Question: a. Balance per the bank statement dated October 31,2020 , is $26,830. b. Balance of the Cash account on the company books as of October

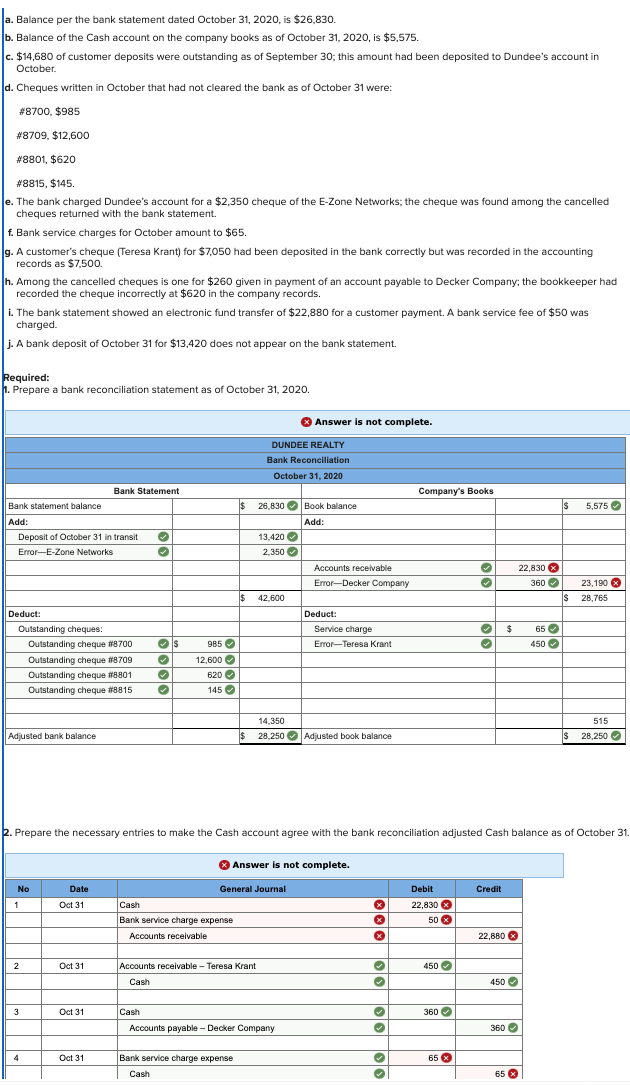

a. Balance per the bank statement dated October 31,2020 , is $26,830. b. Balance of the Cash account on the company books as of October 31, 2020, is $5,575. c. $14,680 of customer deposits were outstanding as of September 30; this amount had been deposited to Dundee's account in October. d. Cheques written in October that had not cleared the bank as of October 31 were: #8700,$985#8709,$12,600#8801,$620#8815,$145. e. The bank charged Dundee's account for a $2,350 cheque of the E-Zone Networks; the cheque was found among the cancelled cheques returned with the bank statement. f. Bank service charges for October amount to $65. g. A customer's cheque (Teresa Krant) for $7,050 had been deposited in the bank correctly but was recorded in the accounting records as $7,500. h. Among the cancelled cheques is one for $260 given in payment of an account payable to Decker Company; the bookkeeper had recorded the cheque incorrectly at $620 in the company records. i. The bank statement showed an electronic fund transfer of $22,880 for a customer payment. A bank service fee of $50 was charged. j. A bank deposit of October 31 for $13,420 does not appear on the bank statement. Required: 1. Prepare a bank reconciliation statement as of October 31,2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts