assets 200,000 Assuming that Duster follows IFRS, determine the 2020 effect of the Service cost 58,000 pension plan on pension expense and the company's shareholders' equity. 11 Employer contributions paid evenly through 2020 77,000 Display amounts to be subtracted as negative amounts. 12 Applicable interest or discount rate 10% 13 Actual return on plan assets $ 25,000 Average plan assets 14 Actuarial loss due to change in actuarial assumptions 14,000 15 Pension expense: 16 Current service cost 17 10 18 Pension expense 19 20 Remeasurement gain or loss (OCI): 21 22 23 24 25 Effect on shareholders' equity 26 27 28 mo A B C DEF G H J K 1 Function: SUM; Formula: Add, Subtract, Multiply, Divide; Cell Referencing 2 3 BE19.9 - Using Excel to Account for Pensions Student Work Area 4 PROBLEM Required: Provide input into cells shaded in yellow in this template. Use 5 Duster Corporation is a private company with a defined benefit pension plan. mathematical formulas with cell references to the Problem and work areas 6 The following information is available for Duster Corporation for 2020: as indicated. 7 8 Opening balance, DBO $ 210,000 9 Opening balance, plan assets 200,000 Assuming that Duster follows IFRS, determine the 2020 effect of the Service cost 58,000 pension plan on pension expense and the company's shareholders' equity. 11 Employer contributions paid evenly through 2020 77,000 Display amounts to be subtracted as negative amounts. 12 Applicable interest or discount rate 10% 13 Actual return on plan assets $ 25,000 Average plan assets 14 Actuarial loss due to change in actuarial assumptions 14,000 15 Pension expense: 16 Current service cost 17 10 18 Pension expense 19 20 Remeasurement gain or loss (OCI): 21 22 23 24 25 Effect on shareholders' equity 26 27 28 mo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts