Question: a) Based on the following table which summarizes the prices of Government default-free, zero- coupon bonds (expressed as a percentage of face value): Maturity 1

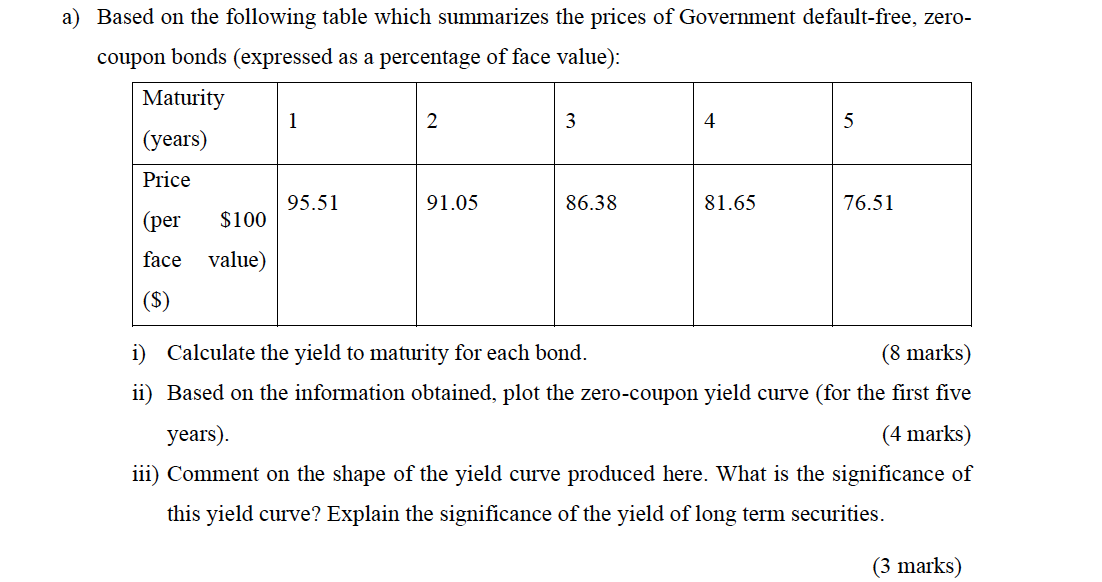

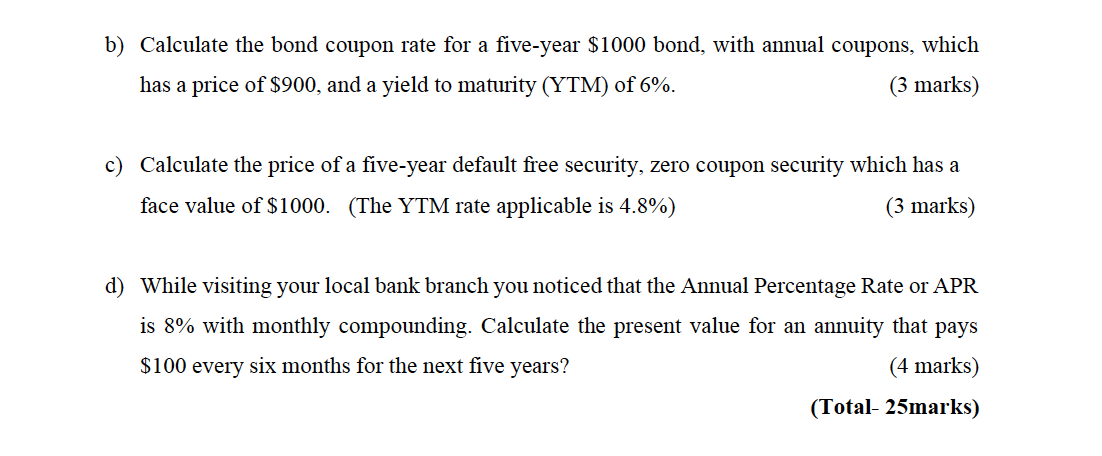

a) Based on the following table which summarizes the prices of Government default-free, zero- coupon bonds (expressed as a percentage of face value): Maturity 1 2 3 5 (years) 4 Price 95.51 91.05 86.38 81.65 76.51 (per $100 face value) ($) i) Calculate the yield to maturity for each bond. (8 marks) ii) Based on the information obtained, plot the zero-coupon yield curve (for the first five years). (4 marks) iii) Comment on the shape of the yield curve produced here. What is the significance of this yield curve? Explain the significance of the yield of long term securities. (3 marks) b) Calculate the bond coupon rate for a five-year $1000 bond, with annual coupons, which has a price of $900, and a yield to maturity (YTM) of 6%. (3 marks) c) Calculate the price of a five-year default free security, zero coupon security which has a face value of $1000. (The YTM rate applicable is 4.8%) (3 marks) d) While visiting your local bank branch you noticed that the Annual Percentage Rate or APR is 8% with monthly compounding. Calculate the present value for an annuity that pays $100 every six months for the next five years? (4 marks) (Total- 25marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts