Question: A B D E F G H 1 2 Player Company acquired 60 percent ownership of Scout Company's voting shares on January 1, 20X2.

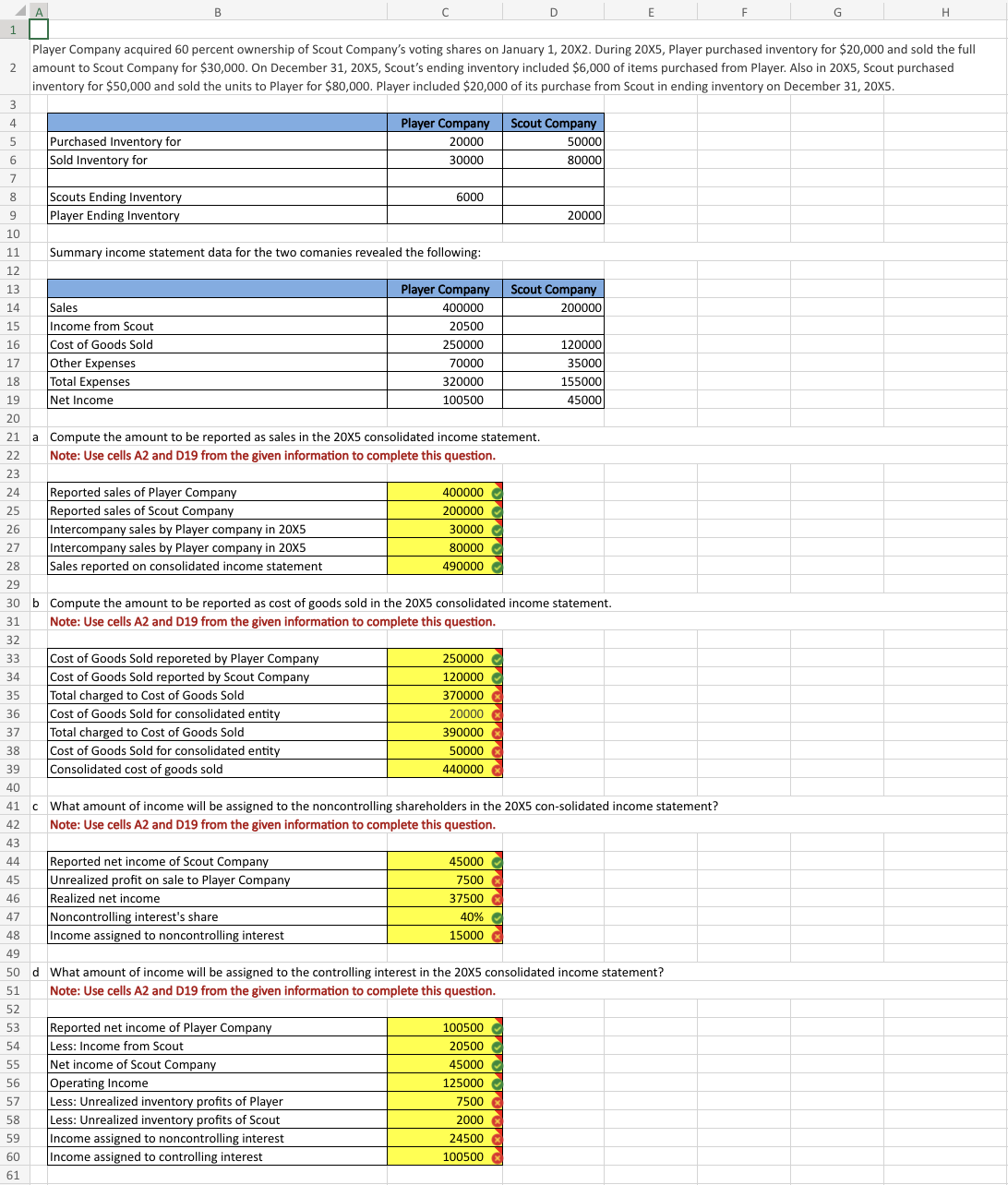

A B D E F G H 1 2 Player Company acquired 60 percent ownership of Scout Company's voting shares on January 1, 20X2. During 20X5, Player purchased inventory for $20,000 and sold the full amount to Scout Company for $30,000. On December 31, 20X5, Scout's ending inventory included $6,000 of items purchased from Player. Also in 20X5, Scout purchased inventory for $50,000 and sold the units to Player for $80,000. Player included $20,000 of its purchase from Scout in ending inventory on December 31, 20X5. 3 4 5 Purchased Inventory for Player Company 20000 Scout Company 50000 6 Sold Inventory for 30000 80000 7 8 Scouts Ending Inventory 9 Player Ending Inventory 6000 20000 10 11 Summary income statement data for the two comanies revealed the following: 12 13 14 Sales Player Company 400000 Scout Company 200000 15 Income from Scout 20500 16 Cost of Goods Sold 250000 120000 17 Other Expenses 70000 35000 18 Total Expenses 320000 155000 19 Net Income 100500 45000 20 21 22 a Compute the amount to be reported as sales in the 20X5 consolidated income statement. Note: Use cells A2 and D19 from the given information to complete this question. 23 24 Reported sales of Player Company 25 Reported sales of Scout Company 26 Intercompany sales by Player company in 20X5 27 Intercompany sales by Player company in 20X5 28 Sales reported on consolidated income statement 400000 200000 30000 80000 490000 29 30 b Compute the amount to be reported as cost of goods sold in the 20X5 consolidated income statement. 31 Note: Use cells A2 and D19 from the given information to complete this question. 32 33 Cost of Goods Sold reporeted by Player Company 250000 34 Cost of Goods Sold reported by Scout Company 120000 35 Total charged to Cost of Goods Sold 370000 36 Cost of Goods Sold for consolidated entity 20000 37 Total charged to Cost of Goods Sold 390000 38 Cost of Goods Sold for consolidated entity 39 Consolidated cost of goods sold 50000 440000 40 41 42 c What amount of income will be assigned to the noncontrolling shareholders in the 20X5 con-solidated income statement? Note: Use cells A2 and D19 from the given information to complete this question. 43 44 Reported net income of Scout Company 45 Unrealized profit on sale to Player Company 46 Realized net income 47 Noncontrolling interest's share 48 Income assigned to noncontrolling interest 45000 7500 37500 40% 15000 49 50 d What amount of income will be assigned to the controlling interest in the 20X5 consolidated income statement? Note: Use cells A2 and D19 from the given information to complete this question. 51 52 53 Reported net income of Player Company 100500 54 Less: Income from Scout 20500 55 Net income of Scout Company 45000 56 Operating Income 125000 57 Less: Unrealized inventory profits of Player 7500 58 Less: Unrealized inventory profits of Scout 2000 59 Income assigned to noncontrolling interest 24500 60 Income assigned to controlling interest 100500 61

Step by Step Solution

There are 3 Steps involved in it

Lets work through the questions step by step A Sales Reported on the Consolidated Income Statement 1 ... View full answer

Get step-by-step solutions from verified subject matter experts