Question: A bond fund manager is concerned about interest rate volatility over the next 3 months. The value of the bond portfolio is $10M and the

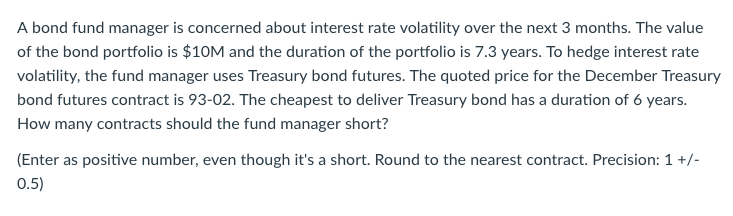

A bond fund manager is concerned about interest rate volatility over the next 3 months. The value of the bond portfolio is $10M and the duration of the portfolio is 7.3 years. To hedge interest rate volatility, the fund manager uses Treasury bond futures. The quoted price for the December Treasury bond futures contract is 93-02. The cheapest to deliver Treasury bond has a duration of 6 years. How many contracts should the fund manager short? (Enter as positive number, even though it's a short. Round to the nearest contract. Precision: 1+ 0.5)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock