Question: a) Bond Pricing - Rules of compounding Consider a bond with a 2 year maturity, a coupon of 6% paid semi-annually and a yield-to-maturity y

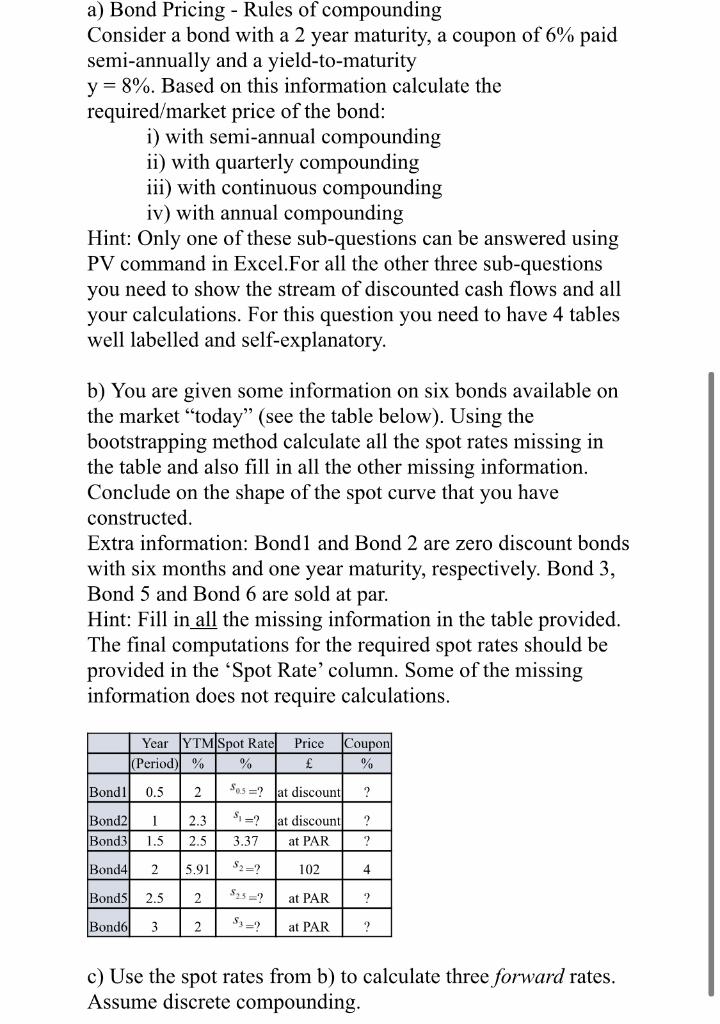

a) Bond Pricing - Rules of compounding Consider a bond with a 2 year maturity, a coupon of 6% paid semi-annually and a yield-to-maturity y = 8%. Based on this information calculate the required/market price of the bond: i) with semi-annual compounding ii) with quarterly compounding iii) with continuous compounding iv) with annual compounding Hint: Only one of these sub-questions can be answered using PV command in Excel.For all the other three sub-questions you need to show the stream of discounted cash flows and all your calculations. For this question you need to have 4 tables well labelled and self-explanatory. b) You are given some information on six bonds available on the market "today (see the table below). Using the bootstrapping method calculate all the spot rates missing in the table and also fill in all the other missing information. Conclude on the shape of the spot curve that you have constructed Extra information: Bondl and Bond 2 are zero discount bonds with six months and one year maturity, respectively. Bond 3, Bond 5 and Bond 6 are sold at par. Hint: Fill in all the missing information in the table provided. The final computations for the required spot rates should be provided in the 'Spot Rate' column. Some of the missing information does not require calculations. Price Year YTM Spot Ratel (Period) % % Coupon % Bondi 0.5 2 Sos =? Jat discount ? Bond2| Bond3 1 1.5 2.3 2.5 at discount at PAR ? ? 3.37 Bond4 2 5.91 102 4 Bonds 2.5 2 at PAR ? Bond6 3 2 at PAR ? c) Use the spot rates from b) to calculate three forward rates. Assume discrete compounding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts