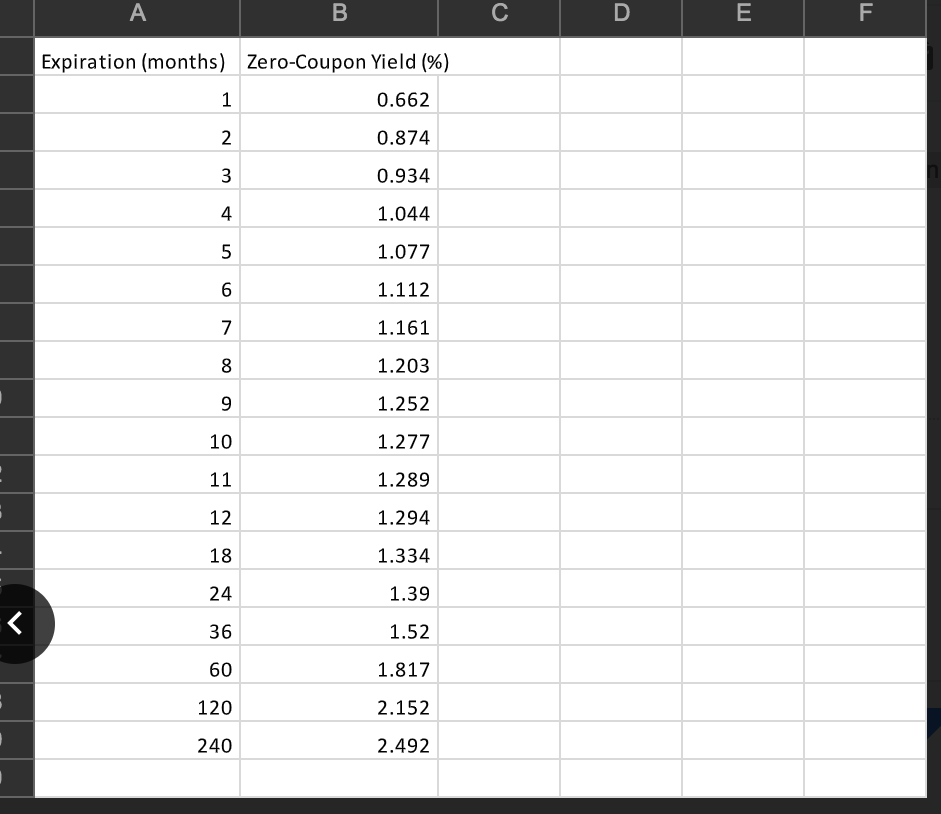

Question: A B D E F Expiration (months) Zero-Coupon Yield (%) 1 0.662 N 0.874 3 0.934 4 1.044 5 1.077 6 1.112 7 1.161 00

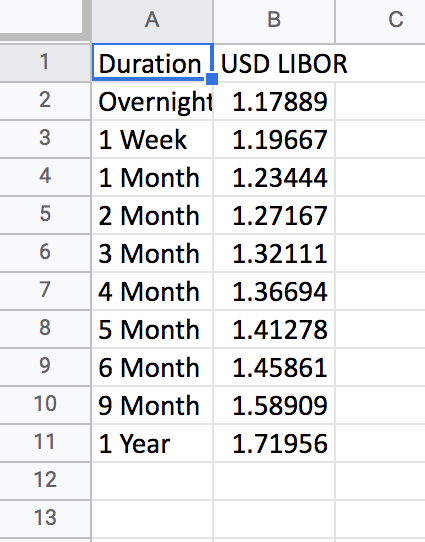

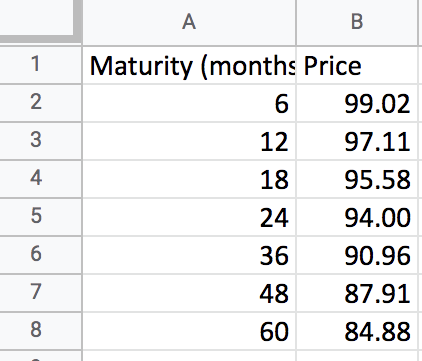

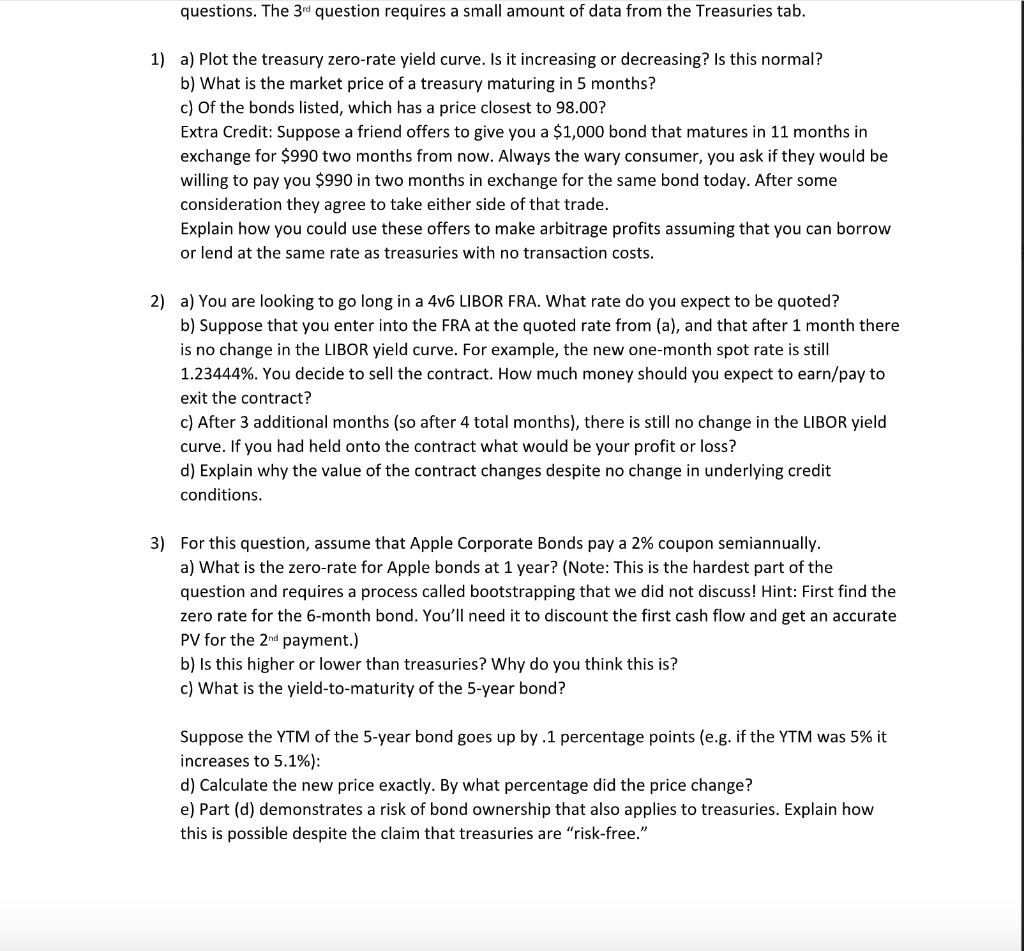

A B D E F Expiration (months) Zero-Coupon Yield (%) 1 0.662 N 0.874 3 0.934 4 1.044 5 1.077 6 1.112 7 1.161 00 1.203 9 1.252 10 1.277 11 1.289 . 12 1.294 18 1.334 24 1.39 ( r 36 1.52 60 1.817 120 2.152 240 2.492 A B 1 1 2 3 4 5 6 Duration LUSD LIBOR Overnight 1.17889 1 Week 1.19667 1 Month 1.23444 2 Month 1.27167 3 Month 1.32111 4 Month 1.36694 5 Month 1.41278 6 Month 1.45861 9 Month 1.58909 1 Year 1.71956 7 8 9 10 11 12 13 A B 1 2 3 4 Maturity (months Price 6 99.02 12 97.11 18 95.58 24 94.00 36 90.96 48 87.91 60 84.88 5 6 7 8 questions. The 3rd question requires a small amount of data from the Treasuries tab. 1) a) Plot the treasury zero-rate yield curve. Is it increasing or decreasing? Is this normal? b) What is the market price of a treasury maturing in 5 months? c) of the bonds listed, which has a price closest to 98.00? Extra Credit: Suppose a friend offers to give you a $1,000 bond that matures in 11 months in exchange for $990 two months from now. Always the wary consumer, you ask if they would be willing to pay you $990 in two months in exchange for the same bond today. After some consideration they agree to take either side of that trade. Explain how you could use these offers to make arbitrage profits assuming that you can borrow or lend at the same rate as treasuries with no transaction costs. 2) a) You are looking to go long in a 4v6 LIBOR FRA. What rate do you expect to be quoted? b) Suppose that you enter into the FRA at the quoted rate from (a), and that after 1 month there is no change in the LIBOR yield curve. For example, the new one-month spot rate is still 1.23444%. You decide to sell the contract. How much money should you expect to earn/pay to exit the contract? c) After 3 additional months (so after 4 total months), there is still no change in the LIBOR yield curve. If you had held onto the contract what would be your profit or loss? d) Explain why the value of the contract changes despite no change in underlying credit conditions. 3) For this question, assume that Apple Corporate Bonds pay a 2% coupon semiannually. a) What is the zero-rate for Apple bonds at 1 year? (Note: This is the hardest part of the question and requires a process called bootstrapping that we did not discuss! Hint: First find the zero rate for the 6-month bond. You'll need it to discount the first cash flow and get an accurate PV for the 2nd payment.) b) Is this higher or lower than treasuries? Why do you think this is? c) What is the yield-to-maturity of the 5-year bond? Suppose the YTM of the 5-year bond goes up by.1 percentage points (e.g. if the YTM was 5% it increases to 5.1%): d) Calculate the new price exactly. By what percentage did the price change? e) Part (d) demonstrates a risk of bond ownership that also applies to treasuries. Explain how this is possible despite the claim that treasuries are "risk-free." A B D E F Expiration (months) Zero-Coupon Yield (%) 1 0.662 N 0.874 3 0.934 4 1.044 5 1.077 6 1.112 7 1.161 00 1.203 9 1.252 10 1.277 11 1.289 . 12 1.294 18 1.334 24 1.39 ( r 36 1.52 60 1.817 120 2.152 240 2.492 A B 1 1 2 3 4 5 6 Duration LUSD LIBOR Overnight 1.17889 1 Week 1.19667 1 Month 1.23444 2 Month 1.27167 3 Month 1.32111 4 Month 1.36694 5 Month 1.41278 6 Month 1.45861 9 Month 1.58909 1 Year 1.71956 7 8 9 10 11 12 13 A B 1 2 3 4 Maturity (months Price 6 99.02 12 97.11 18 95.58 24 94.00 36 90.96 48 87.91 60 84.88 5 6 7 8 questions. The 3rd question requires a small amount of data from the Treasuries tab. 1) a) Plot the treasury zero-rate yield curve. Is it increasing or decreasing? Is this normal? b) What is the market price of a treasury maturing in 5 months? c) of the bonds listed, which has a price closest to 98.00? Extra Credit: Suppose a friend offers to give you a $1,000 bond that matures in 11 months in exchange for $990 two months from now. Always the wary consumer, you ask if they would be willing to pay you $990 in two months in exchange for the same bond today. After some consideration they agree to take either side of that trade. Explain how you could use these offers to make arbitrage profits assuming that you can borrow or lend at the same rate as treasuries with no transaction costs. 2) a) You are looking to go long in a 4v6 LIBOR FRA. What rate do you expect to be quoted? b) Suppose that you enter into the FRA at the quoted rate from (a), and that after 1 month there is no change in the LIBOR yield curve. For example, the new one-month spot rate is still 1.23444%. You decide to sell the contract. How much money should you expect to earn/pay to exit the contract? c) After 3 additional months (so after 4 total months), there is still no change in the LIBOR yield curve. If you had held onto the contract what would be your profit or loss? d) Explain why the value of the contract changes despite no change in underlying credit conditions. 3) For this question, assume that Apple Corporate Bonds pay a 2% coupon semiannually. a) What is the zero-rate for Apple bonds at 1 year? (Note: This is the hardest part of the question and requires a process called bootstrapping that we did not discuss! Hint: First find the zero rate for the 6-month bond. You'll need it to discount the first cash flow and get an accurate PV for the 2nd payment.) b) Is this higher or lower than treasuries? Why do you think this is? c) What is the yield-to-maturity of the 5-year bond? Suppose the YTM of the 5-year bond goes up by.1 percentage points (e.g. if the YTM was 5% it increases to 5.1%): d) Calculate the new price exactly. By what percentage did the price change? e) Part (d) demonstrates a risk of bond ownership that also applies to treasuries. Explain how this is possible despite the claim that treasuries are "risk-free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts