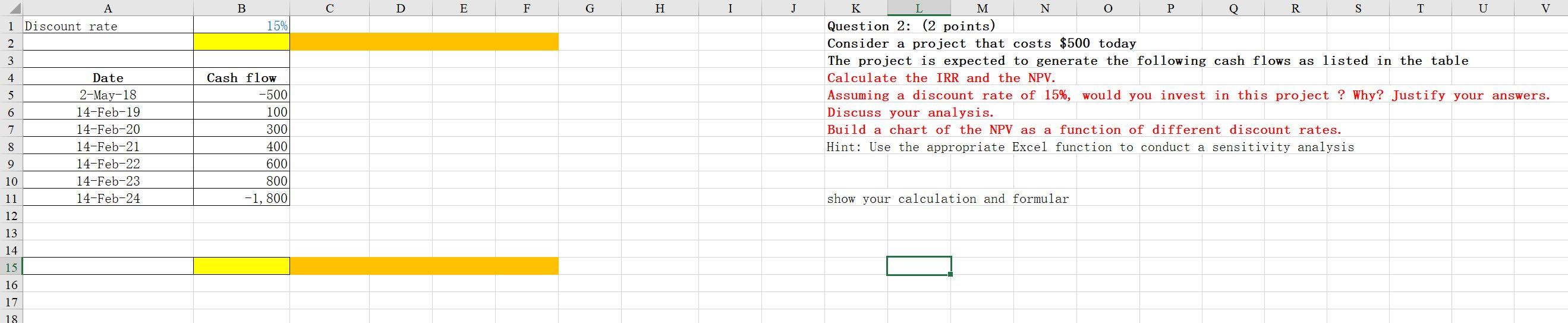

Question: A B D E F G H I J U Discount rate 15% 1 2 3 4 5 6 K L M N O P

A B D E F G H I J U Discount rate 15% 1 2 3 4 5 6 K L M N O P R S T V Question 2: (2 points) Consider a project that costs $500 today The project is expected to generate the following cash flows as listed in the table Calculate the IRR and the NPV. Assuming a discount rate of 15%, would you invest in this project ? Why? Justify your answers. Discuss your analysis. Build a chart of the NPV as a function of different discount rates. Hint: Use the appropriate Excel function to conduct a sensitivity analysis Date 2-May-18 14-Feb-19 14-Feb-20 14-Feb-21 14-Feb-22 14-Feb-23 14-Feb-24 7 Cash flow -500 100 300 400 600 800 -1, 800 8 9 10 11 show your calculation and formular 12 13 14 15 16 17 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts