Question: A B D E F G H I 3 TREASURY BOND CALCULATION 4 5 6 7 8 Current date Previous interest payment date Next interest

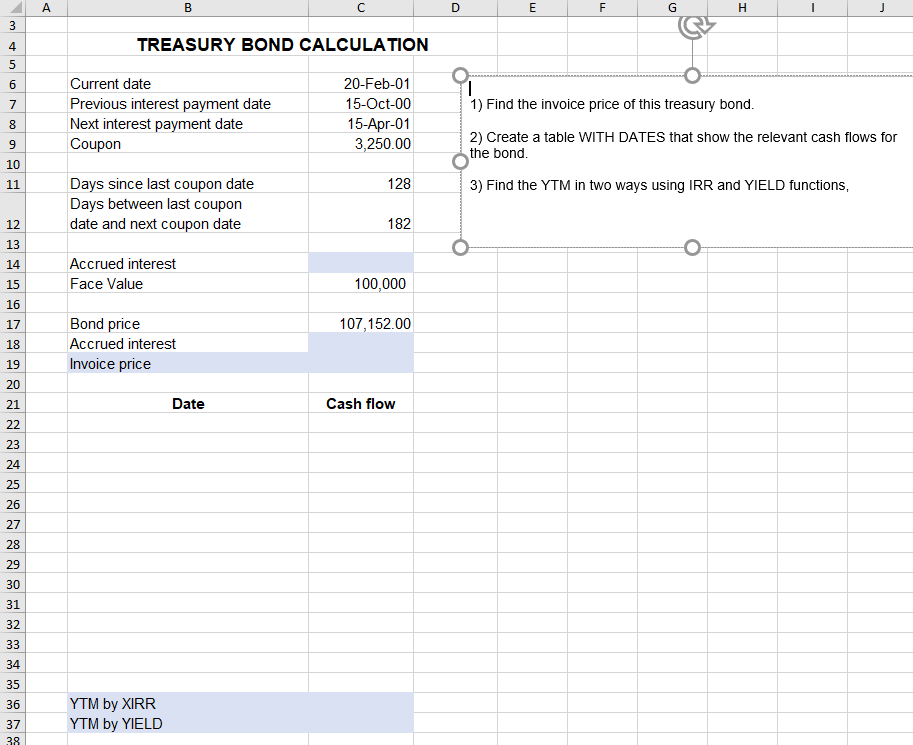

A B D E F G H I 3 TREASURY BOND CALCULATION 4 5 6 7 8 Current date Previous interest payment date Next interest payment date Coupon 20-Feb-01 15-Oct-00 15-Apr-01 3,250.00 1 1) Find the invoice price of this treasury bond. 2) Create a table WITH DATES that show the relevant cash flows for the bond. 9 10 11 128 3) Find the YTM in two ways using IRR and YIELD functions, Days since last coupon date Days between last coupon date and next coupon date 12 182 13 14 Accrued interest Face Value 15 100,000 16 17 107,152.00 18 Bond price Accrued interest Invoice price 19 20 21 Date Cash flow 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 YTM by XIRR YTM by YIELD 37 38 A B D E F G H I 3 TREASURY BOND CALCULATION 4 5 6 7 8 Current date Previous interest payment date Next interest payment date Coupon 20-Feb-01 15-Oct-00 15-Apr-01 3,250.00 1 1) Find the invoice price of this treasury bond. 2) Create a table WITH DATES that show the relevant cash flows for the bond. 9 10 11 128 3) Find the YTM in two ways using IRR and YIELD functions, Days since last coupon date Days between last coupon date and next coupon date 12 182 13 14 Accrued interest Face Value 15 100,000 16 17 107,152.00 18 Bond price Accrued interest Invoice price 19 20 21 Date Cash flow 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 YTM by XIRR YTM by YIELD 37 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts