Question: A & B only Unit 14 Practice Exercises 1. Under what circumstances would it be advisable to borrow money to take a cash discount? 2.

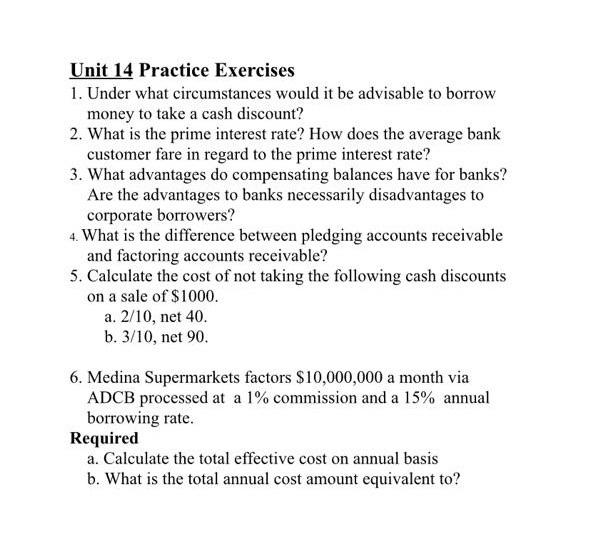

Unit 14 Practice Exercises 1. Under what circumstances would it be advisable to borrow money to take a cash discount? 2. What is the prime interest rate? How does the average bank customer fare in regard to the prime interest rate? 3. What advantages do compensating balances have for banks? Are the advantages to banks necessarily disadvantages to corporate borrowers? 4. What is the difference between pledging accounts receivable and factoring accounts receivable? 5. Calculate the cost of not taking the following cash discounts on a sale of $1000. a. 2/10, net 40. b. 3/10, net 90. 6. Medina Supermarkets factors $10,000,000 a month via ADCB processed at a 1% commission and a 15% annual borrowing rate. Required a. Calculate the total effective cost on annual basis b. What is the total annual cost amount equivalent to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts