Question: A B C Tim Crane started Crane Roof Repairs on April 2, 2024, by investing $4,020 cash in the business, During April, the following transactions

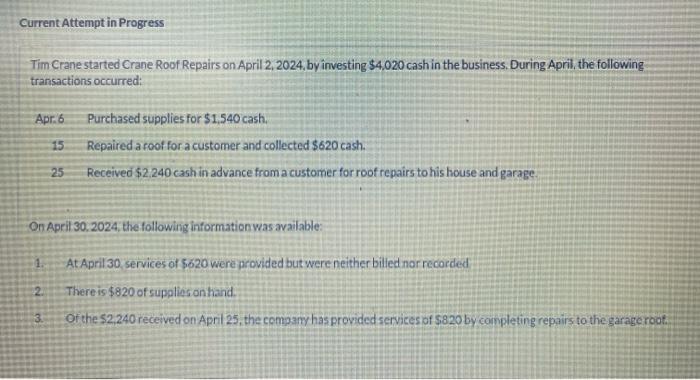

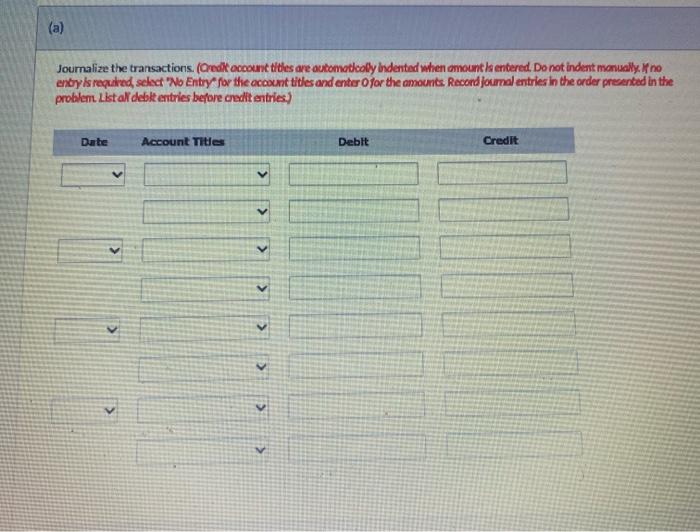

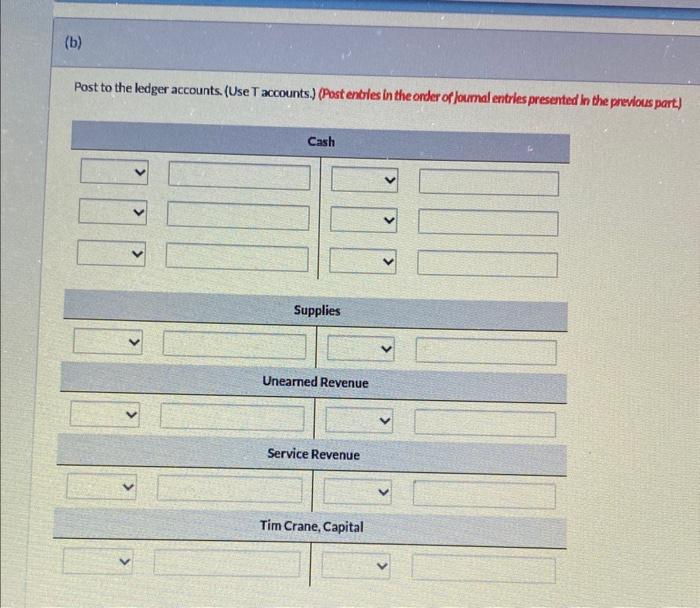

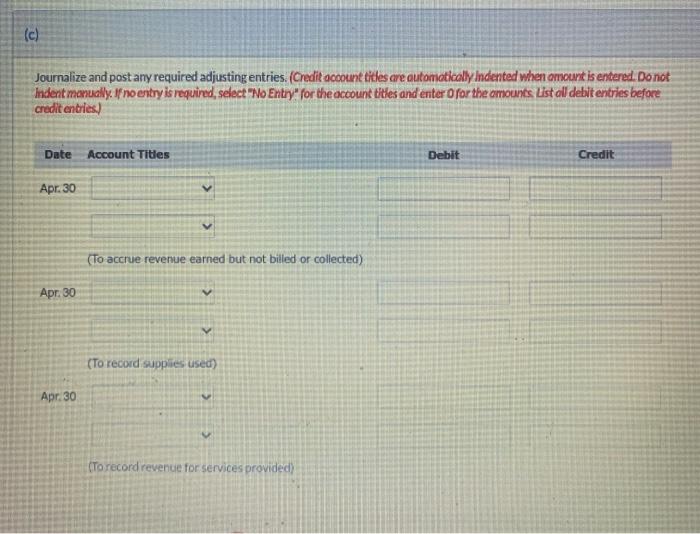

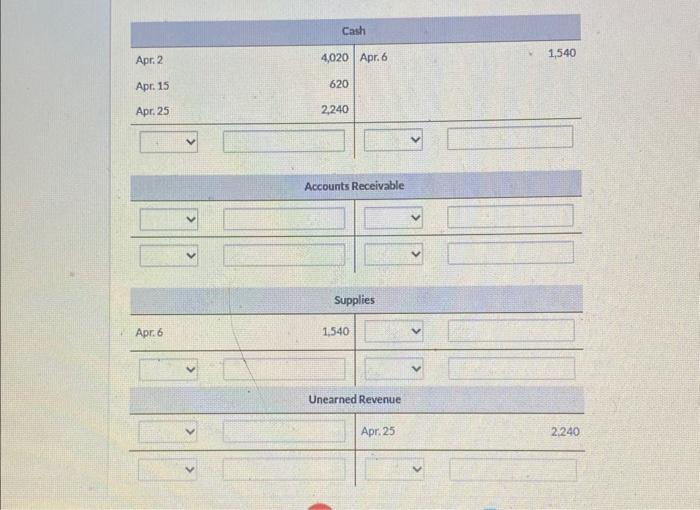

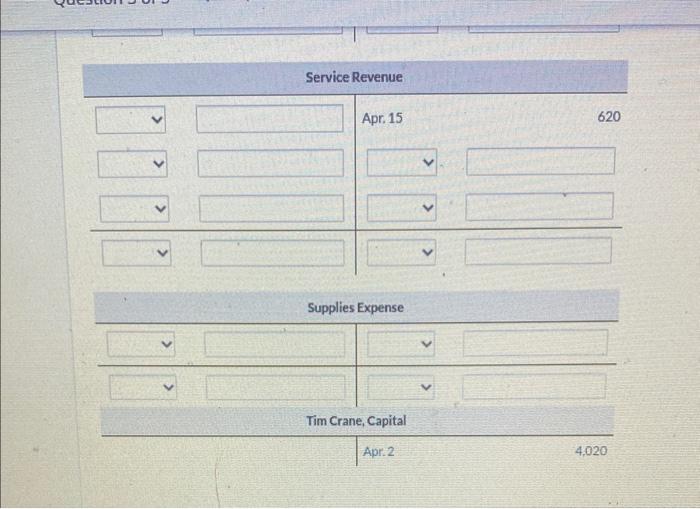

Tim Crane started Crane Roof Repairs on April 2, 2024, by investing $4,020 cash in the business, During April, the following transactions occurred: Apr. 6 Purchased supplies for $1,540 cash. 15. Repaired a foof for a customer and collected $620 cash. 25 Received $2.240 cash in advance from a customer for roof repairs to his house and garage. Qn April 30. 2024, the following information was available: 1. At April 30 services of $520 were provided but were neither billed nor recorded 2. There is $820 of supplies on thand. 3. Of the $2,240 received on April 25, the compamy has provided services of 5820 by completing repairs to the garage root. Journalize the transactions. (Oredi cocoounct tites are outomotlcoly bindented when amount k entered Do not indent manually If no enbyls repaked, select "No Entry for the account tities and enter O for the amounts. Record Joumal entries in the order presentad in the problen Listalidebk entries before credit endries.) (b) Post to the ledger accounts. (Use T accounts.) (Post entrles in the order of foumal entries presented in the previous part) Supplies Unearned Revenue Service Revenue Tim Crane, Capital Journalize and post any required adjusting entries. (Credit acoount titles are outomoticolly indented when omount is entered Don in th indent monually. If no entry is required, select. No Entry" for the account titles and enter o for the amounts, List oll debit entries before. creditentries. Accounts Receivable Unearned Revenue \begin{tabular}{c|c|cc} \hlinev & Apr.25 \\ \hlinev & & v & 2,240 \\ \hline \end{tabular} Service Revenue Apr. 15 620 Supplies Expense Tim Crane, Capital Apr. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts