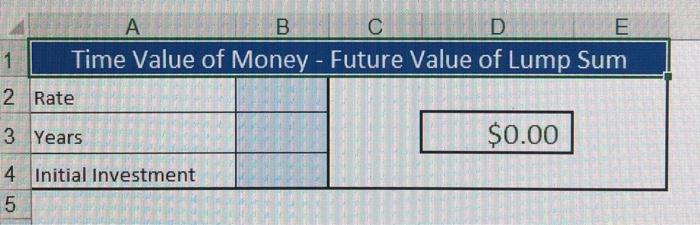

Question: A B D E 1 Time Value of Money - Future Value of Lump Sum 2 Rate 3 Years $0.00 4 Initial Investment 5 1

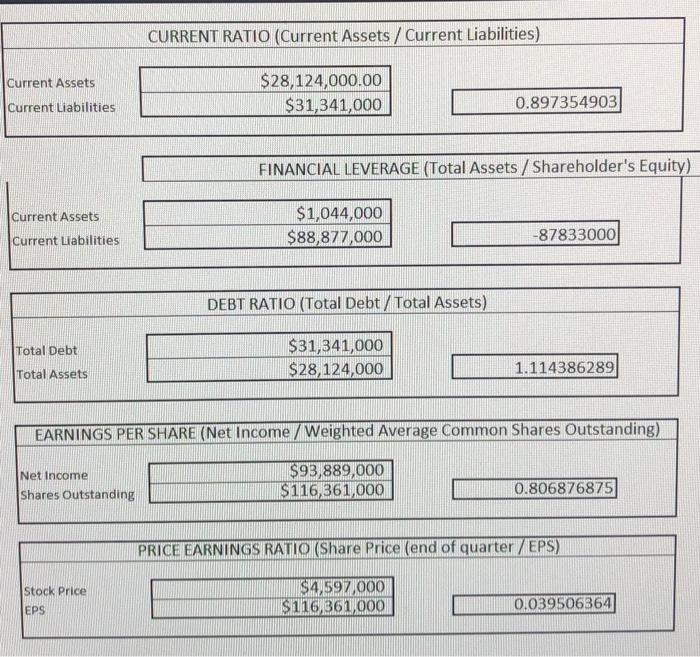

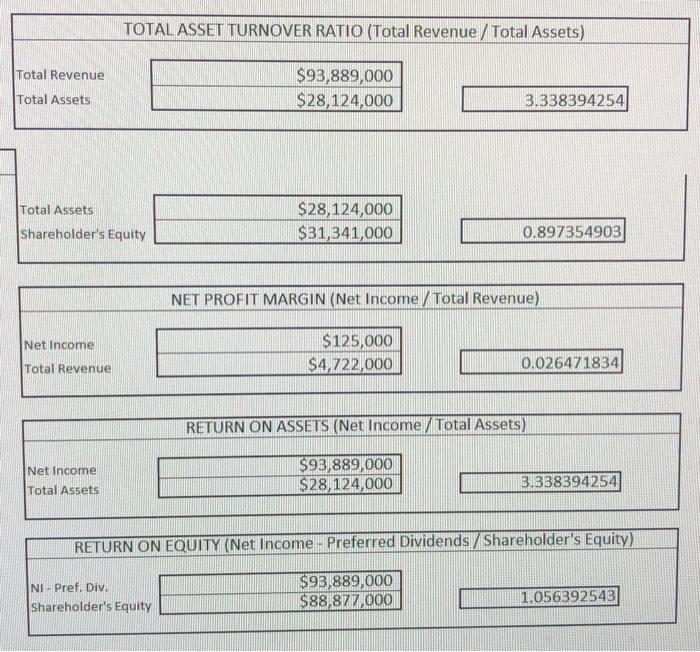

A B D E 1 Time Value of Money - Future Value of Lump Sum 2 Rate 3 Years $0.00 4 Initial Investment 5 1 1 CURRENT RATIO (Current Assets / Current Liabilities) Current Assets $28,124,000.00 $31,341,000 Current Liabilities 0.897354903 FINANCIAL LEVERAGE (Total Assets / Shareholder's Equity) Current Assets $1,044,000 $88,877,000 Current Liabilities -87833000 DEBT RATIO (Total Debt / Total Assets) Total Debt $31,341,000 $28,124,000 Total Assets 1.114386289 EARNINGS PER SHARE (Net Income /Weighted Average Common Shares Outstanding) Net Income Shares Outstanding $93,889,000 $116,361,000 0.806876875 PRICE EARNINGS RATIO (Share Price (end of quarter/EPS) Stock Price $4,597,000 $116,361,000 0.039506364 EPS TOTAL ASSET TURNOVER RATIO (Total Revenue / Total Assets) Total Revenue $93,889,000 $28,124,000 Total Assets 3.338394254 Total Assets $28,124,000 $31,341,000 Shareholder's Equity 0.897354903 NET PROFIT MARGIN (Net Income / Total Revenue) Net Income $125,000 $4,722,000 0.026471834 Total Revenue RETURN ON ASSETS (Net Income / Total Assets) Net Income Total Assets $93,889,000 $28,124,000 3.338394254 RETURN ON EQUITY (Net Income. Preferred Dividends Shareholder's Equity) NI - Pref. Div. Shareholder's Equity $93,889,000 $88,877,000 1.056392543

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts