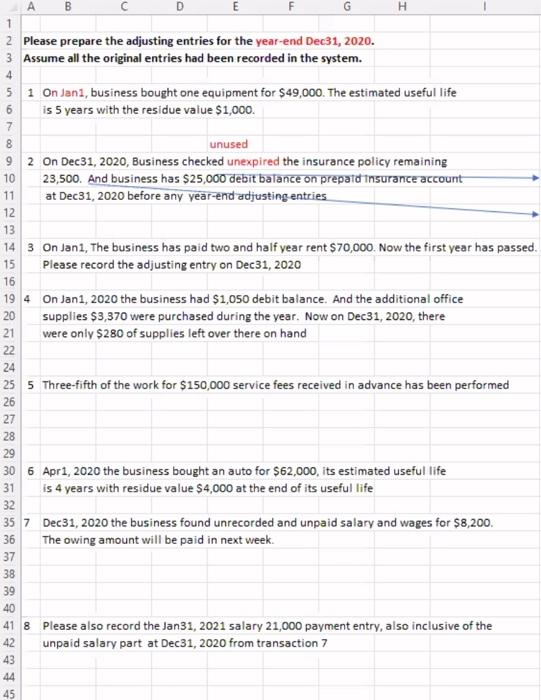

Question: A B D E G H 1 4 2 Please prepare the adjusting entries for the year-end Dec 31, 2020. 3 Assume all the original

A B D E G H 1 4 2 Please prepare the adjusting entries for the year-end Dec 31, 2020. 3 Assume all the original entries had been recorded in the system. 5 1 On Jani, business bought one equipment for $49,000. The estimated useful life 6 is 5 years with the residue value $1,000. 7 8 unused 9 2 On Dec 31, 2020, Business checked unexpired the insurance policy remaining 10 23,500. And business has $25,000 debit balance on preparat insurance account 11 at Dec31, 2020 before any year-end adjusting entries 12 13 14 3 On Jani, The business has paid two and half year rent $70,000. Now the first year has passed. 15 Please record the adjusting entry on Dec 31, 2020 16 19 4 On Jan1, 2020 the business had $1,050 debit balance. And the additional office supplies $3,370 were purchased during the year. Now on Dec 31, 2020, there 21 were only $280 of supplies left over there on hand 24 25 5 Three-fifth of the work for $150,000 service fees received in advance has been performed 9 36 30 6 Apr 1, 2020 the business bought an auto for $62,000, its estimated useful life 31 is 4 years with residue value $4,000 at the end of its useful life 32 35 7 Dec 31, 2020 the business found unrecorded and unpaid salary and wages for $8,200. The owing amount will be paid in next week. 37 38 39 40 41 8 Please also record the Jan31, 2021 salary 21,000 payment entry, also inclusive of the 42 unpaid salary part at Dec31, 2020 from transaction 7 43 44 45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts