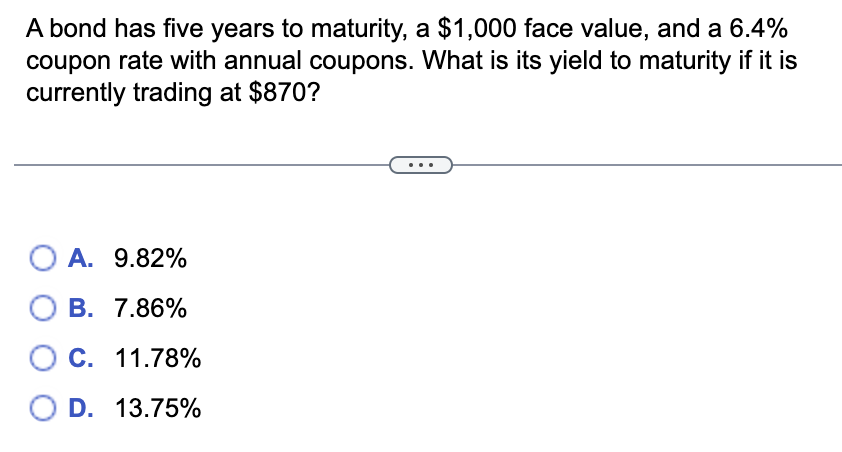

Question: A bond has five years to maturity, a $1,000 face value, and a 6.4% coupon rate with annual coupons. What is its yield to maturity

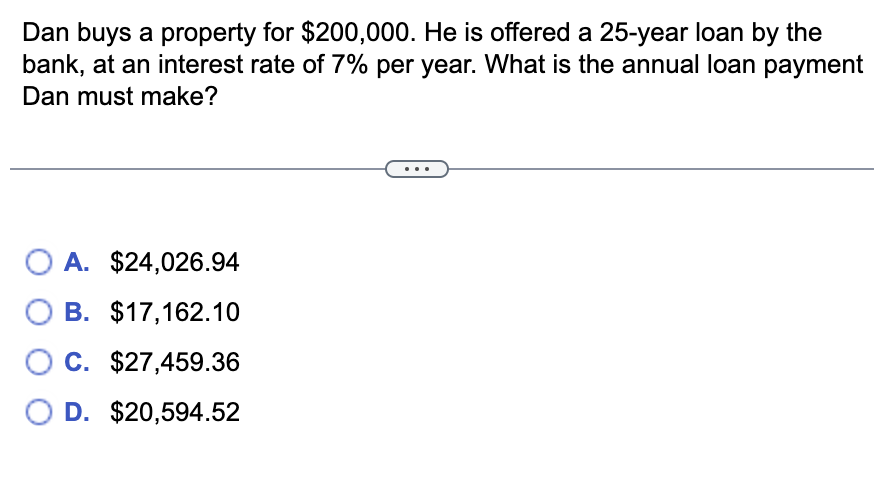

A bond has five years to maturity, a $1,000 face value, and a 6.4% coupon rate with annual coupons. What is its yield to maturity if it is currently trading at $870 ? A. 9.82% B. 7.86% C. 11.78% D. 13.75% Dan buys a property for $200,000. He is offered a 25 -year loan by the bank, at an interest rate of 7% per year. What is the annual loan payment Dan must make? A. $24,026.94 B. $17,16210 C. $27,459.36 D. $20,594.52

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock