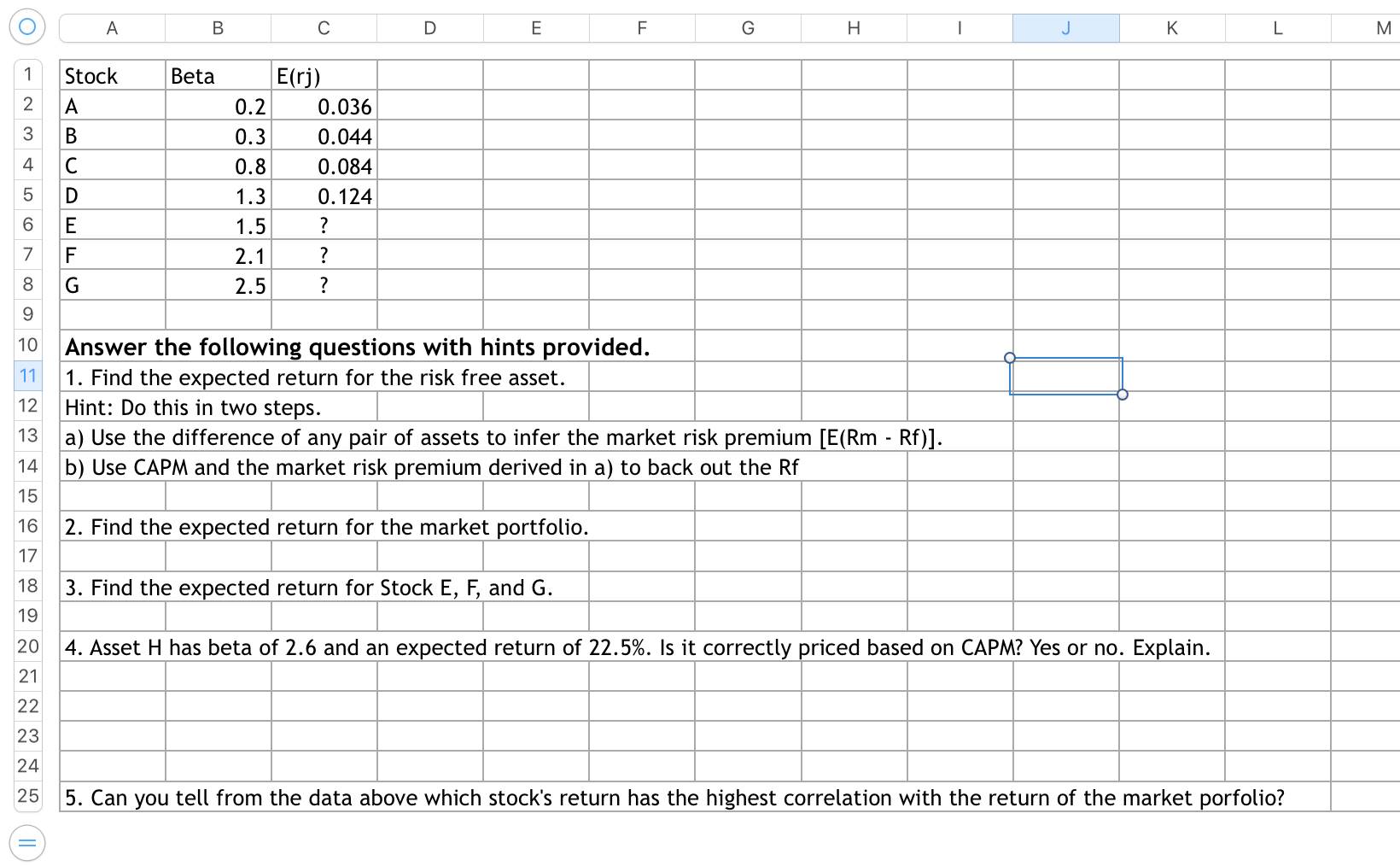

Question: A B D E F G . 1 J K L M 1 Stock Beta 2 A 3 B C 4 E(ri) 0.036 0.044 0.084

A B D E F G . 1 J K L M 1 Stock Beta 2 A 3 B C 4 E(ri) 0.036 0.044 0.084 0.124 ? ? ? 5 0.2 0.3 0.8 1.3 1.5 2.1 2.5 D 6 E 7 F 8 G 9 10 11 12 13 Answer the following questions with hints provided. 1. Find the expected return for the risk free asset. Hint: Do this in two steps. a) Use the difference of any pair of assets to infer the market risk premium [E(Rm - Rf)]. b) Use CAPM and the market risk premium derived in a) to back out the Rf 14 15 16 2. Find the expected return for the market portfolio. 17 18 3. Find the expected return for Stock E, F, and G. 19 20 4. Asset H has beta of 2.6 and an expected return of 22.5%. Is it correctly priced based on CAPM? Yes or no. Explain. 21 22 23 24 25 5. Can you tell from the data above which stock's return has the highest correlation with the return of the market porfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts