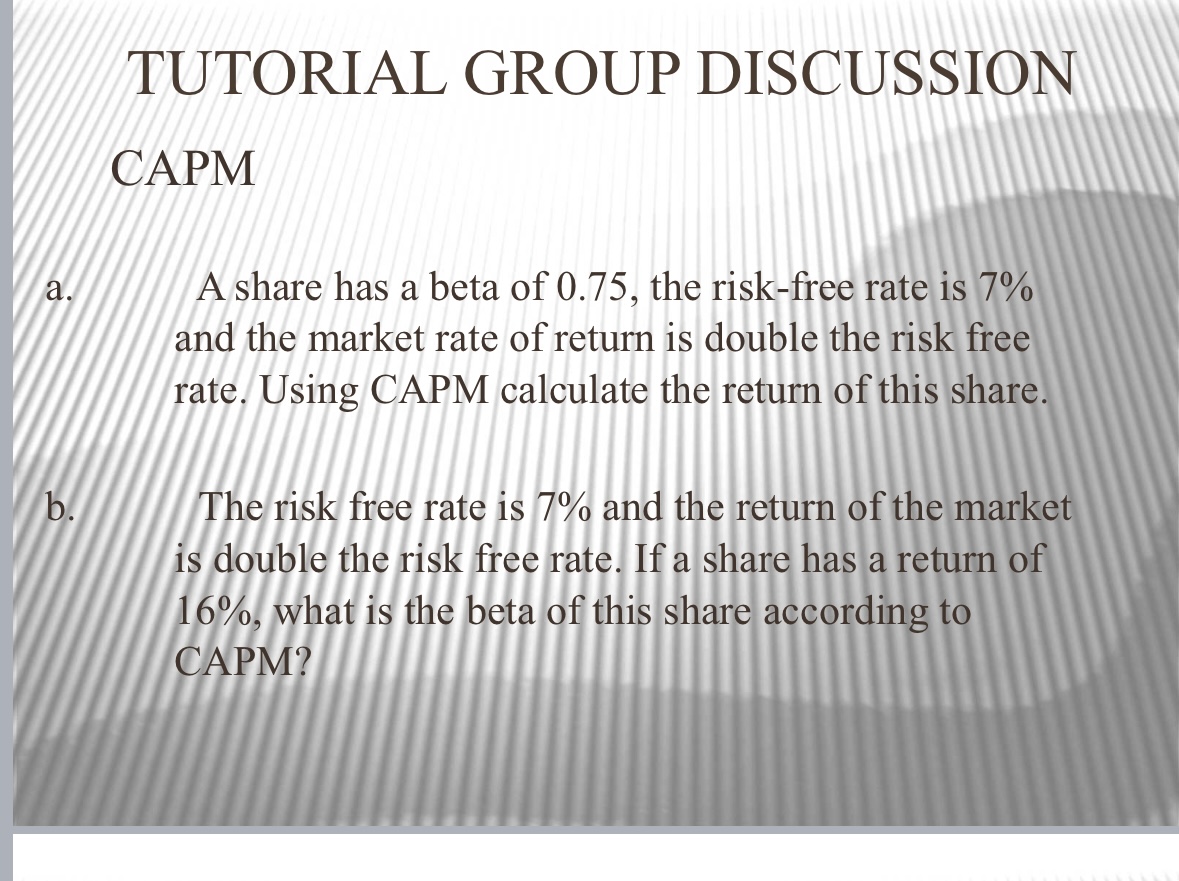

Question: a. b. TUTORIAL GROUP DISCUSSION CAPM A share has a beta of 0.75, the risk-free rate is 7% and the market rate of return

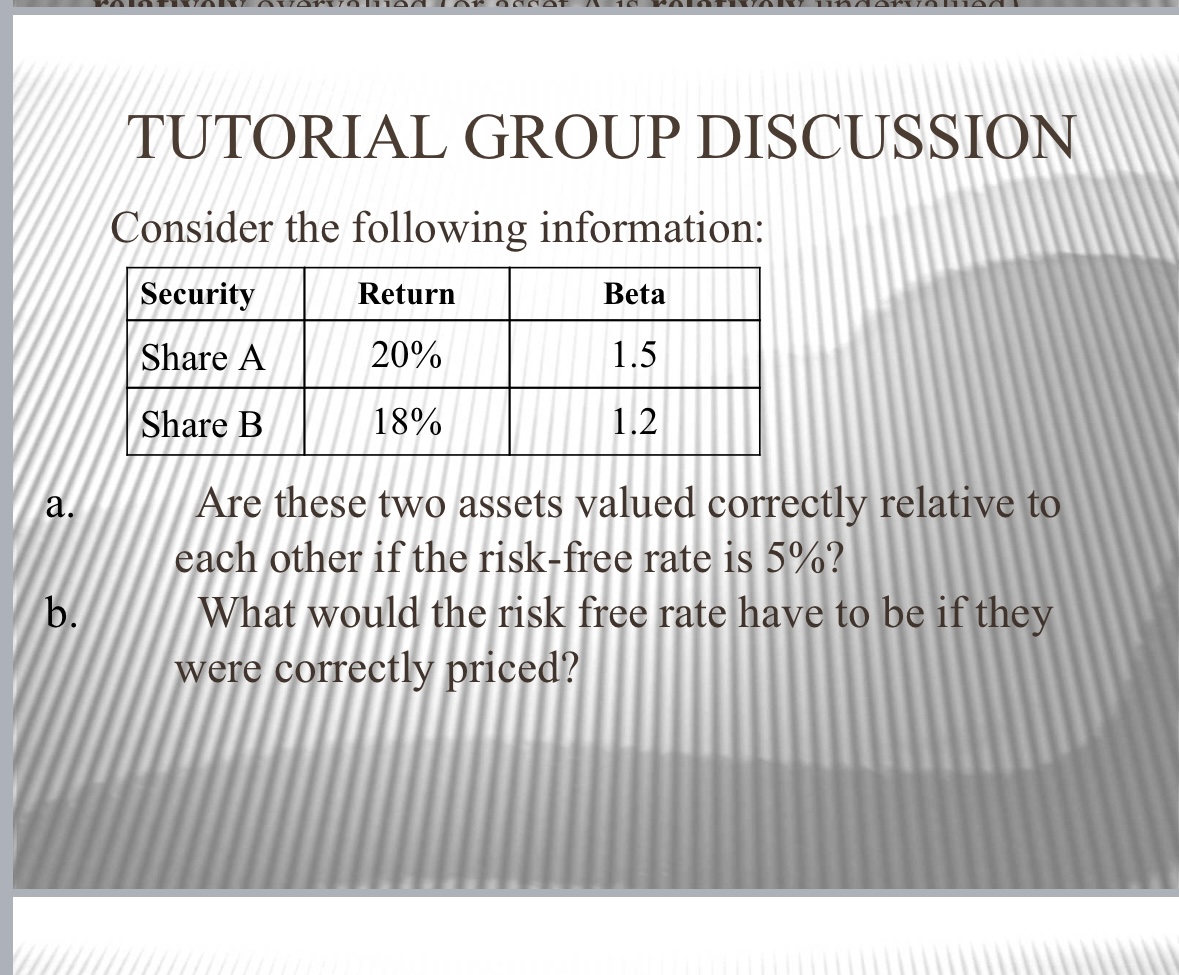

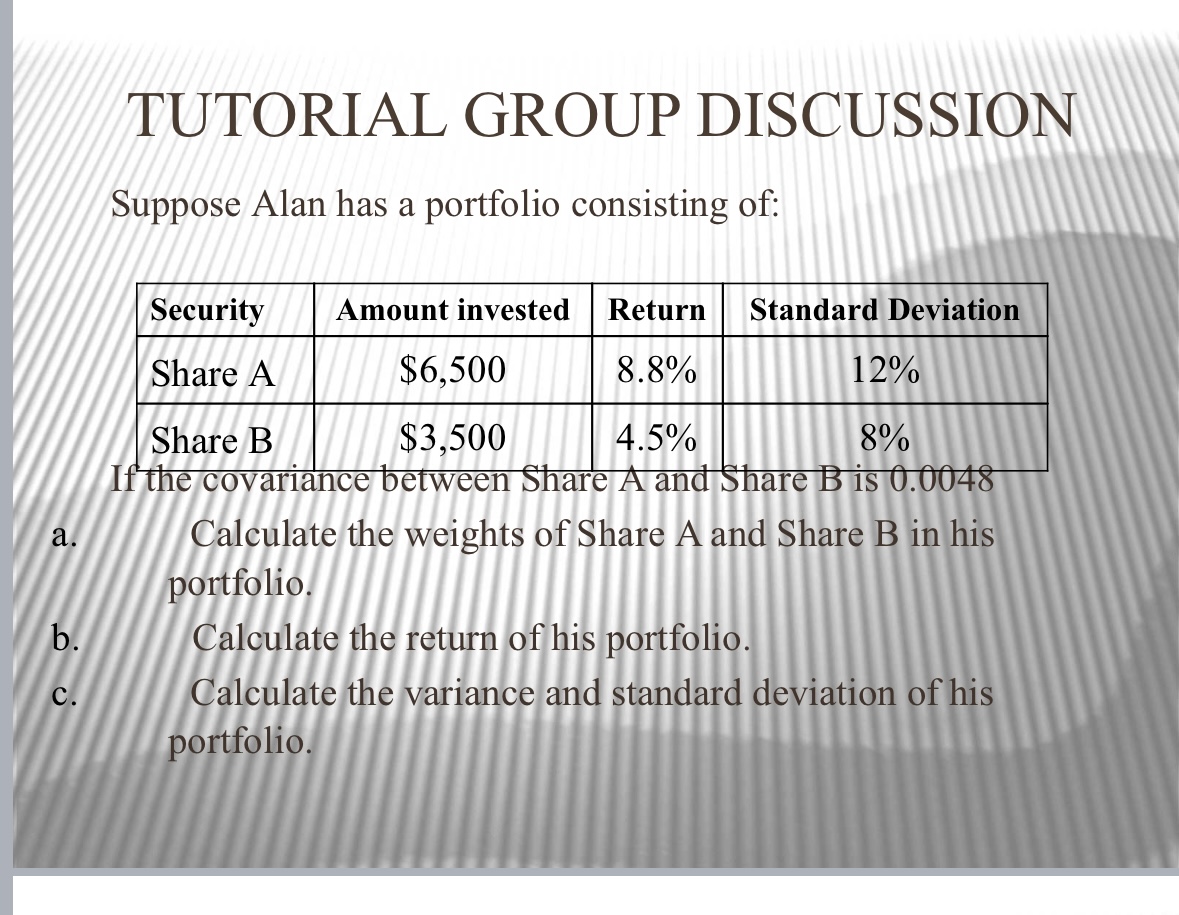

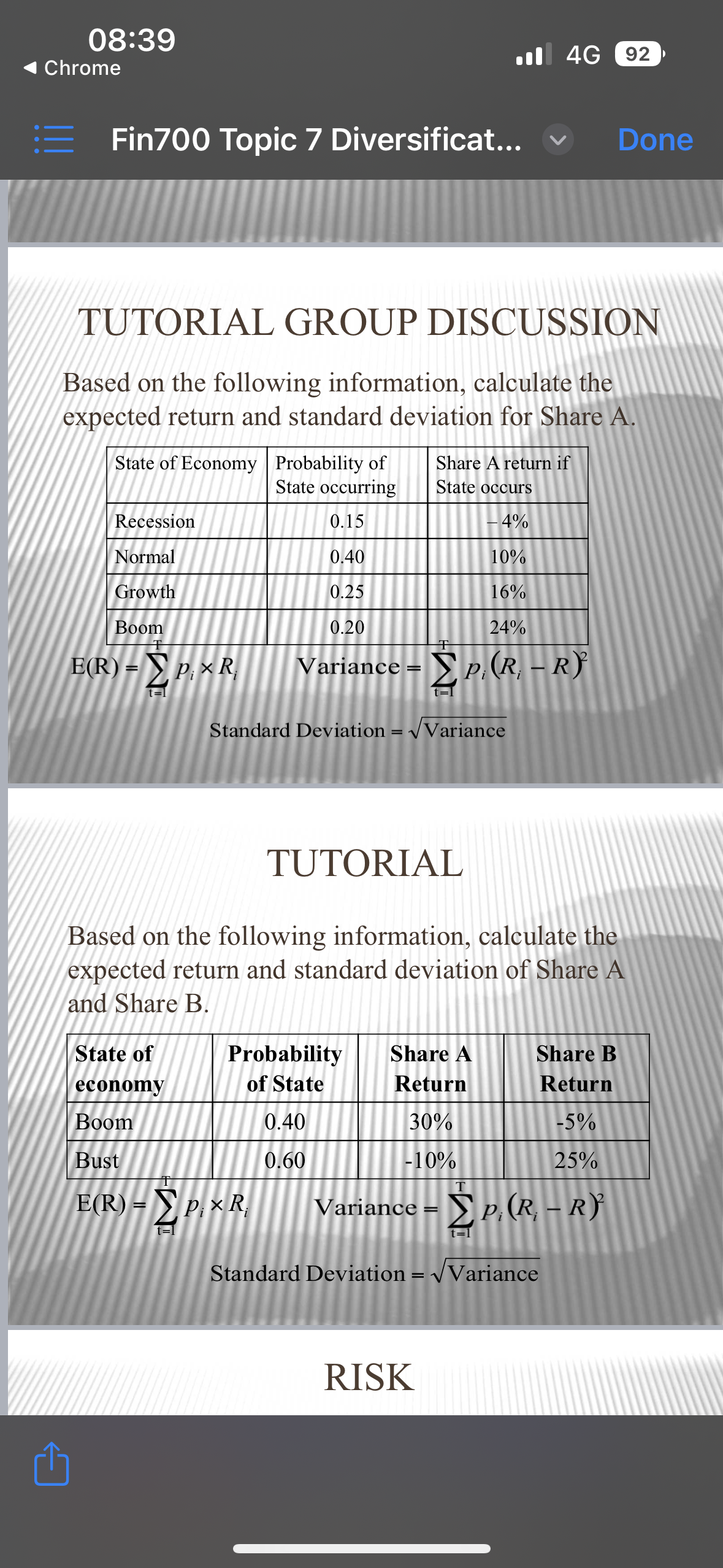

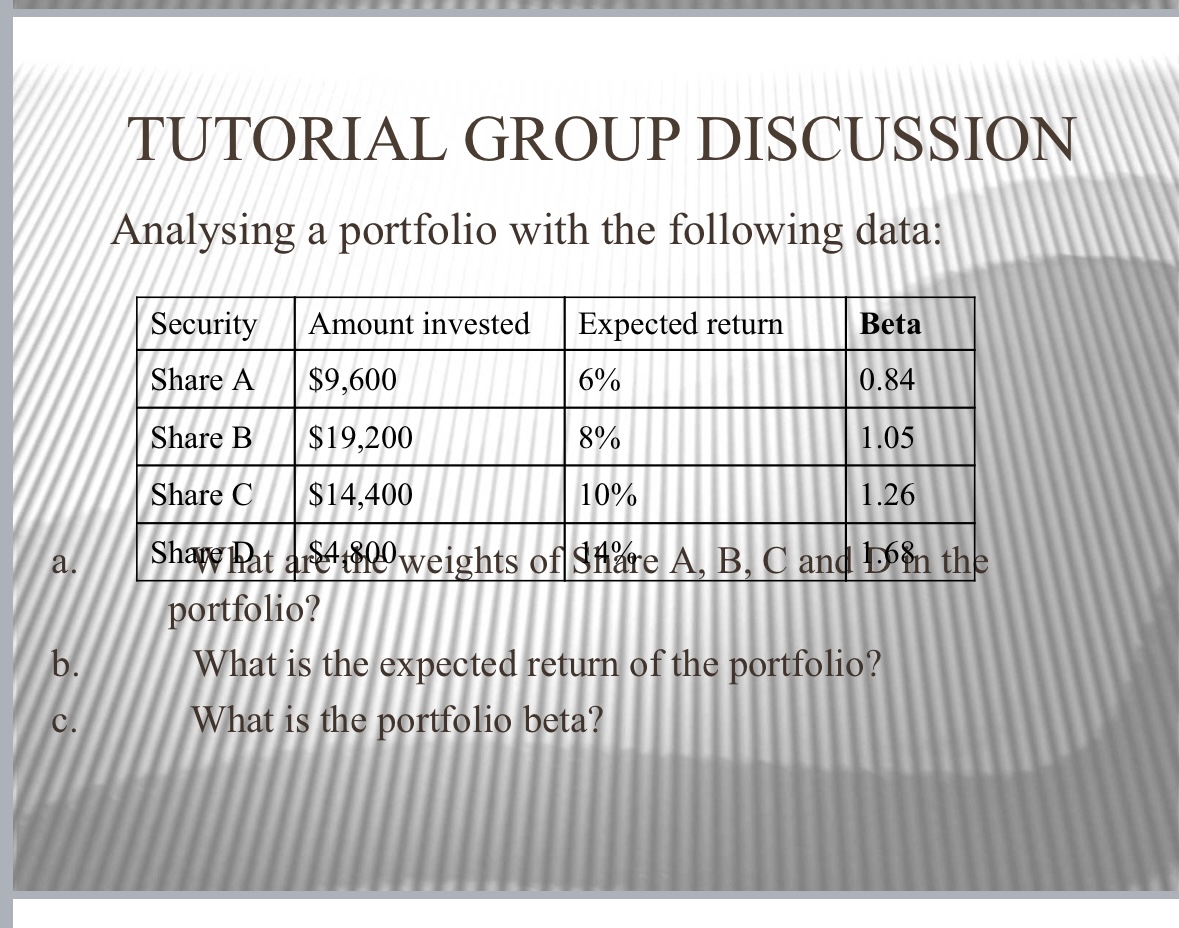

a. b. TUTORIAL GROUP DISCUSSION CAPM A share has a beta of 0.75, the risk-free rate is 7% and the market rate of return is double the risk free rate. Using CAPM calculate the return of this share. The risk free rate is 7% and the return of the market is double the risk free rate. If a share has a return of 16%, what is the beta of this share according to CAPM? a. b. TUTORIAL GROUP DISCUSSION Consider the following information: Security Beta Share A 1.5 Share B 1.2 Return 20% 18% Are these two assets valued correctly relative to each other if the risk-free rate is 5%? What would the risk free rate have to be if they were correctly priced? a. b. C. TUTORIAL GROUP DISCUSSION Suppose Alan has a portfolio consisting of: Security Amount invested Return Standard Deviation Share A 8.8% $6,500 12% Share B $3,500 4.5% 8% If the covariance between Share A and Share B is 0.0048 Calculate the weights of Share A and Share B in his portfolio. Calculate the return of his portfolio. Calculate the variance and standard deviation of his portfolio. 08:39 Chrome = Fin700 Topic 7 Diversificat... TUTORIAL GROUP DISCUSSION Based on the following information, calculate the expected return and standard deviation for Share A. Recession Normal Growth Boom E(R) = 1 R 1 State of Economy Probability of Share A return if State occurs State occurring 0.15 -4% 0.40 10% 0.25 16% 0.20 24% Variance = p. (R, R) Pi t=1 Standard Deviation = Variance t=l TUTORIAL Based on the following information, calculate the expected return and standard deviation of Share A and Share B. State of economy Boom Bust E(R) = P R 4G 92 Probability Share A of State Return 0.40 30% 0.60 -10% T Variance = P, (R, R) t=1 Standard Deviation = Variance RISK Done Share B Return -5% 25% a. b. C. TUTORIAL GROUP DISCUSSION Analysing a portfolio with the following data: Security Amount invested Expected return Beta Share A $9,600 6% 0.84 Share B $19,200 8% 1.05 Share C $14,400 10% 1.26 Shape Pat arweights of Share A, B, C and on the portfolio? What is the expected return of the portfolio? What is the portfolio beta?

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Here are the stepbystep solutions to the CAPM problems 1 a A share has a beta of 075 the riskfree rate is 7 and the market rate of return is double the risk free rate Using CAPM calculate the return o... View full answer

Get step-by-step solutions from verified subject matter experts