Question: A B D E F E17-2 (LO 1, 2, 4) Weighted Average Number of Shares Gogeon Inc. is publicly traded and uses a calendar year

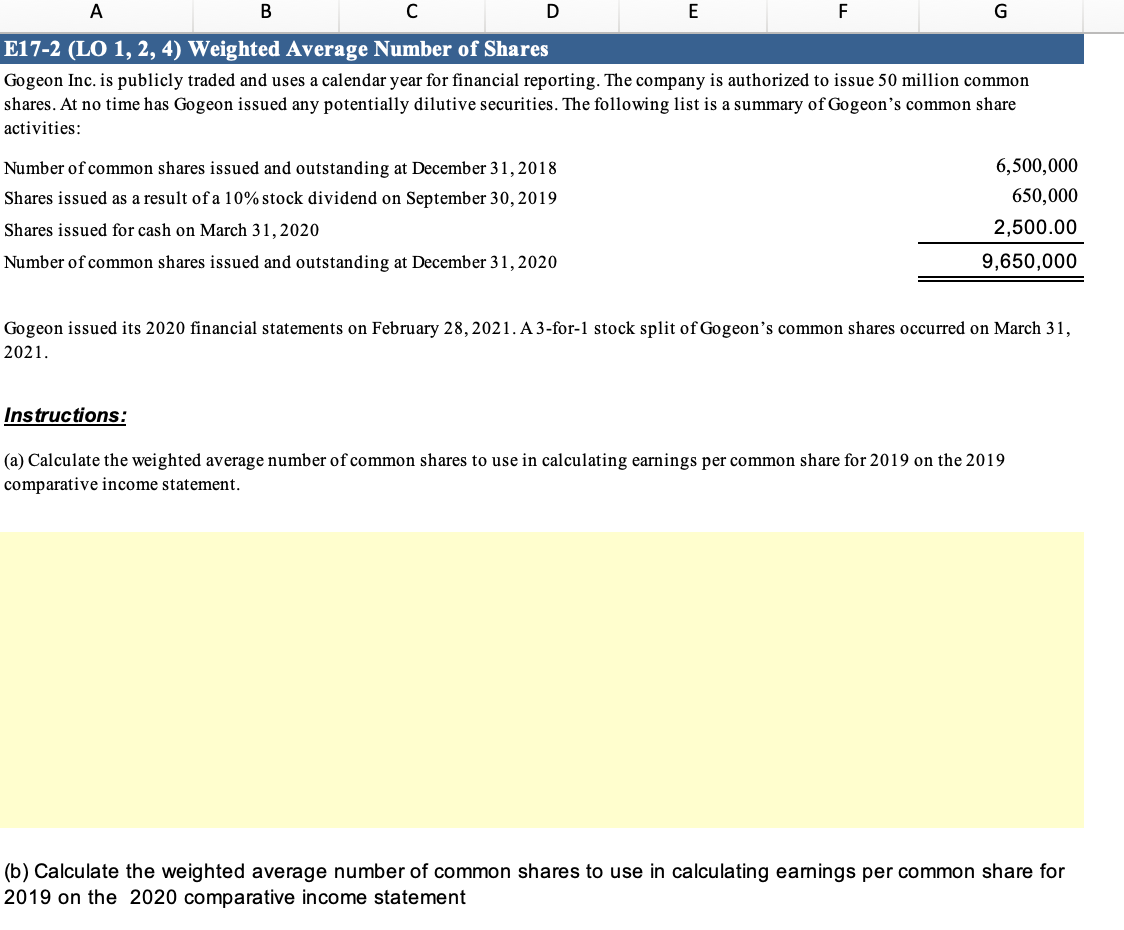

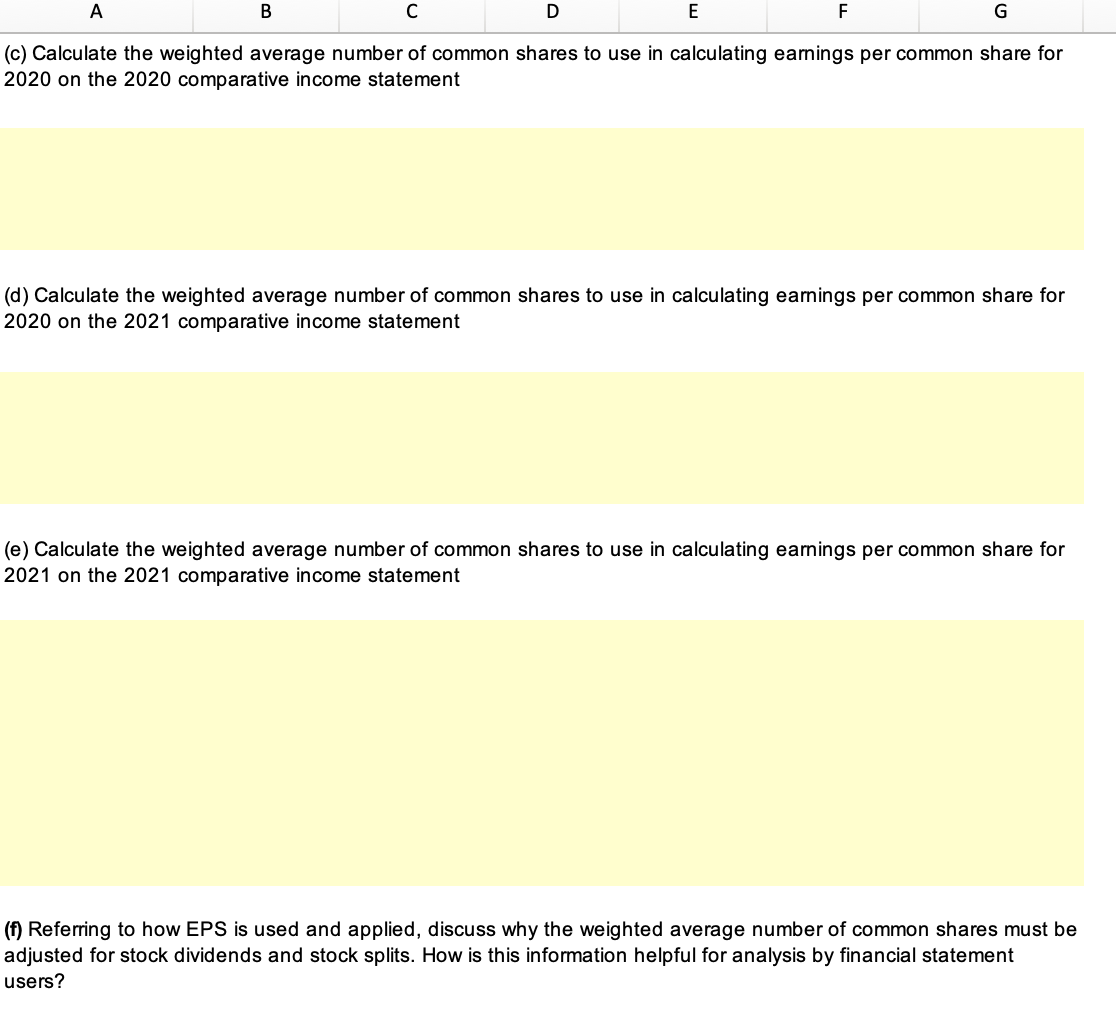

A B D E F E17-2 (LO 1, 2, 4) Weighted Average Number of Shares Gogeon Inc. is publicly traded and uses a calendar year for financial reporting. The company is authorized to issue 50 million common shares. At no time has Gogeon issued any potentially dilutive securities. The following list is a summary of Gogeon's common share activities: Number of common shares issued and outstanding at December 31, 2018 Shares issued as a result of a 10% stock dividend on September 30, 2019 Shares issued for cash on March 31, 2020 Number of common shares issued and outstanding at December 31, 2020 6,500,000 650,000 2,500.00 9,650,000 Gogeon issued its 2020 financial statements on February 28, 2021. A 3-for-1 stock split of Gogeon's common shares occurred on March 31, 2021. Instructions: number of common shares to use in calculating earnings per common share for 2019 on the 2019 (a) Calculate the weighted aver comparative income statement. (b) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2019 on the 2020 comparative income statement A B D E F G (c) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2020 on the 2020 comparative income statement (d) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2020 on the 2021 comparative income statement (e) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2021 on the 2021 comparative income statement (f) Referring to how EPS is used and applied, discuss why the weighted average number of common shares must be adjusted for stock dividends and stock splits. How is this information helpful for analysis by financial statement users? (g) Assume Gogeon Inc. was privately owned and used ASPE. How would the EPS requirements differ from the requirements using IFRS? A B D E F E17-2 (LO 1, 2, 4) Weighted Average Number of Shares Gogeon Inc. is publicly traded and uses a calendar year for financial reporting. The company is authorized to issue 50 million common shares. At no time has Gogeon issued any potentially dilutive securities. The following list is a summary of Gogeon's common share activities: Number of common shares issued and outstanding at December 31, 2018 Shares issued as a result of a 10% stock dividend on September 30, 2019 Shares issued for cash on March 31, 2020 Number of common shares issued and outstanding at December 31, 2020 6,500,000 650,000 2,500.00 9,650,000 Gogeon issued its 2020 financial statements on February 28, 2021. A 3-for-1 stock split of Gogeon's common shares occurred on March 31, 2021. Instructions: number of common shares to use in calculating earnings per common share for 2019 on the 2019 (a) Calculate the weighted aver comparative income statement. (b) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2019 on the 2020 comparative income statement A B D E F G (c) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2020 on the 2020 comparative income statement (d) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2020 on the 2021 comparative income statement (e) Calculate the weighted average number of common shares to use in calculating earnings per common share for 2021 on the 2021 comparative income statement (f) Referring to how EPS is used and applied, discuss why the weighted average number of common shares must be adjusted for stock dividends and stock splits. How is this information helpful for analysis by financial statement users? (g) Assume Gogeon Inc. was privately owned and used ASPE. How would the EPS requirements differ from the requirements using IFRS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts