Question: A B E G 3 D 1 Problem 4 - Capital Budgeting - 12 Marks - 20 minutes 2 Hughie Inc. plans to purchase a

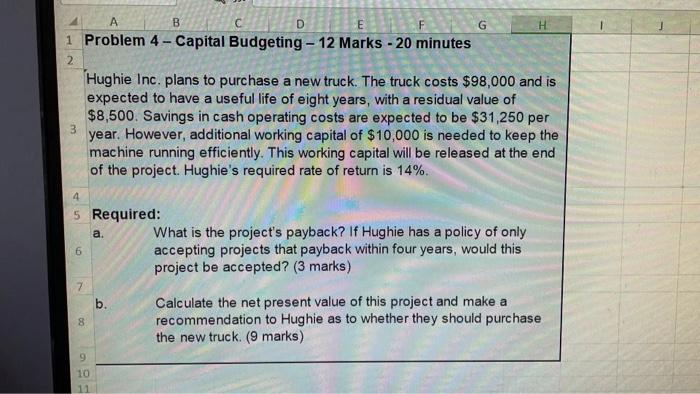

A B E G 3 D 1 Problem 4 - Capital Budgeting - 12 Marks - 20 minutes 2 Hughie Inc. plans to purchase a new truck. The truck costs $98,000 and is expected to have a useful life of eight years, with a residual value of $8,500. Savings in cash operating costs are expected to be $31,250 per year. However, additional working capital of $10,000 is needed to keep the machine running efficiently. This working capital will be released at the end of the project. Hughie's required rate of return is 14%. 4 5 Required: What is the project's payback? If Hughie has a policy of only accepting projects that payback within four years, would this project be accepted? (3 marks) a. 6 b. 00 Calculate the net present value of this project and make a recommendation to Hughie as to whether they should purchase the new truck. (9 marks) 9 10 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts