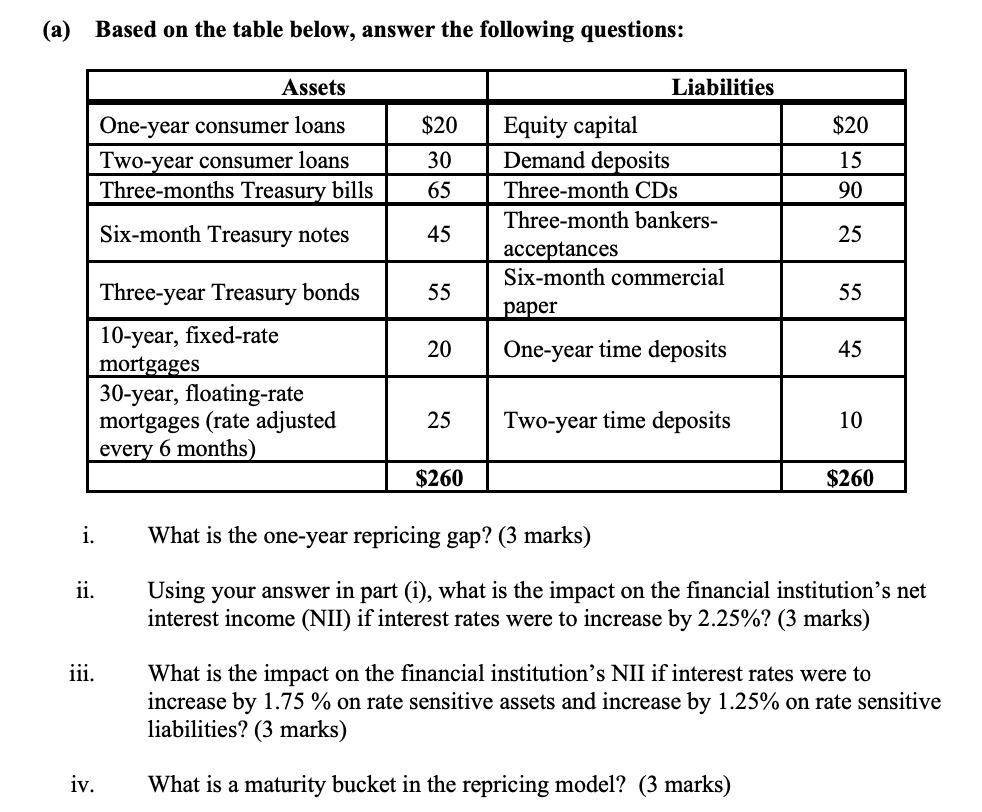

Question: (a) Based on the table below, answer the following questions: Assets Liabilities $20 $20 One-year consumer loans Two-year consumer loans Three-months Treasury bills 30 15

(a) Based on the table below, answer the following questions: Assets Liabilities $20 $20 One-year consumer loans Two-year consumer loans Three-months Treasury bills 30 15 65 90 Equity capital Demand deposits Three-month CDs Three-month bankers- acceptances Six-month commercial Six-month Treasury notes 45 25 55 55 paper 20 One-year time deposits 45 Three-year Treasury bonds 10-year, fixed-rate mortgages 30-year, floating-rate mortgages (rate adjusted every 6 months) 25 Two-year time deposits 10 $260 $260 i. What is the one-year repricing gap? (3 marks) . Using your answer in part (i), what is the impact on the financial institution's net interest income (NII) if interest rates were to increase by 2.25%? (3 marks) 11i. What is the impact on the financial institution's NII if interest rates were to increase by 1.75 % on rate sensitive assets and increase by 1.25% on rate sensitive liabilities? (3 marks) iv. What is a maturity bucket in the repricing model? (3 marks) (a) Based on the table below, answer the following questions: Assets Liabilities $20 $20 One-year consumer loans Two-year consumer loans Three-months Treasury bills 30 15 65 90 Equity capital Demand deposits Three-month CDs Three-month bankers- acceptances Six-month commercial Six-month Treasury notes 45 25 55 55 paper 20 One-year time deposits 45 Three-year Treasury bonds 10-year, fixed-rate mortgages 30-year, floating-rate mortgages (rate adjusted every 6 months) 25 Two-year time deposits 10 $260 $260 i. What is the one-year repricing gap? (3 marks) . Using your answer in part (i), what is the impact on the financial institution's net interest income (NII) if interest rates were to increase by 2.25%? (3 marks) 11i. What is the impact on the financial institution's NII if interest rates were to increase by 1.75 % on rate sensitive assets and increase by 1.25% on rate sensitive liabilities? (3 marks) iv. What is a maturity bucket in the repricing model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts