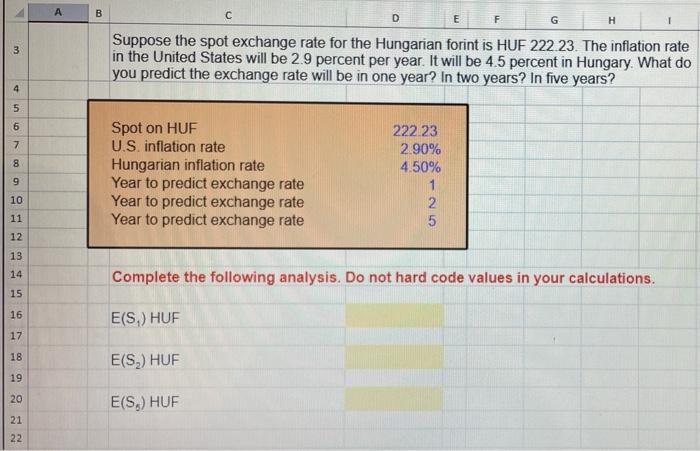

Question: A B D E F H 3 Suppose the spot exchange rate for the Hungarian forint is HUF 222 23. The inflation rate in the

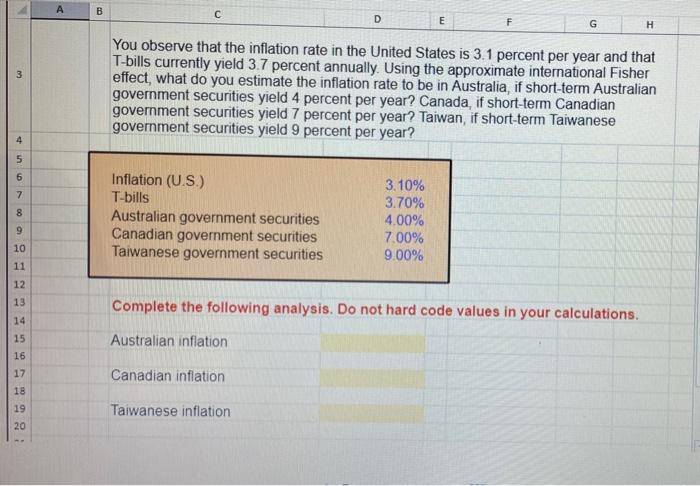

A B D E F H 3 Suppose the spot exchange rate for the Hungarian forint is HUF 222 23. The inflation rate in the United States will be 2.9 percent per year. It will be 4.5 percent in Hungary. What do you predict the exchange rate will be in one year? In two years? In five years? 4 5 6 en 7 8 Spot on HUF U.S. inflation rate Hungarian inflation rate Year to predict exchange rate Year to predict exchange rate Year to predict exchange rate 222.23 2.90% 4.50% 1 2 5 9 10 11 12 13 14 Complete the following analysis. Do not hard code values in your calculations. 15 16 E(S) HUF 17 18 E(S) HUF 19 20 E(S.) HUF 21 22 A B D E F G H 3 You observe that the inflation rate in the United States is 3.1 percent per year and that T-bills currently yield 3.7 percent annually. Using the approximate international Fisher effect, what do you estimate the inflation rate to be in Australia, if short-term Australian government securities yield 4 percent per year? Canada, if short-term Canadian government securities yield 7 percent per year? Taiwan, if short-term Taiwanese government securities yield 9 percent per year? 4 5 6 7 8 Inflation (U.S.) T-bills Australian government securities Canadian government securities Taiwanese government securities 3.10% 3.70% 4.00% 7.00% 9.00% 9 10 11 12 13 14 Complete the following analysis. Do not hard code values in your calculations. Australian inflation 15 16 17 18 19 20 Canadian inflation Taiwanese inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts