Question: A , B & C Plz! (Equivalent annual cost calculation) The Templeton Marudacturing and Distnibution Cormpany of Tacoma, Washington. is contemplating the purchase of a

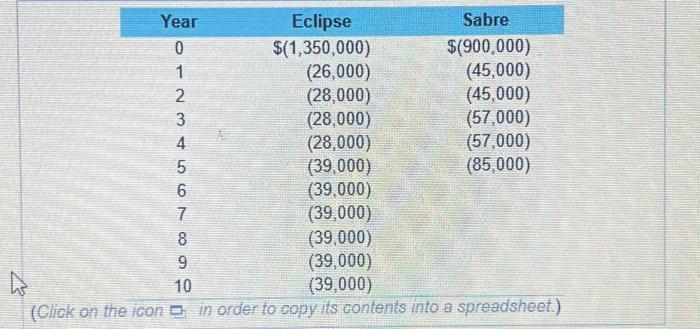

(Equivalent annual cost calculation) The Templeton Marudacturing and Distnibution Cormpany of Tacoma, Washington. is contemplating the purchase of a new conveyor belt system for one of is regional distribution facilities. Both alternatives wil accomplish the same task but the Eclipse Modol is substantially more expensive than the Sabre Model and will not have to be replaced for 10 years, whereas the cheaper model will need to be replaced in just 5 yoars. The costs of purchasing the fwo systems and the costs of operating them annualy over their expocted lives is provided below a. Templeton typicaly evaluates investments in plant improvements using a required rate of retum of 11 percent What are the NPVs for the two systems? b. Calculate the equivalent annual costs for the fwo systems C. Based on your analysis of the lwo systems using both their NPV and EAC, which system do you recommend the company pick? Why? a. The NPV tor Ecipse at a discourt rate of 11% is 5 (Round to the nearest dollar) (Click on the icon in order to eopy its contents mto a spreadsneet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts