Question: A borrower and a lender negotiate a 1 0 - year $ 1 0 , 0 0 0 , 0 0 0 commercial mortgage loan

A borrower and a lender negotiate a year $ commercial mortgage loan with a interest rate and a year payment amortization. According to the promissory note, the loan includes a lockout period for half of the loan term years during which prepayment is not allowed.

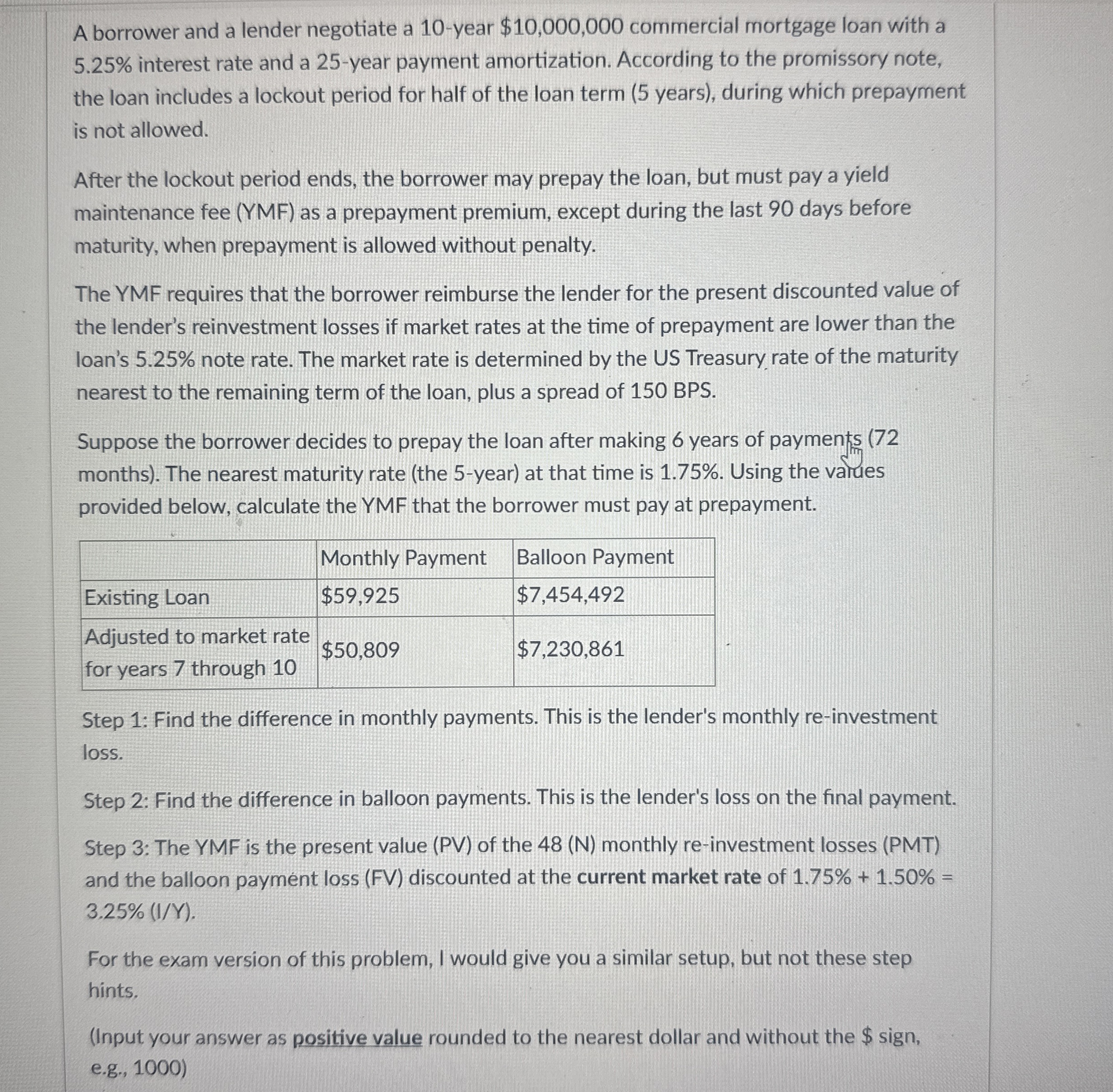

After the lockout period ends, the borrower may prepay the loan, but must pay a yield maintenance fee YMF as a prepayment premium, except during the last days before maturity, when prepayment is allowed without penalty.

The YMF requires that the borrower reimburse the lender for the present discounted value of the lender's reinvestment losses if market rates at the time of prepayment are lower than the loan's note rate. The market rate is determined by the US Treasury rate of the maturity nearest to the remaining term of the loan, plus a spread of BPS

Suppose the borrower decides to prepay the loan after making years of payments months The nearest maturity rate the year at that time is Using the varues provided below, calculate the YMF that the borrower must pay at prepayment.

tableMonthly Payment,Balloon PaymentExisting Loan,$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock