Question: (a) Based on the Income Statement below, calculate payout ratio, retention ratio and interest coverage ratio. All the numbers in the statement are in

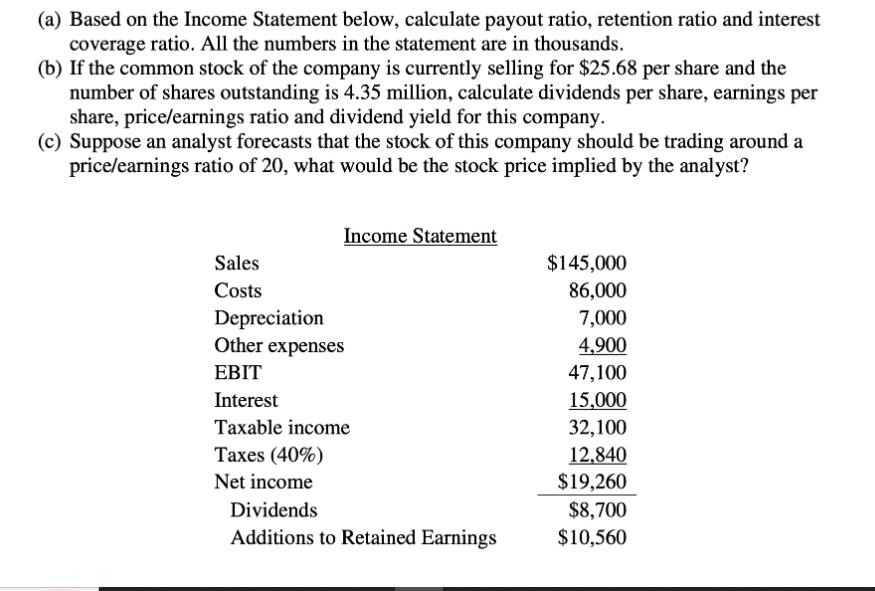

(a) Based on the Income Statement below, calculate payout ratio, retention ratio and interest coverage ratio. All the numbers in the statement are in thousands. (b) If the common stock of the company is currently selling for $25.68 per share and the number of shares outstanding is 4.35 million, calculate dividends per share, earnings per share, price/earnings ratio and dividend yield for this company. (c) Suppose an analyst forecasts that the stock of this company should be trading around a price/earnings ratio of 20, what would be the stock price implied by the analyst? Sales Costs Income Statement Depreciation Other expenses EBIT Interest Taxable income Taxes (40%) Net income Dividends Additions to Retained Earnings $145,000 86,000 7,000 4,900 47,100 15,000 32,100 12,840 $19,260 $8,700 $10,560

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Lets break down your questions step by step a Calculate payout ratio retention ratio and interest co... View full answer

Get step-by-step solutions from verified subject matter experts