Question: A) B) C) Please do requirements A-C (I will like!) Thank you ! In the manufacture of 9,400 units of a product, direct materials cost

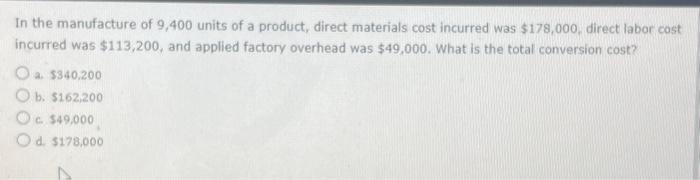

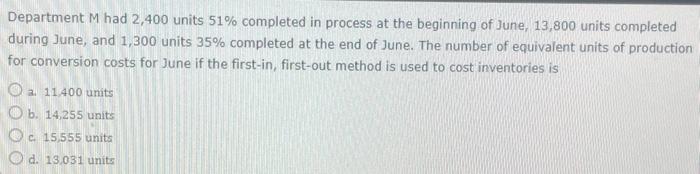

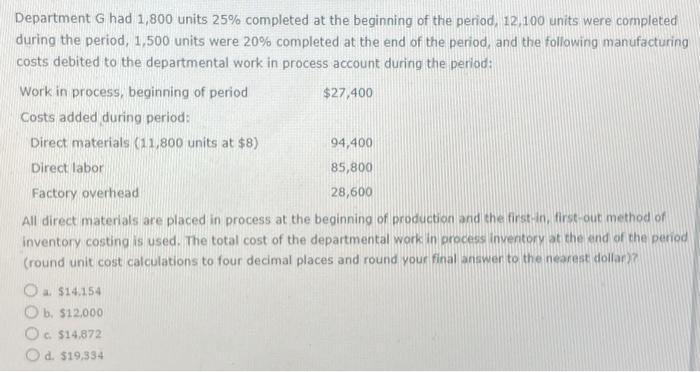

In the manufacture of 9,400 units of a product, direct materials cost incurred was $178,000, direct labor cost incurred was $113,200, and applied factory overhead was $49,000. What is the total conversion cost? a. 5340,200 b. $162,200 c. $49,000 d. 5178,000 Department M had 2,400 units 51% completed in process at the beginning of June, 13,800 units completed during June, and 1,300 units 35% completed at the end of June. The number of equivalent units of production for conversion costs for June if the first-in, first-out method is used to cost inventories is a. 11,400 units b. 14,255 units c. 15,555 units d. 13,031 units Department G had 1,800 units 25% completed at the beginning of the period, 12,100 units were completed during the period, 1,500 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: All direct materials are placed in process at the beginning of production and the firstin, first-out method of inventory costing is used. The total cost of the departmental work in process invertory at the knd of the period (round unit cost calculations to four decimal places and round your final answer to the nearest dollar)? a. $14.154 b. 512,000 c. $14.872 d. $19,334

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts