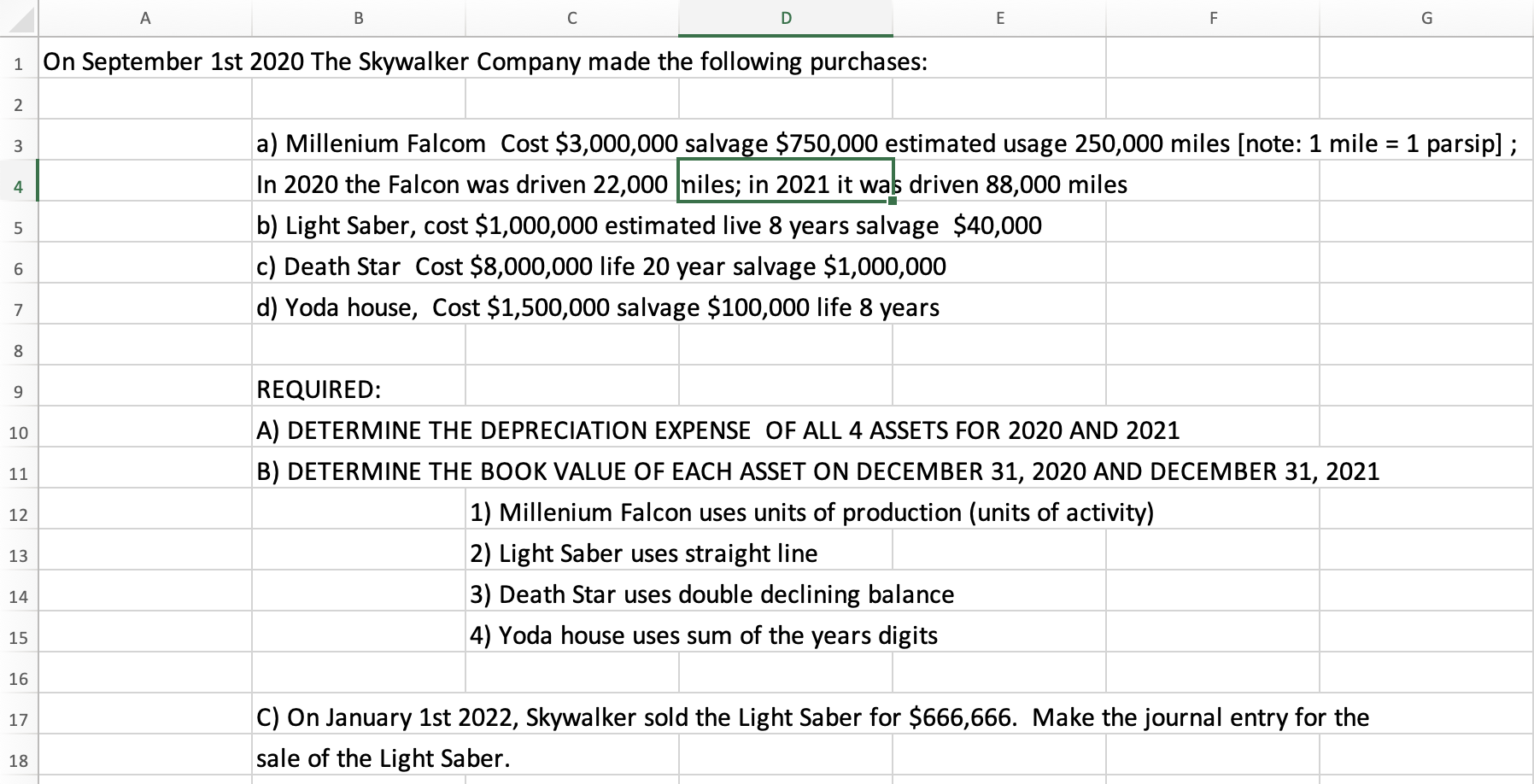

Question: A B D E F G 1 On September 1st 2020 The Skywalker Company made the following purchases: 2. 3 = 4 5 a) Millenium

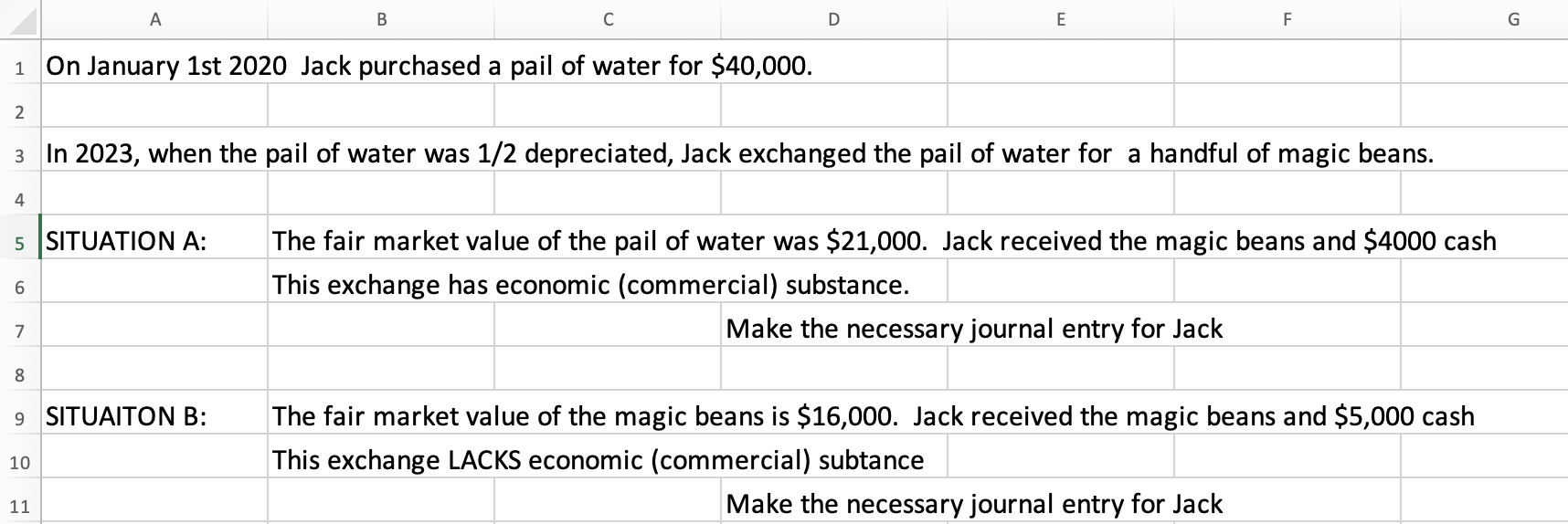

A B D E F G 1 On September 1st 2020 The Skywalker Company made the following purchases: 2. 3 = 4 5 a) Millenium Falcom Cost $3,000,000 salvage $750,000 estimated usage 250,000 miles (note: 1 mile = 1 parsip]; In 2020 the Falcon was driven 22,000 niles; in 2021 it was driven 88,000 miles b) Light Saber, cost $1,000,000 estimated live 8 years salvage $40,000 c) Death Star Cost $8,000,000 life 20 year salvage $1,000,000 d) Yoda house, Cost $1,500,000 salvage $100,000 life 8 years 6 7 00 8 9 10 11 12 REQUIRED: A) DETERMINE THE DEPRECIATION EXPENSE OF ALL 4 ASSETS FOR 2020 AND 2021 B) DETERMINE THE BOOK VALUE OF EACH ASSET ON DECEMBER 31, 2020 AND DECEMBER 31, 2021 1) Millenium Falcon uses units of production (units of activity) 2) Light Saber uses straight line 3) Death Star uses double declining balance 4) Yoda house uses sum of the years digits 13 14 15 16 17 C) On January 1st 2022, Skywalker sold the Light Saber for $666,666. Make the journal entry for the sale of the Light Saber. 18 A B D E F G 1 On January 1st 2020 Jack purchased a pail of water for $40,000. 2. 3 In 2023, when the pail of water was 1/2 depreciated, Jack exchanged the pail of water for a handful of magic beans. 4 5 SITUATION A: 6 The fair market value of the pail of water was $21,000. Jack received the magic beans and $4000 cash This exchange has economic (commercial) substance. Make the necessary journal entry for Jack 7 8 9 SITUAITON B: 10 The fair market value of the magic beans is $16,000. Jack received the magic beans and $5,000 cash This exchange LACKS economic (commercial) subtance Make the necessary journal entry for Jack 11 A B D E F G 1 On September 1st 2020 The Skywalker Company made the following purchases: 2. 3 = 4 5 a) Millenium Falcom Cost $3,000,000 salvage $750,000 estimated usage 250,000 miles (note: 1 mile = 1 parsip]; In 2020 the Falcon was driven 22,000 niles; in 2021 it was driven 88,000 miles b) Light Saber, cost $1,000,000 estimated live 8 years salvage $40,000 c) Death Star Cost $8,000,000 life 20 year salvage $1,000,000 d) Yoda house, Cost $1,500,000 salvage $100,000 life 8 years 6 7 00 8 9 10 11 12 REQUIRED: A) DETERMINE THE DEPRECIATION EXPENSE OF ALL 4 ASSETS FOR 2020 AND 2021 B) DETERMINE THE BOOK VALUE OF EACH ASSET ON DECEMBER 31, 2020 AND DECEMBER 31, 2021 1) Millenium Falcon uses units of production (units of activity) 2) Light Saber uses straight line 3) Death Star uses double declining balance 4) Yoda house uses sum of the years digits 13 14 15 16 17 C) On January 1st 2022, Skywalker sold the Light Saber for $666,666. Make the journal entry for the sale of the Light Saber. 18 A B D E F G 1 On January 1st 2020 Jack purchased a pail of water for $40,000. 2. 3 In 2023, when the pail of water was 1/2 depreciated, Jack exchanged the pail of water for a handful of magic beans. 4 5 SITUATION A: 6 The fair market value of the pail of water was $21,000. Jack received the magic beans and $4000 cash This exchange has economic (commercial) substance. Make the necessary journal entry for Jack 7 8 9 SITUAITON B: 10 The fair market value of the magic beans is $16,000. Jack received the magic beans and $5,000 cash This exchange LACKS economic (commercial) subtance Make the necessary journal entry for Jack 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts