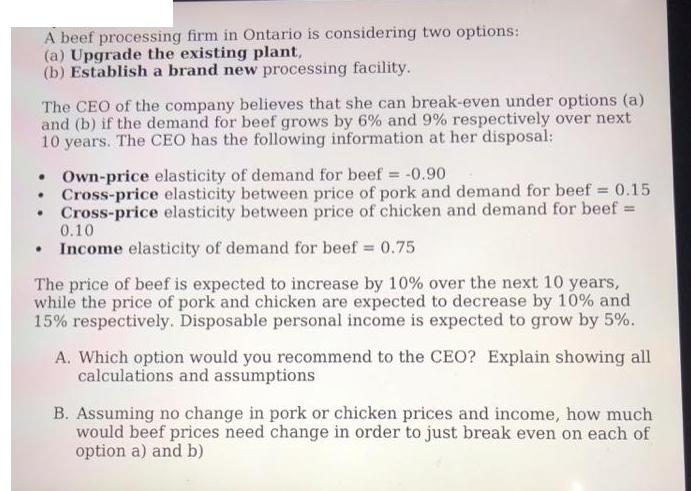

Question: A beef processing firm in Ontario is considering two options: (a) Upgrade the existing plant, (b) Establish a brand new processing facility. The CEO

A beef processing firm in Ontario is considering two options: (a) Upgrade the existing plant, (b) Establish a brand new processing facility. The CEO of the company believes that she can break-even under options (a) and (b) if the demand for beef grows by 6% and 9% respectively over next 10 years. The CEO has the following information at her disposal: Own-price elasticity of demand for beef = -0.90 . Cross-price elasticity between price of pork and demand for beef = 0.15 Cross-price elasticity between price of chicken and demand for beef= 0.10 Income elasticity of demand for beef = 0.75 The price of beef is expected to increase by 10% over the next 10 years, while the price of pork and chicken are expected to decrease by 10% and 15% respectively. Disposable personal income is expected to grow by 5%. A. Which option would you recommend to the CEO? Explain showing all calculations and assumptions B. Assuming no change in pork or chicken prices and income, how much would beef prices need change in order to just break even on each of option a) and b)

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts