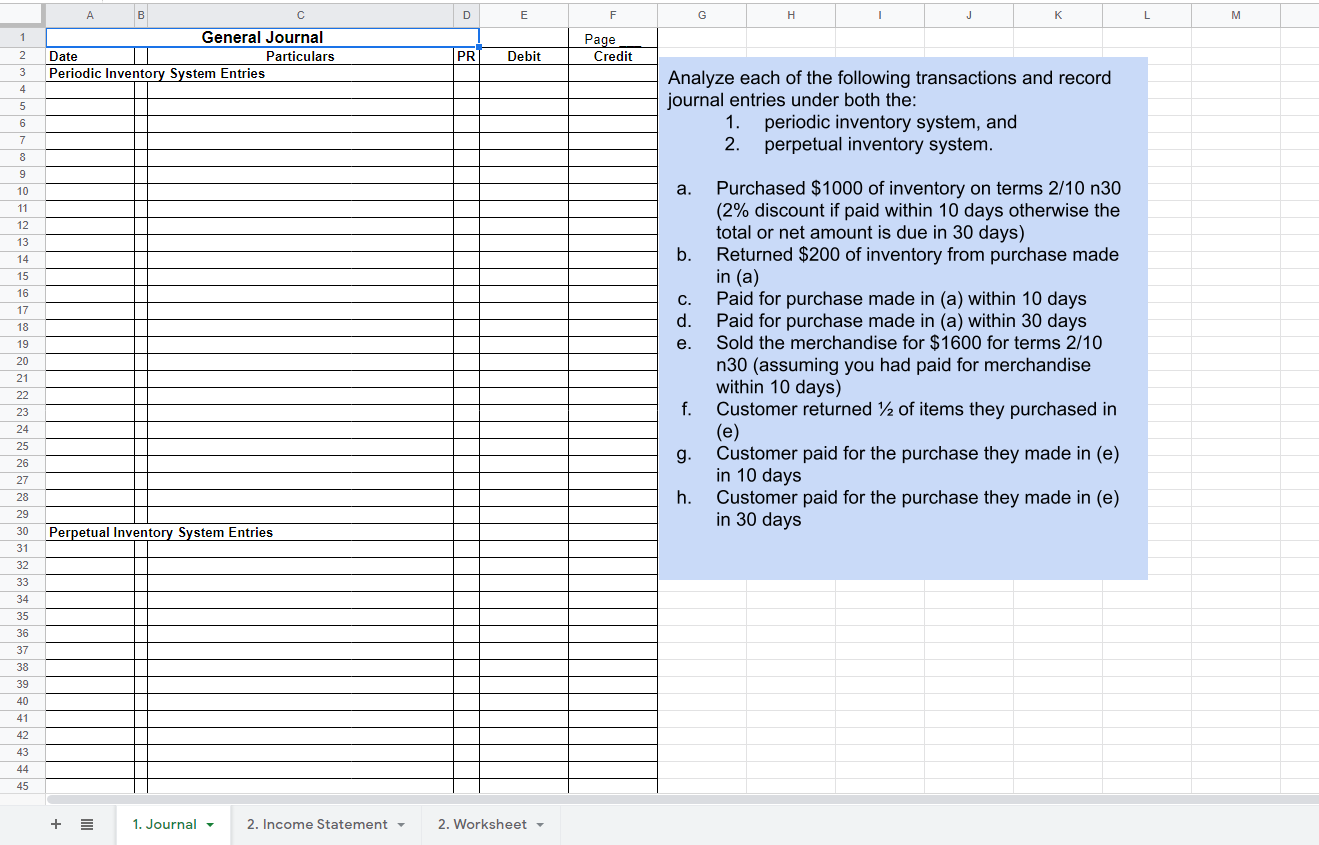

Question: A B D D E F G H J K L M 1 Page Credit General Journal Date Particulars Periodic Inventory System Entries PR 2

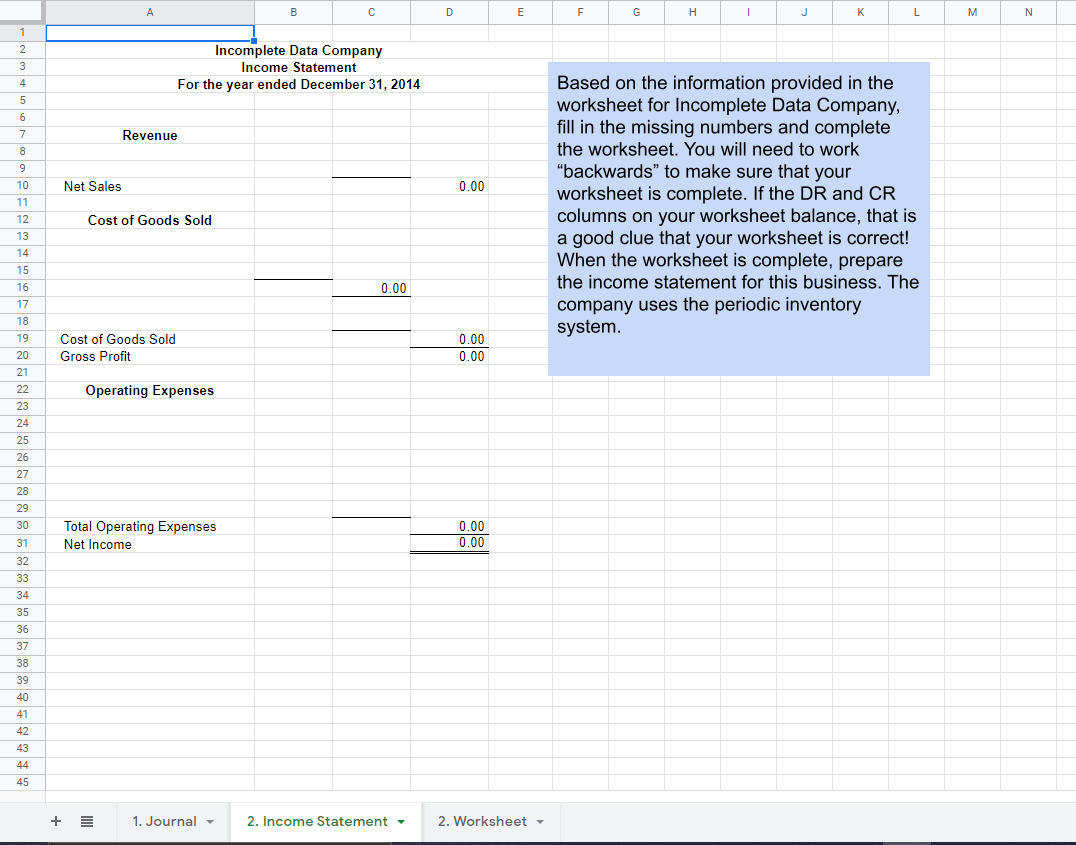

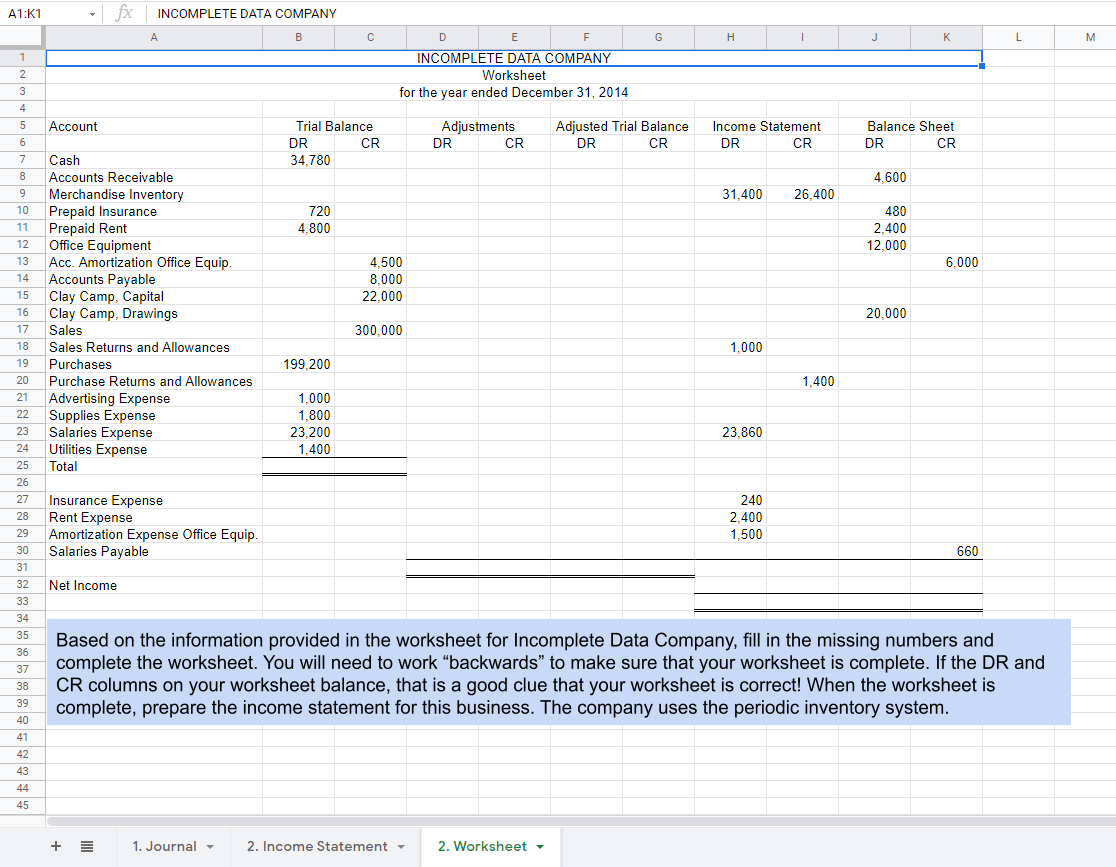

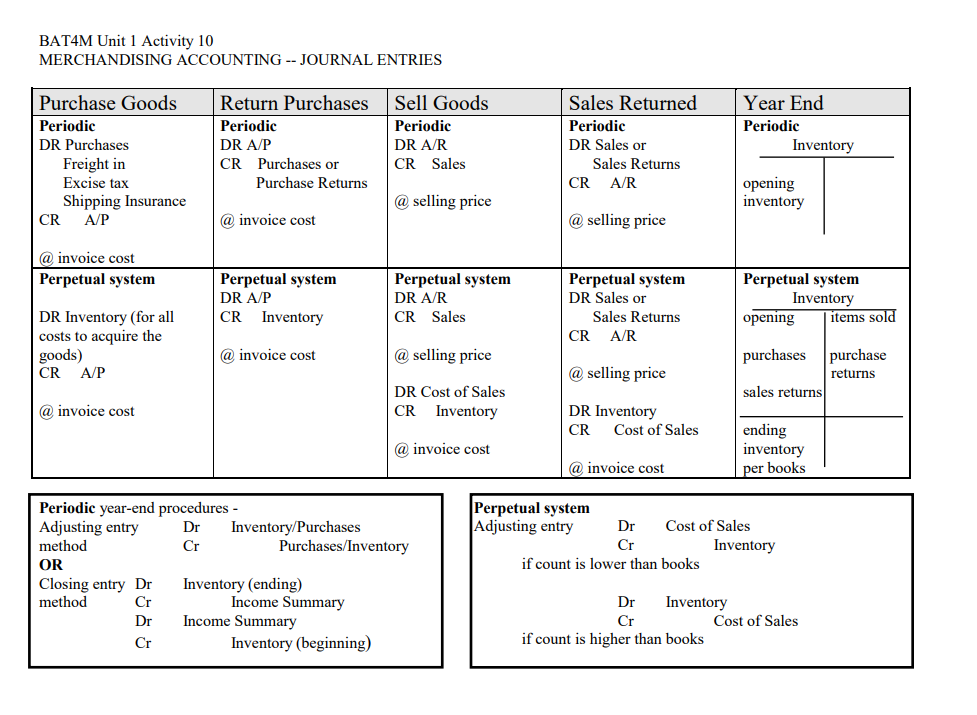

A B D D E F G H J K L M 1 Page Credit General Journal Date Particulars Periodic Inventory System Entries PR 2 3 Debit 4 5 6 7 8 Analyze each of the following transactions and record journal entries under both the: 1. periodic inventory system, and 2. perpetual inventory system. 9 b. 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 a. Purchased $1000 of inventory on terms 2/10 n30 (2% discount if paid within 10 days otherwise the total or net amount is due in 30 days) Returned $200 of inventory from purchase made in (a) c. Paid for purchase made in (a) within 10 days d. Paid for purchase made in (a) within 30 days e. Sold the merchandise for $1600 for terms 2/10 n30 (assuming you had paid for merchandise within 10 days) f. Customer returned 12 of items they purchased in (e) g. Customer paid for the purchase they made in (e) in 10 days h. Customer paid for the purchase they made in (e) in 30 days Perpetual Inventory System Entries 45 + E 1. Journal - 2. Income Statement - 2. Worksheet - A B B D E F G H H J K L M N 1 2 2 3 4 5 Incomplete Data Company Income Statement For the year ended December 31, 2014 6 7 Revenue 8 Net Sales 0.00 Based on the information provided in the worksheet for Incomplete Data Company, fill in the missing numbers and complete the worksheet. You will need to work "backwards" to make sure that your worksheet is complete. If the DR and CR columns on your worksheet balance, that is a good clue that your worksheet is correct! When the worksheet is complete, prepare the income statement for this business. The company uses the periodic inventory system. Cost of Goods Sold 0.00 Cost of Goods Sold Gross Profit 0.00 0.00 Operating Expenses 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 0.00 Total Operating Expenses Net Income 0.00 + E 1. Journal - 2. Income Statement 2. Worksheet A1:K1 - fx INCOMPLETE DATA COMPANY A B C G H J K L M 1 D E F INCOMPLETE DATA COMPANY Worksheet for the year ended December 31, 2014 2 3 4 5 Account Trial Balance DR CR 34,780 Adjustments DR CR Adjusted Trial Balance DR CR Income Statement DR CR Balance Sheet DR CR 6 4,600 7 8 8 9 10 11 31,400 26,400 720 4,800 480 2.400 12,000 6.000 4.500 8.000 22.000 Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Prepaid Rent Office Equipment Acc. Amortization Office Equip Accounts Payable Clay Camp, Capital Clay Camp, Drawings Sales Sales Returns and Allowances Purchases Purchase Returns and Allowances Advertising Expense Supplies Expense Salaries Expense Utilities Expense Total 20,000 12 13 14 15 16 17 18 19 20 21 22 23 24 300,000 1.000 199.200 1.400 1.000 1,800 23,200 1,400 23,860 25 26 27 28 29 Insurance Expense Rent Expense Amortization Expense Office Equip Salaries Payable 240 2,400 1.500 660 Net Income 30 31 32 33 34 35 36 37 38 39 Based on the information provided in the worksheet for Incomplete Data Company, fill in the missing numbers and complete the worksheet. You will need to work "backwards to make sure that your worksheet is complete. If the DR and CR columns on your worksheet balance, that is a good clue that your worksheet is correct! When the worksheet is complete, prepare the income statement for this business. The company uses the periodic inventory system. 40 41 42 43 44 45 + 1. Journal - 2. Income Statement 2. Worksheet BATAM Unit 1 Activity 10 MERCHANDISING ACCOUNTING -- JOURNAL ENTRIES Purchase Goods Periodic DR Purchases Freight in Excise tax Shipping Insurance CR A/P Return Purchases Periodic DR A/P CR Purchases or Purchase Returns Sell Goods Periodic DR AR CR Sales Sales Returned Periodic DR Sales or Sales Returns CR A/R Year End Periodic Inventory @ selling price opening inventory @ invoice cost @ selling price @ invoice cost Perpetual system Perpetual system DR A/P CR Inventory Perpetual system DR AR CR Sales Perpetual system DR Sales or Sales Returns CR A/R Perpetual system Inventory opening items sold DR Inventory (for all costs to acquire the goods) CR A/P @ invoice cost @ selling price @ selling price purchases purchase returns sales returns DR Cost of Sales CR Inventory @ invoice cost DR Inventory CR Cost of Sales @ invoice cost ending inventory per books @ invoice cost Perpetual system Adjusting entry Dr Cost of Sales Cr Inventory if count is lower than books Periodic year-end procedures Adjusting entry Dr Inventory/Purchases method Cr Purchases/Inventory OR Closing entry Dr Inventory (ending) method Cr Income Summary Dr Income Summary Cr Inventory (beginning) Dr Inventory Cr Cost of Sales if count is higher than books A B D D E F G H J K L M 1 Page Credit General Journal Date Particulars Periodic Inventory System Entries PR 2 3 Debit 4 5 6 7 8 Analyze each of the following transactions and record journal entries under both the: 1. periodic inventory system, and 2. perpetual inventory system. 9 b. 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 a. Purchased $1000 of inventory on terms 2/10 n30 (2% discount if paid within 10 days otherwise the total or net amount is due in 30 days) Returned $200 of inventory from purchase made in (a) c. Paid for purchase made in (a) within 10 days d. Paid for purchase made in (a) within 30 days e. Sold the merchandise for $1600 for terms 2/10 n30 (assuming you had paid for merchandise within 10 days) f. Customer returned 12 of items they purchased in (e) g. Customer paid for the purchase they made in (e) in 10 days h. Customer paid for the purchase they made in (e) in 30 days Perpetual Inventory System Entries 45 + E 1. Journal - 2. Income Statement - 2. Worksheet - A B B D E F G H H J K L M N 1 2 2 3 4 5 Incomplete Data Company Income Statement For the year ended December 31, 2014 6 7 Revenue 8 Net Sales 0.00 Based on the information provided in the worksheet for Incomplete Data Company, fill in the missing numbers and complete the worksheet. You will need to work "backwards" to make sure that your worksheet is complete. If the DR and CR columns on your worksheet balance, that is a good clue that your worksheet is correct! When the worksheet is complete, prepare the income statement for this business. The company uses the periodic inventory system. Cost of Goods Sold 0.00 Cost of Goods Sold Gross Profit 0.00 0.00 Operating Expenses 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 0.00 Total Operating Expenses Net Income 0.00 + E 1. Journal - 2. Income Statement 2. Worksheet A1:K1 - fx INCOMPLETE DATA COMPANY A B C G H J K L M 1 D E F INCOMPLETE DATA COMPANY Worksheet for the year ended December 31, 2014 2 3 4 5 Account Trial Balance DR CR 34,780 Adjustments DR CR Adjusted Trial Balance DR CR Income Statement DR CR Balance Sheet DR CR 6 4,600 7 8 8 9 10 11 31,400 26,400 720 4,800 480 2.400 12,000 6.000 4.500 8.000 22.000 Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Prepaid Rent Office Equipment Acc. Amortization Office Equip Accounts Payable Clay Camp, Capital Clay Camp, Drawings Sales Sales Returns and Allowances Purchases Purchase Returns and Allowances Advertising Expense Supplies Expense Salaries Expense Utilities Expense Total 20,000 12 13 14 15 16 17 18 19 20 21 22 23 24 300,000 1.000 199.200 1.400 1.000 1,800 23,200 1,400 23,860 25 26 27 28 29 Insurance Expense Rent Expense Amortization Expense Office Equip Salaries Payable 240 2,400 1.500 660 Net Income 30 31 32 33 34 35 36 37 38 39 Based on the information provided in the worksheet for Incomplete Data Company, fill in the missing numbers and complete the worksheet. You will need to work "backwards to make sure that your worksheet is complete. If the DR and CR columns on your worksheet balance, that is a good clue that your worksheet is correct! When the worksheet is complete, prepare the income statement for this business. The company uses the periodic inventory system. 40 41 42 43 44 45 + 1. Journal - 2. Income Statement 2. Worksheet BATAM Unit 1 Activity 10 MERCHANDISING ACCOUNTING -- JOURNAL ENTRIES Purchase Goods Periodic DR Purchases Freight in Excise tax Shipping Insurance CR A/P Return Purchases Periodic DR A/P CR Purchases or Purchase Returns Sell Goods Periodic DR AR CR Sales Sales Returned Periodic DR Sales or Sales Returns CR A/R Year End Periodic Inventory @ selling price opening inventory @ invoice cost @ selling price @ invoice cost Perpetual system Perpetual system DR A/P CR Inventory Perpetual system DR AR CR Sales Perpetual system DR Sales or Sales Returns CR A/R Perpetual system Inventory opening items sold DR Inventory (for all costs to acquire the goods) CR A/P @ invoice cost @ selling price @ selling price purchases purchase returns sales returns DR Cost of Sales CR Inventory @ invoice cost DR Inventory CR Cost of Sales @ invoice cost ending inventory per books @ invoice cost Perpetual system Adjusting entry Dr Cost of Sales Cr Inventory if count is lower than books Periodic year-end procedures Adjusting entry Dr Inventory/Purchases method Cr Purchases/Inventory OR Closing entry Dr Inventory (ending) method Cr Income Summary Dr Income Summary Cr Inventory (beginning) Dr Inventory Cr Cost of Sales if count is higher than books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts