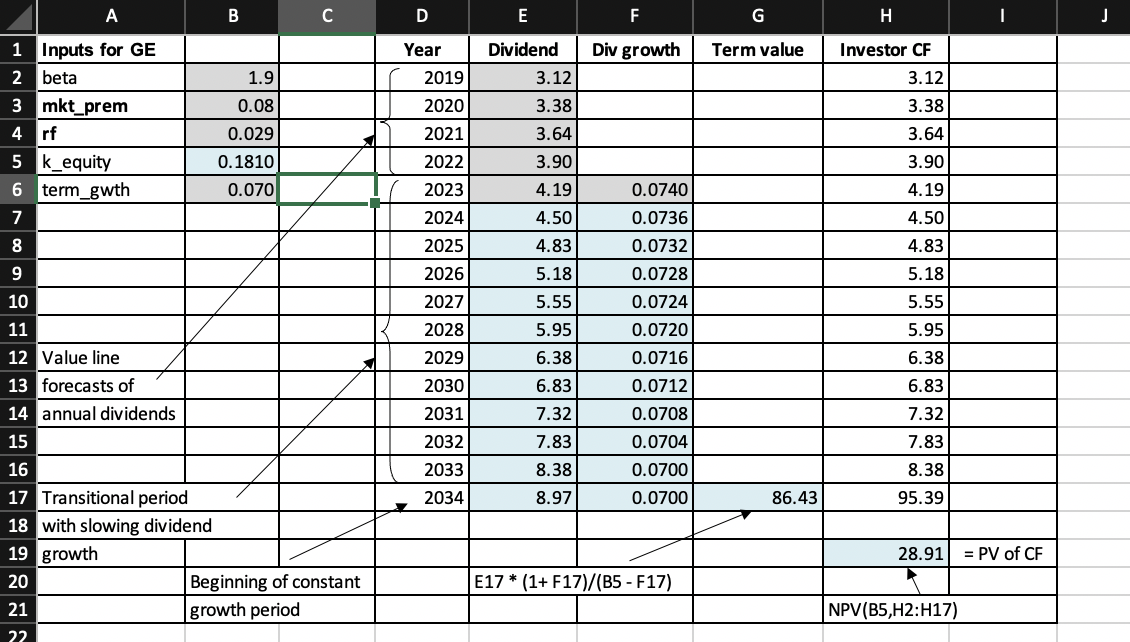

Question: A B D E F G H J Div growth Term value Year 2019 Dividend 3.12 Investor CF 3.12 1.9 0.08 3.38 2020 2021 3.38

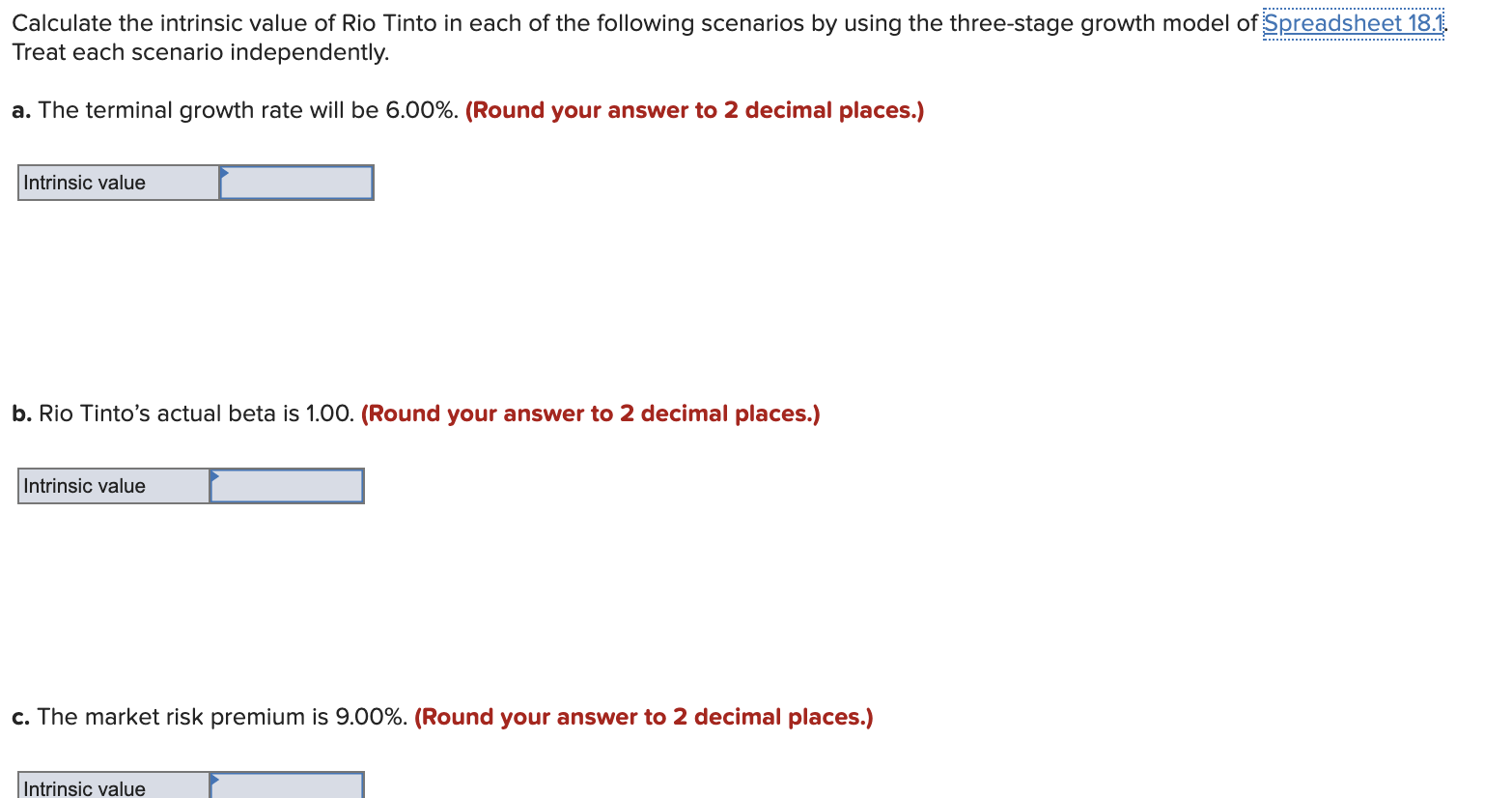

A B D E F G H J Div growth Term value Year 2019 Dividend 3.12 Investor CF 3.12 1.9 0.08 3.38 2020 2021 3.38 3.64 0.029 1 Inputs for GE 2 beta 3 mkt_prem 4 rf 5 k_equity 6 term_gwth 7 8 0.1810 3.90 2022 2023 3.64 3.90 4.19 0.070 4.19 4.50 0.0740 0.0736 2024 4.50 0.0732 2025 2026 9 10 4.83 5.18 5.55 0.0728 0.0724 4.83 5.18 5.55 2027 2028 5.95 2029 5.95 6.38 6.83 0.0720 0.0716 0.0712 2030 2031 6.38 6.83 7.32 7.83 0.0708 7.32 7.83 2032 0.0704 0.0700 11 12 Value line 13 forecasts of 14 annual dividends 15 16 17 Transitional period 18 with slowing dividend 19 growth 20 Beginning of constant 21 growth period 22 2033 2034 8.38 8.97 8.38 95.39 0.0700 86.43 28.91 = PV of CF E17 *(1+F17)/(B5 - F17) NPV(B5, H2:H17) Calculate the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1 Treat each scenario independently. a. The terminal growth rate will be 6.00%. (Round your answer to 2 decimal places.) Intrinsic value b. Rio Tinto's actual beta is 1.00. (Round your answer to 2 decimal places.) Intrinsic value c. The market risk premium is 9.00%. (Round your answer to 2 decimal places.) Intrinsic value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts