Question: A B D E F G H L M N Name Box pmpany wishes to start a new line of chocolate bars. The information about

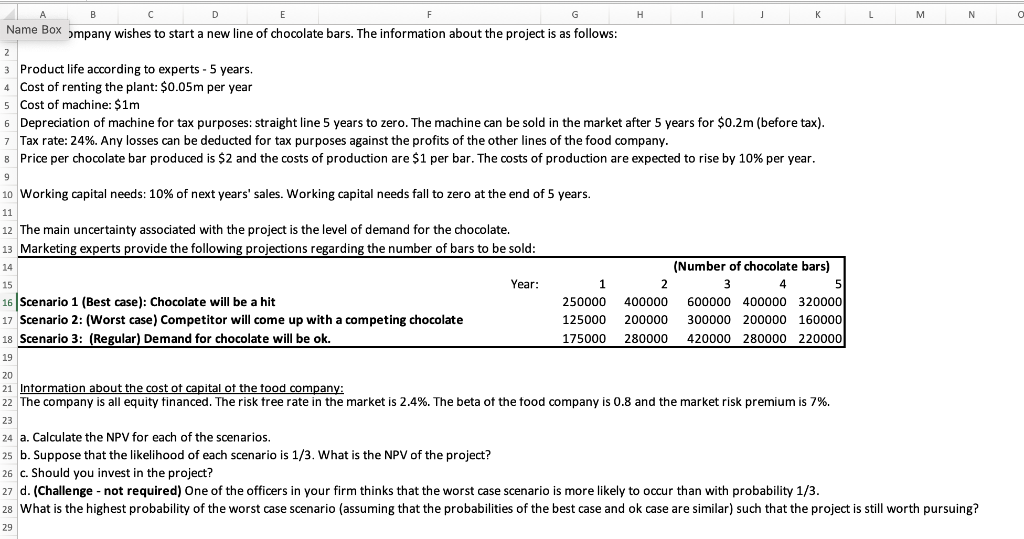

A B D E F G H L M N Name Box pmpany wishes to start a new line of chocolate bars. The information about the project is as follows: 2 3 Product life according to experts - 5 years. 4 Cost of renting the plant: $0.05m per year 5 Cost of machine: $1m 6 Depreciation of machine for tax purposes: straight line 5 years to zero. The machine can be sold in the market after 5 years for $0.2m (before tax). 7 Tax rate: 24%. Any losses can be deducted for tax purposes against the profits of the other lines of the food company. 8 Price per chocolate bar produced is $2 and the costs of production are $1 per bar. The costs of production are expected to rise by 10% per year. 9 10 Working capital needs: 10% of next years' sales. Working capital needs fall to zero at the end of 5 years. 11 12 The main uncertainty associated with the project is the level of demand for the chocolate. 13 Marketing experts provide the following projections regarding the number of bars to be sold: 14 15 Year: 1 250000 16 Scenario 1 (Best case): Chocolate will be a hit 17 Scenario 2: (Worst case) Competitor will come up with a competing chocolate 18 Scenario 3: (Regular) Demand for chocolate will be ok. (Number of chocolate bars) 2 3 4 5 400000 600000 400000 320000 200000 300000 200000 160000 280000 420000 280000 220000 125000 175000 19 20 21 Information about the cost of capital of the food company: 22 The company is all equity financed. The risk tree rate in the market is 2.4%. The beta of the food company is 0.8 and the market risk premium is 7%. 23 24 a. Calculate the NPV for each of the scenarios. 25 b. Suppose that the likelihood of each scenario is 1/3. What is the NPV of the project? 26 C. Should you invest in the project? 27 d. (Challenge - not required) One of the officers in your firm thinks that the worst case scenario is more likely to occur than with probability 1/3. 28 What is the highest probability of the worst case scenario (assuming that the probabilities of the best case and ok case are similar) such that the project is still worth pursuing? 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts