Question: A, B, C go with question number 2. 2. Assume you saw on CNN that Apple is currently selling its stocks for $220 per share

A, B, C go with question number 2.

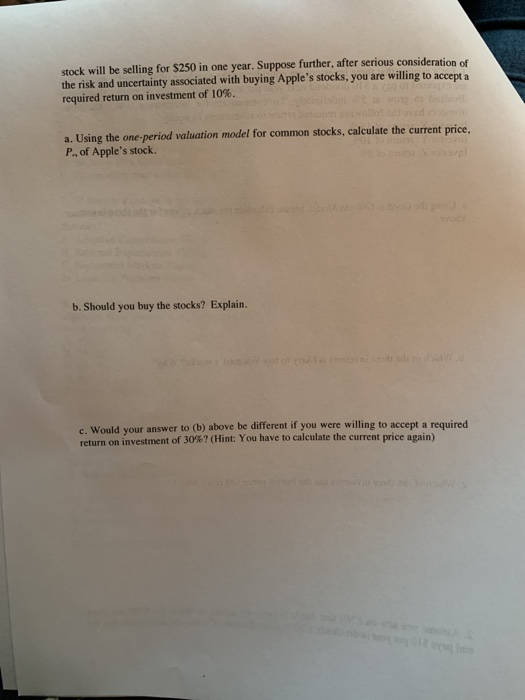

A, B, C go with question number 2. 2. Assume you saw on CNN that Apple is currently selling its stocks for $220 per share and pays $10 per year in dividends. CNN's Chief Business Correspondent predicts that the stock will be selling for $250 in one year. Suppose further, after serious consideration of the risk and uncertainty associated with buying Apple's stocks, you are willing to accepta required return on investment of 10%. a. Using the one-period valuation model for common stocks, calculate the current price. P..of Apple's stock. b. Should you buy the stocks? Explain. c. Would your answer to (b) above be different if you were willing to accept a required return on investment of 30%? (Hint: You have to calculate the current price again)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts