Question: a) Big Auto Part Inc. is authorized to issue 5,000,000 common shares. In its initial public offering during 2015, Big Parts issued 500,000 common shares

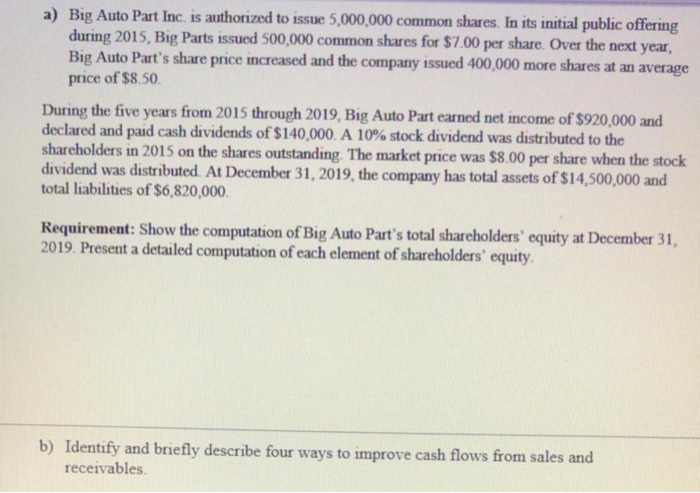

a) Big Auto Part Inc. is authorized to issue 5,000,000 common shares. In its initial public offering during 2015, Big Parts issued 500,000 common shares for $7.00 per share. Over the next year, Big Auto Part's share price increased and the company issued 400,000 more shares at an average price of $8.50 During the five years from 2015 through 2019, Big Auto Part earned net income of $920,000 and declared and paid cash dividends of $140,000. A 10% stock dividend was distributed to the shareholders in 2015 on the shares outstanding. The market price was $8.00 per share when the stock dividend was distributed. At December 31, 2019, the company has total assets of $14,500,000 and total liabilities of $6,820,000. Requirement: Show the computation of Big Auto Part's total shareholders' equity at December 31, 2019. Present a detailed computation of each element of shareholders' equity. b) Identify and briefly describe four ways to improve cash flows from sales and receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts