Question: A bank has a positive leverage-adjusted duration gap. What hedging strategy would help bank to reduce its interest rate risk? O A. Buy a put

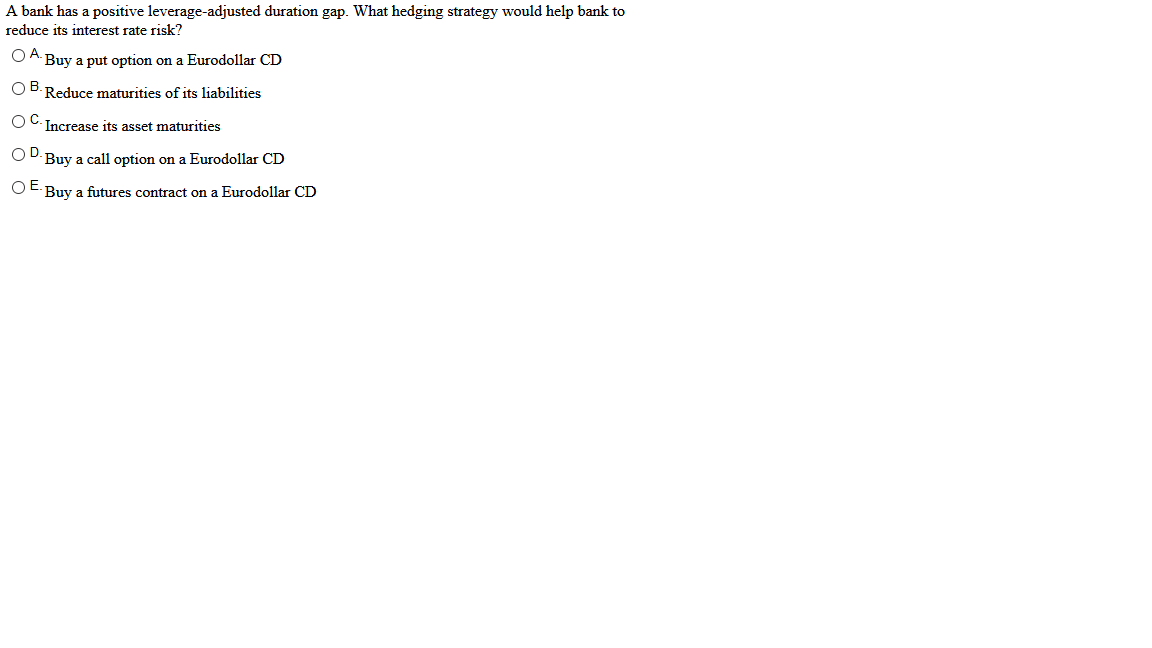

A bank has a positive leverage-adjusted duration gap. What hedging strategy would help bank to reduce its interest rate risk? O A. Buy a put option on a Eurodollar CD B. Reduce maturities of its liabilities OC. Increase its asset maturities OD. Buy a call option on a Eurodollar CD OE. Buy a futures contract on a Eurodollar CD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts