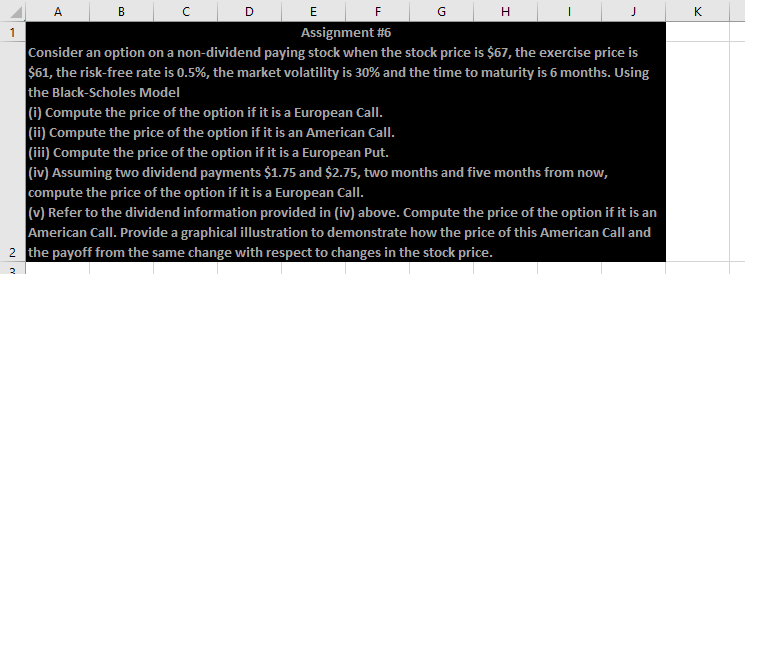

Question: A B E P Assignment #6 Consider an option $61, the risk-free rate is 0.5%, the market volatility is 30% and the time to maturity

A B E P Assignment #6 Consider an option $61, the risk-free rate is 0.5%, the market volatility is 30% and the time to maturity is 6 months. Using the Black-Scholes Model (i) Compute the price of the option if it is a European Call. (ii) Compute the price of the option if it is an American Call. (ii) Compute the price of the option if it is a European Put. (iv) Assuming two dividend payments $1.75 and $2.75, two months and five months from now, compute the price of the option if it is a European Call. (v) Refer to the dividend information provided in (iv) above. Compute the price of the option if it is an American Call. Provide a graphical illustration to demonstrate how the price of this American Call and 2 the payoff from the same change with respect to changes in the stock price. on a non-dividend paying stock when the stock price is $67, the exercise price is 2 I LLI co A B E P Assignment #6 Consider an option $61, the risk-free rate is 0.5%, the market volatility is 30% and the time to maturity is 6 months. Using the Black-Scholes Model (i) Compute the price of the option if it is a European Call. (ii) Compute the price of the option if it is an American Call. (ii) Compute the price of the option if it is a European Put. (iv) Assuming two dividend payments $1.75 and $2.75, two months and five months from now, compute the price of the option if it is a European Call. (v) Refer to the dividend information provided in (iv) above. Compute the price of the option if it is an American Call. Provide a graphical illustration to demonstrate how the price of this American Call and 2 the payoff from the same change with respect to changes in the stock price. on a non-dividend paying stock when the stock price is $67, the exercise price is 2 I LLI co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts