Question: A B D 35 You purchase a call option where the strike price (X) is $91.50 36 The Premium Cost [C] for this call option

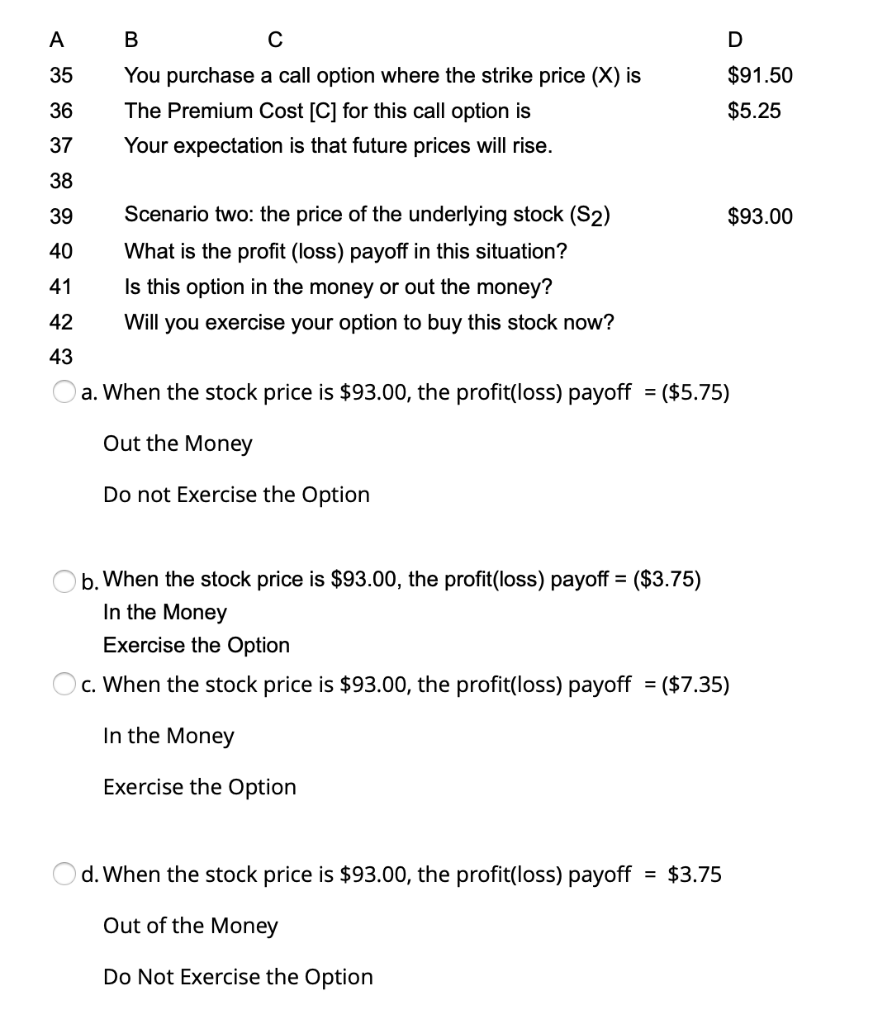

A B D 35 You purchase a call option where the strike price (X) is $91.50 36 The Premium Cost [C] for this call option is $5.25 37 Your expectation is that future prices will rise. 38 39 Scenario two: the price of the underlying stock (S2) $93.00 40 What is the profit (loss) payoff in this situation? 41 Is this option in the money or out the money? 42 Will you exercise your option to buy this stock now? 43 a. When the stock price is $93.00, the profit(loss) payoff = ($5.75) Out the Money Do not Exercise the Option b. When the stock price is $93.00, the profit(loss) payoff = ($3.75) In the Money Exercise the Option c. When the stock price is $93.00, the profit(loss) payoff = ($7.35) In the Money Exercise the Option d. When the stock price is $93.00, the profit(loss) payoff = $3.75 Out of the Money Do Not Exercise the Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts