Question: A. BBJ Pharmaceutical Sdn Bhd (BBJ) is considering the replacement of an existing chemical machine. The existing machine was bought at RM530,000 with RM20,000

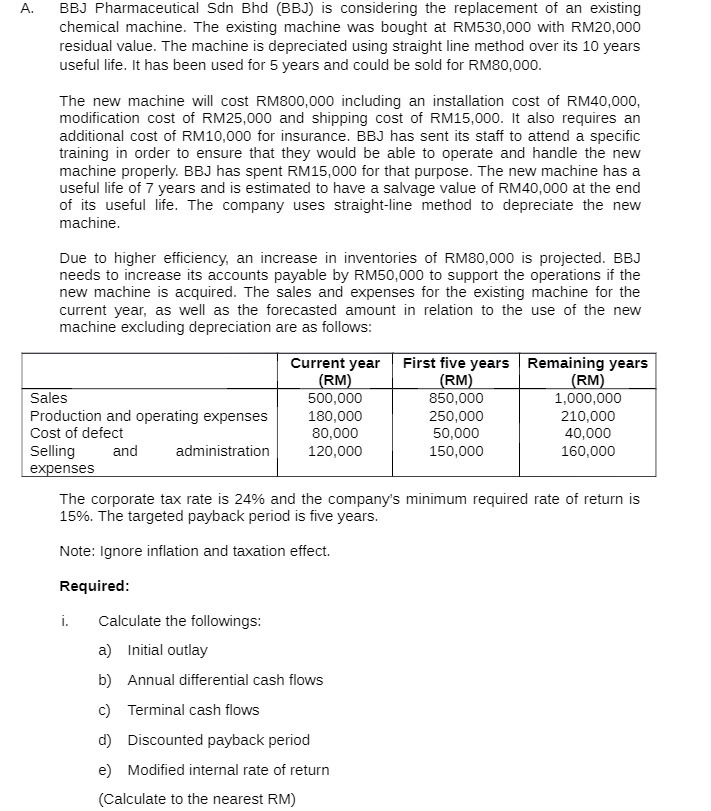

A. BBJ Pharmaceutical Sdn Bhd (BBJ) is considering the replacement of an existing chemical machine. The existing machine was bought at RM530,000 with RM20,000 residual value. The machine is depreciated using straight line method over its 10 years useful life. It has been used for 5 years and could be sold for RM80,000. The new machine will cost RM800,000 including an installation cost of RM40,000, modification cost of RM25,000 and shipping cost of RM15,000. It also requires an additional cost of RM10,000 for insurance. BBJ has sent its staff to attend a specific training in order to ensure that they would be able to operate and handle the new machine properly. BBJ has spent RM15,000 for that purpose. The new machine has a useful life of 7 years and is estimated to have a salvage value of RM40,000 at the end of its useful life. The company uses straight-line method to depreciate the new machine. Due to higher efficiency, an increase in inventories of RM80,000 is projected. BBJ needs to increase its accounts payable by RM50,000 to support the operations if the new machine is acquired. The sales and expenses for the existing machine for the current year, as well as the forecasted amount in relation to the use of the new machine excluding depreciation are as follows: Sales Production and operating expenses Cost of defect administration Selling expenses and i. Current year (RM) 500,000 180,000 80,000 120,000 First five years Remaining years (RM) 850,000 Calculate the followings: a) Initial outlay b) Annual differential cash flows c) Terminal cash flows d) Discounted payback period e) Modified internal rate of return (Calculate to the nearest RM) 250,000 50,000 150,000 The corporate tax rate is 24% and the company's minimum required rate of return is 15%. The targeted payback period is five years. Note: Ignore inflation and taxation effect. Required: (RM) 1,000,000 210,000 40,000 160,000

Step by Step Solution

There are 3 Steps involved in it

To calculate the various financial metrics we need to determine the initial outlay annual differential cash flows terminal cash flows discounted payback period and modified internal rate of return MIR... View full answer

Get step-by-step solutions from verified subject matter experts