Question: A bond with a $1,000 par value has a 5.2% coupon with semi-annual interest payments. The bond has 22 years to maturity. If the yield

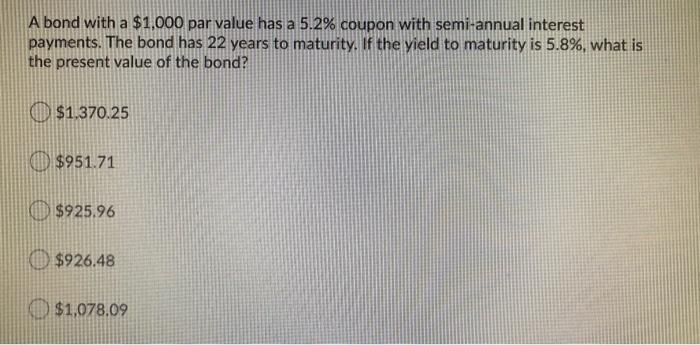

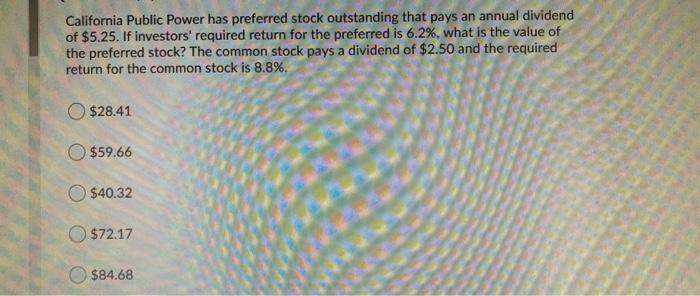

A bond with a $1,000 par value has a 5.2% coupon with semi-annual interest payments. The bond has 22 years to maturity. If the yield to maturity is 5.8%, what is the present value of the bond? 0 $1,370.25 $951.71 $925.96 $926.48 $1,078.09 California Public Power has preferred stock outstanding that pays an annual dividend of $5.25. If investors' required return for the preferred is 6.2%, what is the value of the preferred stock? The common stock pays a dividend of $2.50 and the required return for the common stock is 8.8%. $28.41 $59.66 O $40.32 $72.17 $84.68

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock