Question: A B IU A A . E AO 0120 marks Assuming there are no transaction costs, taxes, or other market imperfections) Camilla, Ltd financed 100%

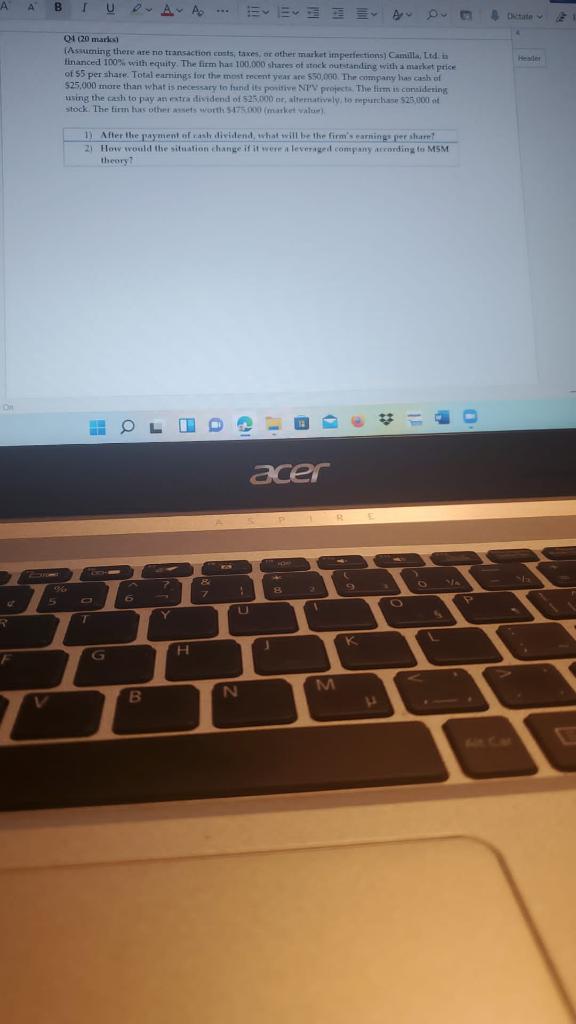

A B IU A A . E AO 0120 marks Assuming there are no transaction costs, taxes, or other market imperfections) Camilla, Ltd financed 100% with equity. The firm has 100.000 shares of unck outstanding with a market price of $5 per share. Total earnings for the most recent year are 550,000. The company has cash of $25,000 more than what is necessary to find its poni NP project. The fimis considering using the cash to pay an extra dividend of $25.000 or, statively, to purchase $25.000 stock. The firm has other sets worth $175.000 market value 1. After the payment of ash dividend what will be the firm's earnings per sam! 2) How would the situation change if it were leveraged company at wording to MSM theory1 OLD acer 8 9 7 5 o Y R T K L H . F M B N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts