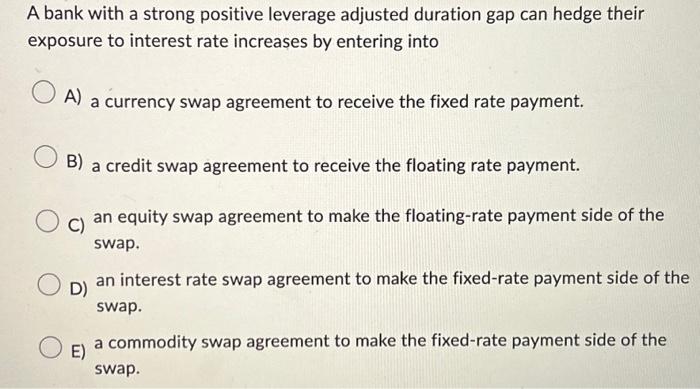

Question: A bank with a strong positive leverage adjusted duration gap can hedge their exposure to interest rate increases by entering into O A) a currency

A bank with a strong positive leverage adjusted duration gap can hedge their exposure to interest rate increases by entering into A) a currency swap agreement to receive the fixed rate payment. B) a credit swap agreement to receive the floating rate payment. C) an equity swap agreement to make the floating-rate payment side of the swap. D) an interest rate swap agreement to make the fixed-rate payment side of the swap. E) a commodity swap agreement to make the fixed-rate payment side of the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts