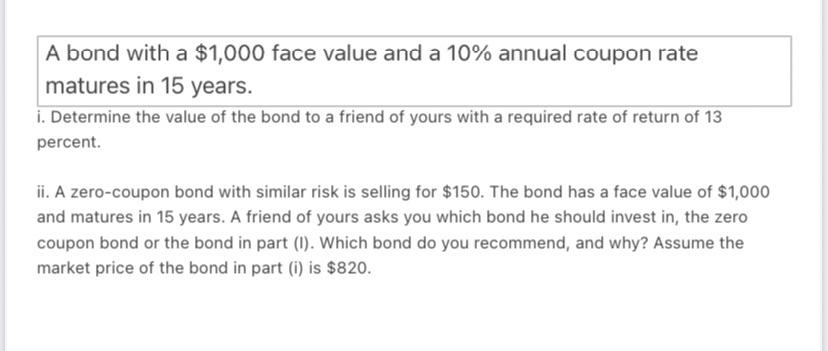

Question: A bond with a $1,000 face value and a 10% annual coupon rate matures in 15 years. i. Determine the value of the bond to

A bond with a $1,000 face value and a 10% annual coupon rate matures in 15 years. i. Determine the value of the bond to a friend of yours with a required rate of return of 13 percent ii. A zero-coupon bond with similar risk is selling for $150. The bond has a face value of $1,000 and matures in 15 years. A friend of yours asks you which bond he should invest in, the zero coupon bond or the bond in part (1). Which bond do you recommend, and why? Assume the market price of the bond in part (1) is $820

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts