Question: a. Based on the above information, how would regulators characterize this FI based on the Standardized Approach leverage ratio zones of Basel III? Please explain.

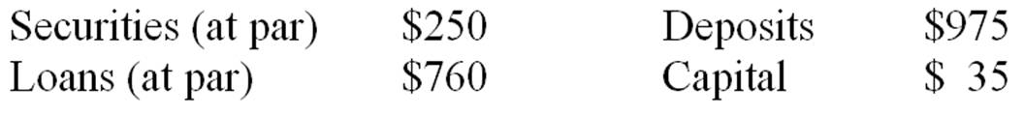

a. Based on the above information, how would regulators characterize this FI based on the Standardized Approach leverage ratio zones of Basel III? Please explain.

|

| b. If problem loans reduce the market value of the loan portfolio by 25 percent, what is the market value of capital? c.If problem loans reduce the market value of the loan portfolio by 25 percent, what is the value of regulatory defined (book value) capital? |

Securities (at par) $250 Loans (at par) $760 Deposits $975 Capital 35 Securities (at par) $250 Loans (at par) $760 Deposits $975 Capital 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts