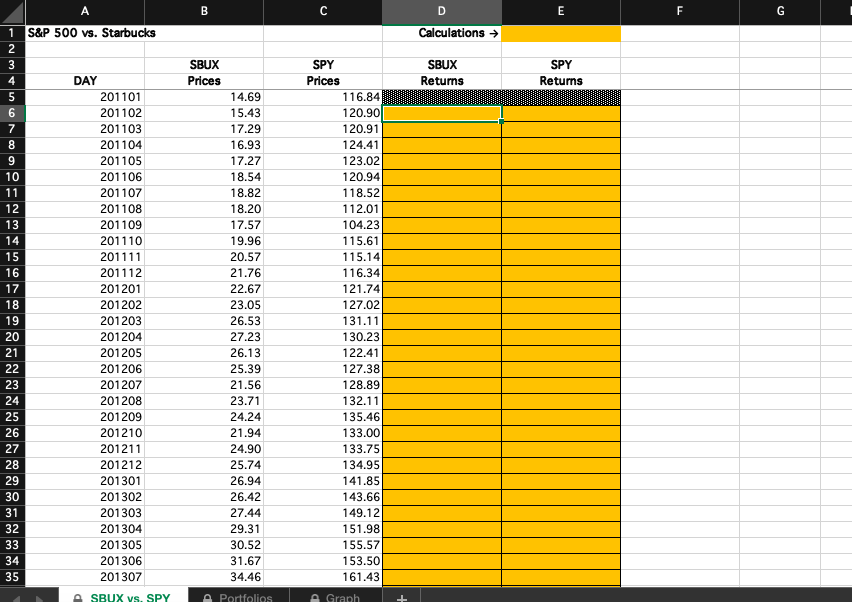

Question: A B C E F G D Calculations SBUX Prices SBUX Returns SPY Returns 1 S&P 500 vs. Starbucks 2 3 4 DAY 5 201101

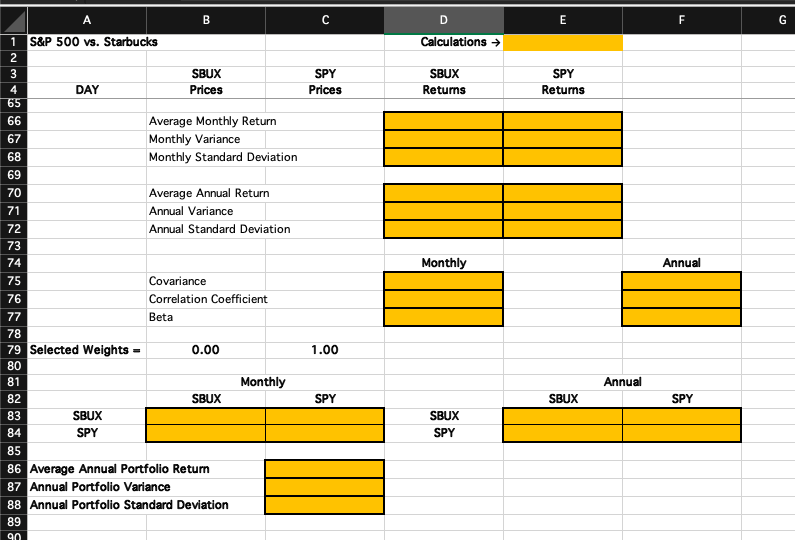

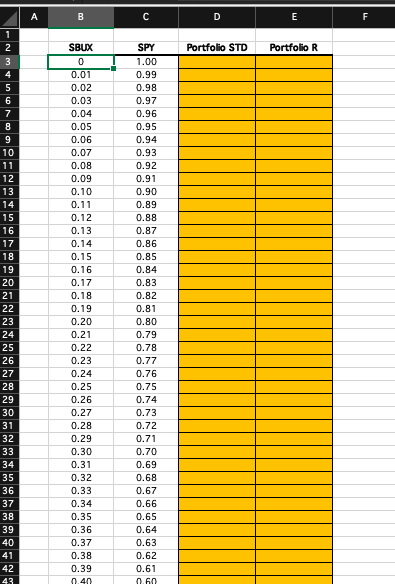

A B C E F G D Calculations SBUX Prices SBUX Returns SPY Returns 1 S&P 500 vs. Starbucks 2 3 4 DAY 5 201101 6 201102 7 201103 8 201104 9 201105 10 201106 11 201107 12 201108 13 201109 14 201110 15 201111 16 201112 17 201201 18 201202 19 201203 20 201204 21 201205 22 201206 23 201207 24 201208 25 201209 26 201210 27 201211 28 201212 29 201301 30 201302 31 201303 32 201304 33 201305 34 201306 35 201307 14.69 15.43 17.29 16.93 17.27 18.54 18.82 18.20 17.57 19.96 20.57 21.76 22.67 23.05 26.53 27.23 26.13 25.39 21.56 23.71 24.24 21.94 24.90 25.74 26.94 26.42 27.44 29.31 30.52 31.67 34.46 SPY Prices 116.84 120.90 120.91 124.41 123.02 120.94 118.52 112.01 104.23 115.61 115.14 116.34 121.74 127.02 131.11 130.23 122.41 127.38 128.89 132.11 135.46 133.00 133.75 134.95 141.85 143.66 149.12 151.98 155.57 153.50 161.43 ASBUX vs. SPY A Portfolios A Graph + A B C D E F G 1 Calculations SPY Prices SBUX Returns SPY Returns Monthly Annual S&P 500 vs. Starbucks 2 3 SBUX 4 DAY Prices 65 66 Average Monthly Return 67 Monthly Variance 68 Monthly Standard Deviation 69 70 Average Annual Return 71 Annual Variance 72 Annual Standard Deviation 73 74 75 Covariance 76 Correlation coefficient 77 Beta 78 79 Selected Weights 0.00 80 81 Monthly 82 SBUX 83 SBUX 84 SPY 85 86 Average Annual Portfolio Return 87 Annual Portfolio Variance 88 Annual Portfolio Standard Deviation 89 1.00 Annual SPY SBUX SPY SBUX SPY an A B C D E F Portfolio STD Portfolio R 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 SBUX 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.10 0.11 0.12 0.13 0.14 0.15 0.16 0.17 0.18 0.19 0.20 0.21 0.22 0.23 0.24 0.25 0.26 0.27 0.28 0.29 0.30 0.31 0.32 0.33 0.34 0.35 0.36 0.37 0.38 0.39 0.40 SPY 1.00 0.99 0.98 0.97 0.96 0.95 0.94 0.93 0.92 0.91 0.90 0.89 0.88 0.87 0.86 0.85 0.84 0.83 0.82 0.81 0.80 0.79 0.78 0.77 0.76 0.75 0.74 0.73 0.72 0.71 0.70 0.69 0.68 0.67 0.66 0.65 0.64 0.63 0.62 0.61 0.60 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 A B C E F G D Calculations SBUX Prices SBUX Returns SPY Returns 1 S&P 500 vs. Starbucks 2 3 4 DAY 5 201101 6 201102 7 201103 8 201104 9 201105 10 201106 11 201107 12 201108 13 201109 14 201110 15 201111 16 201112 17 201201 18 201202 19 201203 20 201204 21 201205 22 201206 23 201207 24 201208 25 201209 26 201210 27 201211 28 201212 29 201301 30 201302 31 201303 32 201304 33 201305 34 201306 35 201307 14.69 15.43 17.29 16.93 17.27 18.54 18.82 18.20 17.57 19.96 20.57 21.76 22.67 23.05 26.53 27.23 26.13 25.39 21.56 23.71 24.24 21.94 24.90 25.74 26.94 26.42 27.44 29.31 30.52 31.67 34.46 SPY Prices 116.84 120.90 120.91 124.41 123.02 120.94 118.52 112.01 104.23 115.61 115.14 116.34 121.74 127.02 131.11 130.23 122.41 127.38 128.89 132.11 135.46 133.00 133.75 134.95 141.85 143.66 149.12 151.98 155.57 153.50 161.43 ASBUX vs. SPY A Portfolios A Graph + A B C D E F G 1 Calculations SPY Prices SBUX Returns SPY Returns Monthly Annual S&P 500 vs. Starbucks 2 3 SBUX 4 DAY Prices 65 66 Average Monthly Return 67 Monthly Variance 68 Monthly Standard Deviation 69 70 Average Annual Return 71 Annual Variance 72 Annual Standard Deviation 73 74 75 Covariance 76 Correlation coefficient 77 Beta 78 79 Selected Weights 0.00 80 81 Monthly 82 SBUX 83 SBUX 84 SPY 85 86 Average Annual Portfolio Return 87 Annual Portfolio Variance 88 Annual Portfolio Standard Deviation 89 1.00 Annual SPY SBUX SPY SBUX SPY an A B C D E F Portfolio STD Portfolio R 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 SBUX 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.10 0.11 0.12 0.13 0.14 0.15 0.16 0.17 0.18 0.19 0.20 0.21 0.22 0.23 0.24 0.25 0.26 0.27 0.28 0.29 0.30 0.31 0.32 0.33 0.34 0.35 0.36 0.37 0.38 0.39 0.40 SPY 1.00 0.99 0.98 0.97 0.96 0.95 0.94 0.93 0.92 0.91 0.90 0.89 0.88 0.87 0.86 0.85 0.84 0.83 0.82 0.81 0.80 0.79 0.78 0.77 0.76 0.75 0.74 0.73 0.72 0.71 0.70 0.69 0.68 0.67 0.66 0.65 0.64 0.63 0.62 0.61 0.60 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts