Question: A borrower acquired a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1, 2020. In payment

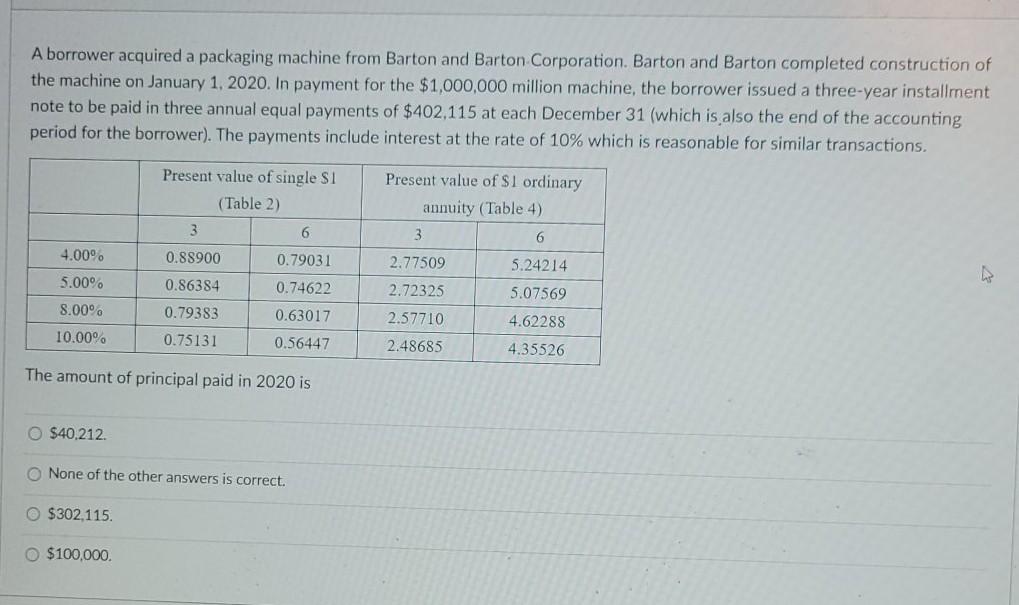

A borrower acquired a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1, 2020. In payment for the $1,000,000 million machine, the borrower issued a three-year installment note to be paid in three annual equal payments of $402,115 at each December 31 (which is also the end of the accounting period for the borrower). The payments include interest at the rate of 10% which is reasonable for similar transactions. Present value of single SI (Table 2) Present value of $I ordinary annuity (Table 4) 3 3 6 4.00 0.88900 2.77509 5.00% 0.79031 0.74622 0.86384 5.24214 5.07569 2.72325 8.00 10.00% 0.63017 0.79383 0.75131 2.57710 4.62288 0.56447 2.48685 4.35526 The amount of principal paid in 2020 is O $40.212 None of the other answers is correct. $302.115. $100,000 The rate of interest that actually is incurred on a note payable is called the: O Contract rate. Effective rate. O Face rate. Stated rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts