Question: a. Based on the following regression whose output estimates the forward P/E ratio for the media industry, estimate the price for CanWest if it just

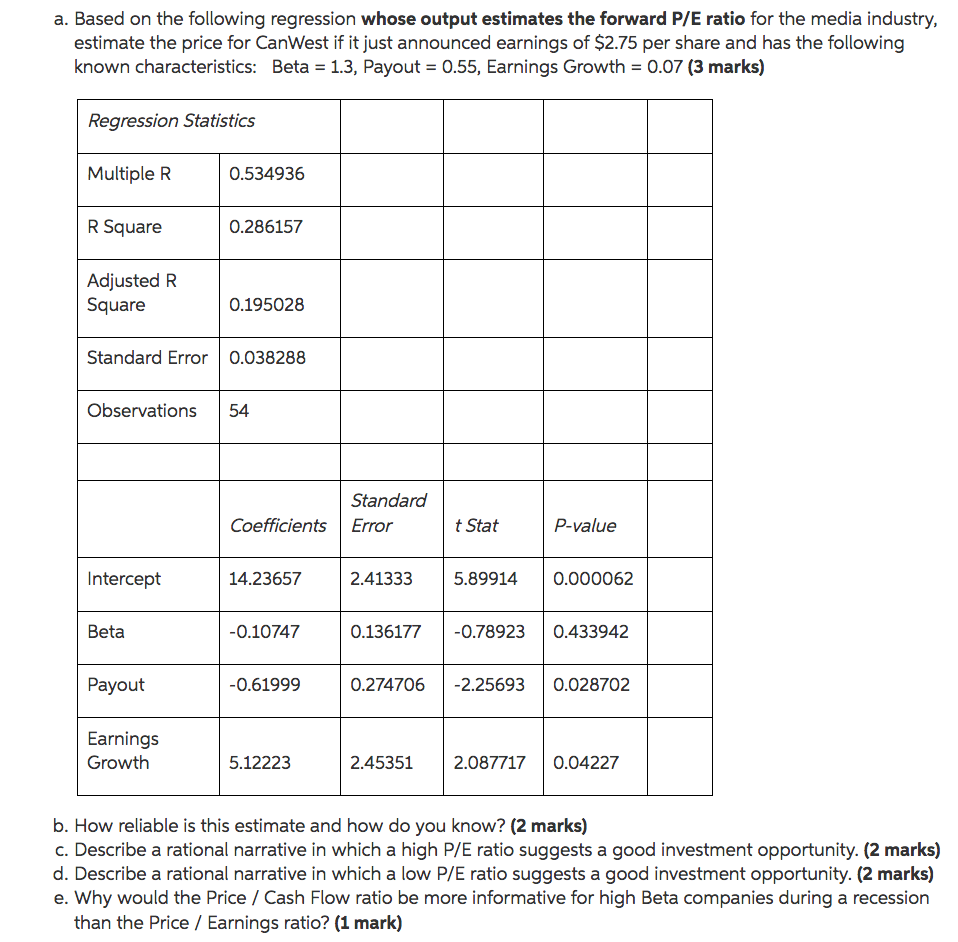

a. Based on the following regression whose output estimates the forward P/E ratio for the media industry, estimate the price for CanWest if it just announced earnings of $2.75 per share and has the following known characteristics: Beta = 1.3, Payout = 0.55, Earnings Growth = 0.07 (3 marks) Regression Statistics Multiple R 0.534936 R Square 0.286157 Adjusted R Square 0.195028 Standard Error 0.038288 Observations Standard Error Coefficients t Stat P-value Intercept 14.23657 2.41333 5.89914 0.000062 Beta -0.10747 0.136177 -0.78923 0.433942 Payout -0.61999 0.274706 -2.25693 0.028702 Earnings Growth 5.12223 2.45351 2.087717 0.04227 b. How reliable is this estimate and how do you know? (2 marks) c. Describe a rational narrative in which a high P/E ratio suggests a good investment opportunity. (2 marks) d. Describe a rational narrative in which a low P/E ratio suggests a good investment opportunity. (2 marks) e. Why would the Price / Cash Flow ratio be more informative for high Beta companies during a recession than the Price / Earnings ratio? (1 mark) a. Based on the following regression whose output estimates the forward P/E ratio for the media industry, estimate the price for CanWest if it just announced earnings of $2.75 per share and has the following known characteristics: Beta = 1.3, Payout = 0.55, Earnings Growth = 0.07 (3 marks) Regression Statistics Multiple R 0.534936 R Square 0.286157 Adjusted R Square 0.195028 Standard Error 0.038288 Observations Standard Error Coefficients t Stat P-value Intercept 14.23657 2.41333 5.89914 0.000062 Beta -0.10747 0.136177 -0.78923 0.433942 Payout -0.61999 0.274706 -2.25693 0.028702 Earnings Growth 5.12223 2.45351 2.087717 0.04227 b. How reliable is this estimate and how do you know? (2 marks) c. Describe a rational narrative in which a high P/E ratio suggests a good investment opportunity. (2 marks) d. Describe a rational narrative in which a low P/E ratio suggests a good investment opportunity. (2 marks) e. Why would the Price / Cash Flow ratio be more informative for high Beta companies during a recession than the Price / Earnings ratio? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts