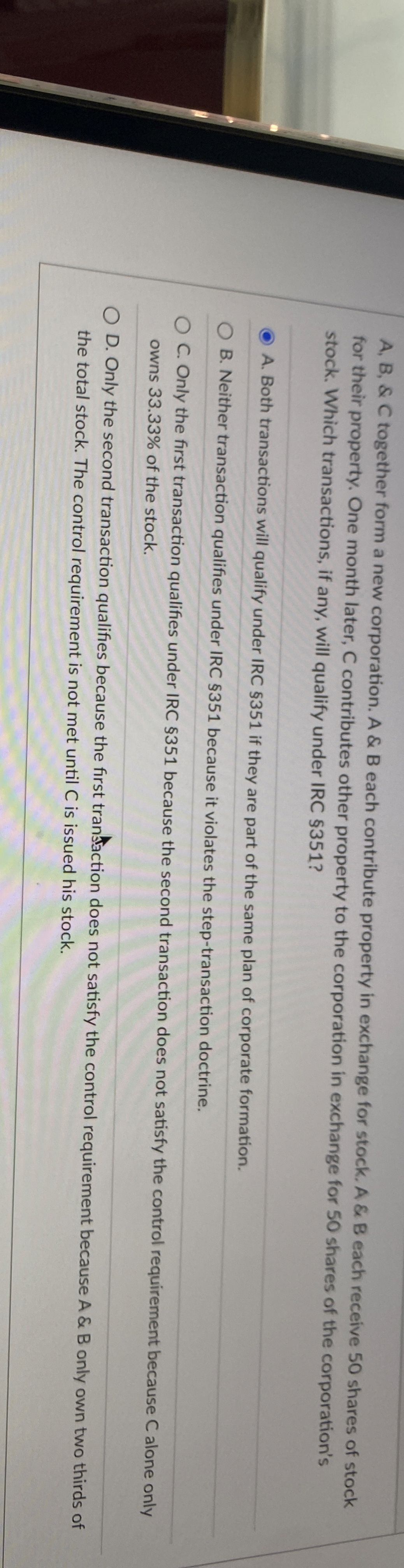

Question: A , B , & C together form a new corporation. A & B each contribute property in exchange for stock. A & B each

& together form a new corporation. A & B each contribute property in exchange for stock. A & B each receive shares of stock

for their property. One month later, contributes other property to the corporation in exchange for shares of the corporation's

stock. Which transactions, if any, will qualify under IRC

A Both transactions will qualify under IRC if they are part of the same plan of corporate formation.

B Neither transaction qualifies under IRC because it violates the steptransaction doctrine.

C Only the first transaction qualifies under IRC because the second transaction does not satisfy the control requirement because alone only

owns of the stock.

D Only the second transaction qualifies because the first translaction does not satisfy the control requirement because & only own two thirds of

the total stock. The control requirement is not met until C is issued his stock.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock