Question: A bond is a long-term contract under which a borrower agrees to make payments of interest and princpal on specific dates to the holders of

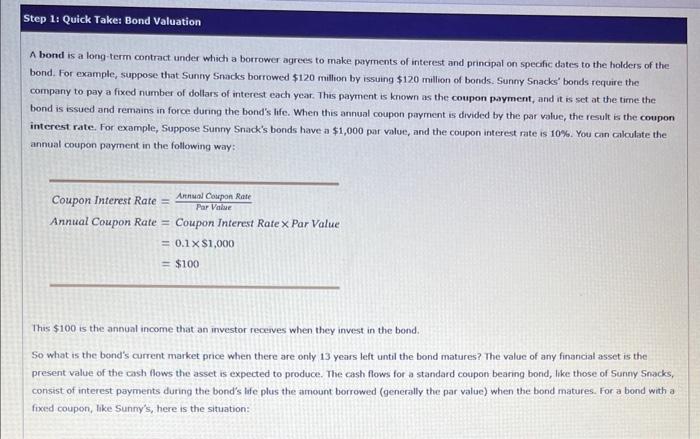

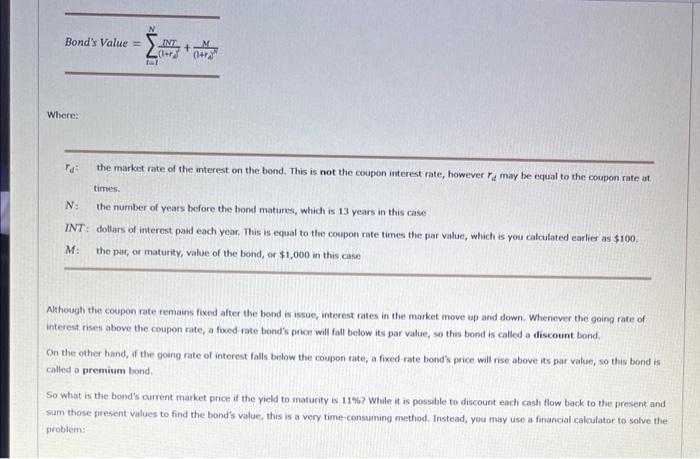

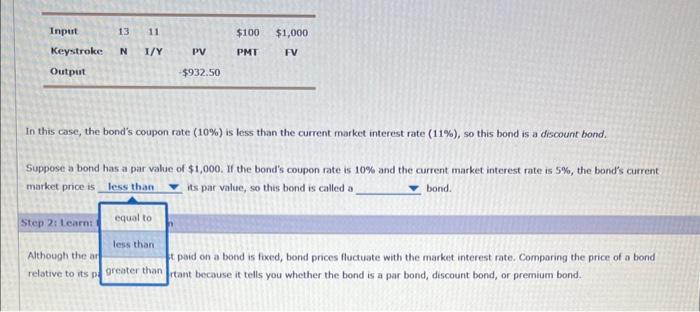

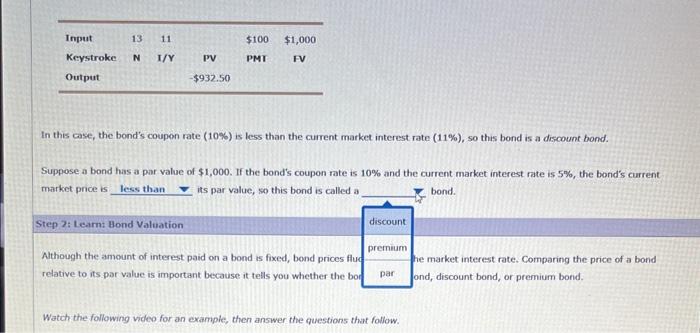

A bond is a long-term contract under which a borrower agrees to make payments of interest and princpal on specific dates to the holders of the bond. For example, suppose that Sunriy Sracks borrowed $120 million by issuing $120 million of bonds. Suriny Snacks' bonds require the company to pay a fixed number of dollars of interest each year. This payment is known as the coupon payment, and it is set at the time the bond is issued and remains in force during the bond's life. When this annual coupon paryment is divided by the par value, the result Es the coupon interest rate. For example, Suppose Sunny Snadk's bonds have a $1,000 par value, ard the coupon interest rate is 10%. You can calculate the annual coupon payment in the following way: CouponInterestRate=ParValueArnualCouponRateAnnualCouponRate=CouponInterestRateParValue=0.1$1,000=$100 This $100 is the annual income that an investor recerves when they invest in the bond. So what is the bond's current market price when there are only, 13 years left until the bond matures? The value of ariy financial asset is the present value of the cash flows the asset is expected to produce. The cash flows for a standard coupon bearing bond, like those of Surny Snacks, consist of interest payments during the bond's lafe plus the amount borrowed (generally the par value) when the bond matures. For a bond with a foced coupon, like Sunny's, here is the situation: Where: rd : the markot rate of the interest on the bond. This is not the coupon interest rate, however rd may be equal to the coupon rate at times. N : the number of years before the bond matures, which is 13 years in this case. INT: dollars of interest paid each year. This is equal to the coupon rate times the par value, which is you calculated earlies as $100. M : the par, or maturity, value of the bond, or $1,000 in this case Athough the coupon rate remains fixed after the bond is issue, interest rates in the market move up and down. Whenever the going rate of interest rises above the coupon rate, a foced rate bond's price will fall below its par value, so this bond is called a discount bond. On the other hand, if the goung rate of interest falls below the coupon rate, a fixed rate bond's price will rise above its par value, so this bond is called a premium bond. So what is the bond's current market price if the yield to maturity is 11% While it is possable to discount each cosh flow back to the present and sum those present values to find the bond's value, this is a very time-consuming method. Instead, you may use a financial calculator to solve the problem: In this case, the bond's coupon rate (10%) is less than the current market interest rate (11\%), so this bond is a discount bond. Suppose a bond has al par value of $1,000. If the bond's coupon rate is 10% and the current market interest rate is 5%, the bond's current matket price is its par value, so this bond is called a bond. Step 2: Alhough the a paid on a bond is foced, bond prices fluctuate with the market interest rate. Comparing the price of a bond relative to its tant because it tells you whether the bond is a par bond, discount bond, or premium bond. In this case, the bond's coupon rate (10%6) is less than the cuirent market interest rate (11\%\%), so this bond is a discount bond. Suppose a bond has a par value of $1,000. If the bond's coupon mate is 10% and the current market interest rate is 5%, the bond's current market price is its par value, so this bond is called a bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts