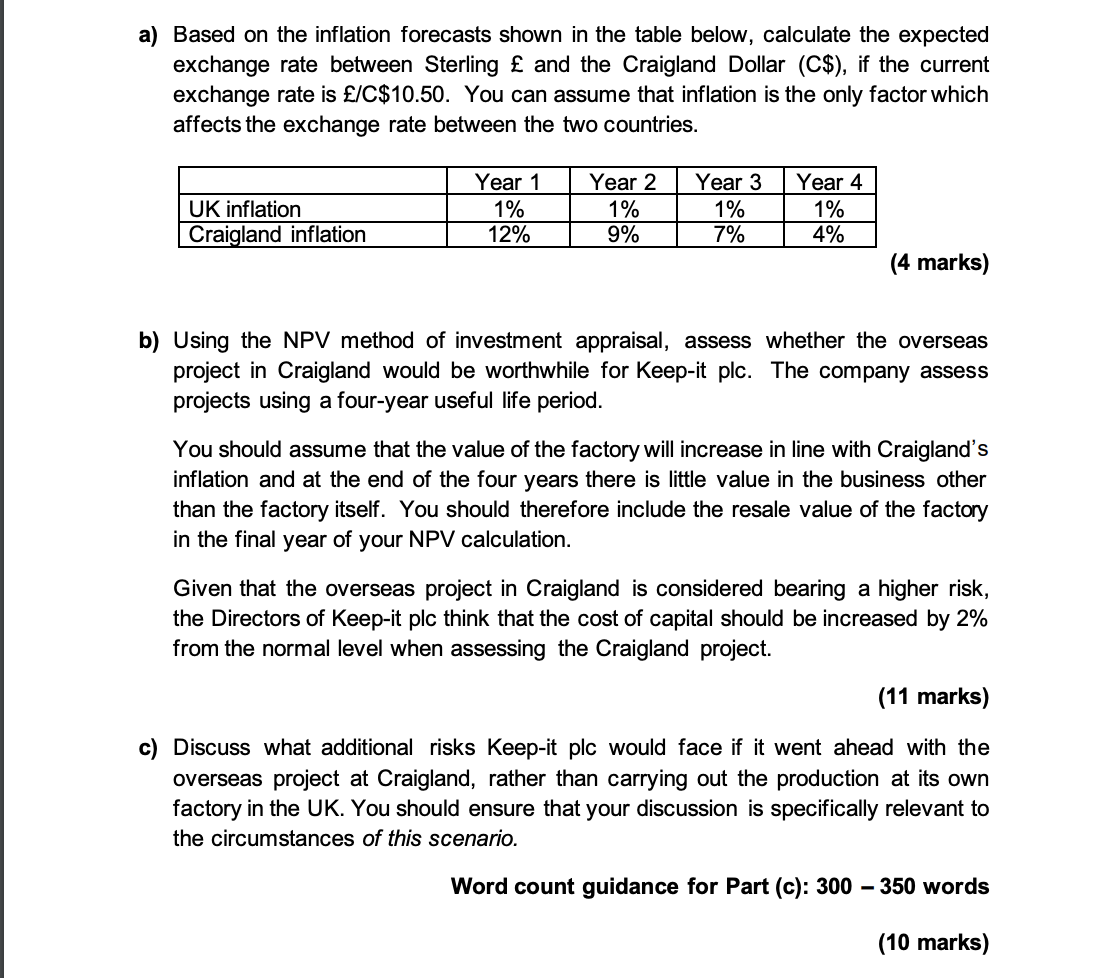

Question: a) Based on the inflation forecasts shown in the table below, calculate the expected exchange rate between Sterling and the Craigland Dollar (C$), if the

a) Based on the inflation forecasts shown in the table below, calculate the expected exchange rate between Sterling and the Craigland Dollar (C$), if the current exchange rate is /C$10.50. You can assume that inflation is the only factor which affects the exchange rate between the two countries. UK inflation Craigland inflation Year 1 1% 12% Year 2 1% 9% Year 3 1% 7% Year 4 1% 4% (4 marks) b) Using the NPV method of investment appraisal, assess whether the overseas project in Craigland would be worthwhile for Keep-it plc. The company assess projects using a four-year useful life period. You should assume that the value of the factory will increase in line with Craigland's inflation and at the end of the four years there is little value in the business other than the factory itself. You should therefore include the resale value of the factory in the final year of your NPV calculation. Given that the overseas project in Craigland is considered bearing a higher risk, the Directors of Keep-it plc think that the cost of capital should be increased by 2% from the normal level when assessing the Craigland project. (11 marks) c) Discuss what additional risks Keep-it plc would face if it went ahead with the overseas project at Craigland, rather than carrying out the production at its own factory in the UK. You should ensure that your discussion is specifically relevant to the circumstances of this scenario. Word count guidance for Part (c): 300 - 350 words (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts