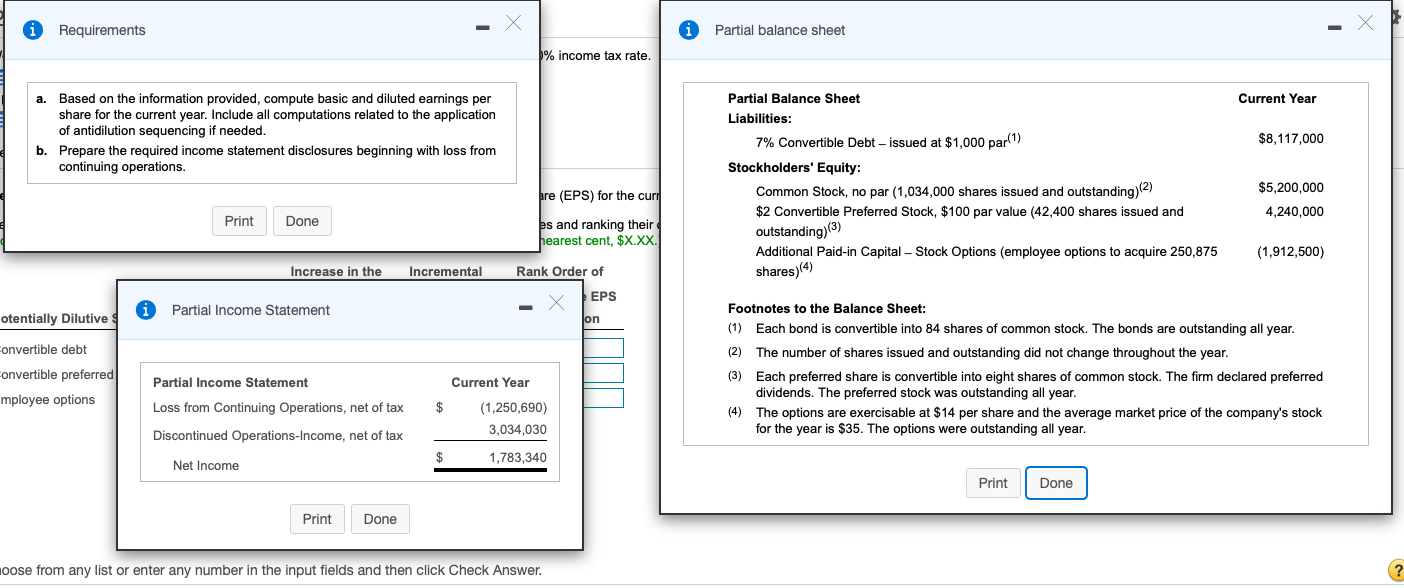

Question: a. Based on the informationprovided, compute basic and diluted earnings per share for the current year. Include all computations related to the application of antidilution

a.

Based on the informationprovided, compute basic and diluted earnings per share for the current year. Include all computations related to the application of antidilution sequencing if needed.

b.

Prepare the required income statement disclosures beginning with loss from continuing operations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock